WITNESS RADIO MILESTONES

How officials looted Shs158 billion from Land Fund

Published

6 years agoon

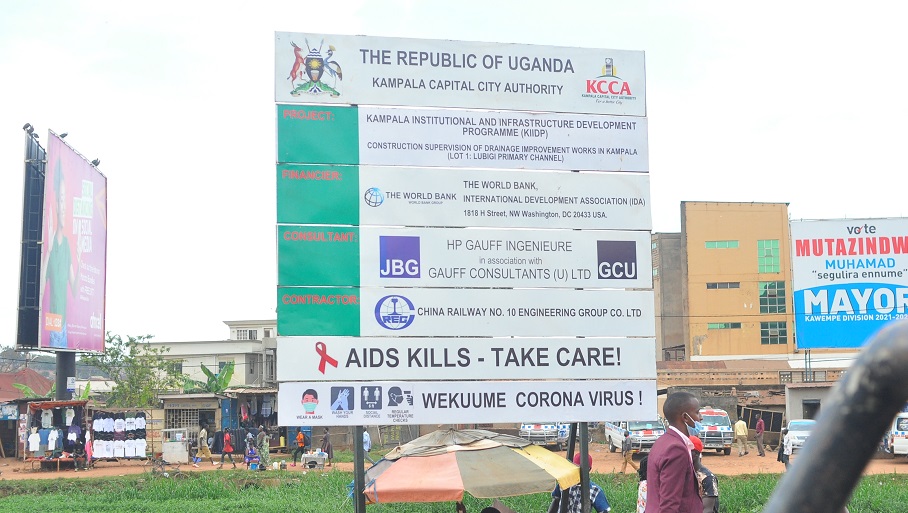

Probe. Justice Catherine Bamugemereire (left), the head of the Commission of Inquiry into Land Matters, and other members of the commission, listen to an official from the Nakaseke District land office at a public hearing in Nabbika Village, Nakaseke District, recently. PHOTO BY DAN WANDERA

A potentially mega corruption scandal worth more than Shs158b threatens to shatter the country’s record of stealing public resources in a single scheme involving a web of government officials, lawyers and other private citizens.

The network is suspected to have carefully hatched and fuelled the ripping-off of public money from the “land fund” with impunity for at least 15 years.

It is a story that begins with the failure by government officials to establish proper procedures to run the Land Fund and ends with the same officials working with a carefully selected team with access to power to dig their fingers deeper into the government purse.

The tale of mega theft also involves the same team, using insider information, manipulating would-be or intended beneficiaries with paltry pay-offs and or forged documents.

To date, the Land Fund established under Section 41 of the Land Act as a “multi-purpose resource envelope meant to serve targeted beneficiaries, including tenants seeking to buy or own land, government seeking to buy land for redistribution to bonafide occupants or resettlement of the landless, among others” has never been operationalised but some government officials working with the “network” are using funds for the “support Uganda Land Commission” project to enrich themselves through shady reimbursements.

Through this and other avenues, taxpayer money has been channeled out ostensibly as compensation to absentee landlords in former lost counties of Buyaga and Bugangaizi in present day Kibaale District in Bunyoro. In 2002, government set up a land fund, among other things, to buy off the absentee landlords who hold land titles in Kibaale and other parts of the country.

In other cases payments have been made and are still being made in names of people who are already dead. The scandal has also put the role of some judicial officers in facilitating the theft of public resources in the spotlight.

For instance, some officers at Hoima Chief Magistrates’ Court issued letters of administration for property valued in billions of shillings yet the court has no jurisdiction to handle transactions worth Shs100m and above.

Sources privy to the dirt that is believed to have been kicked off in 2002 say the Commission of Inquiry into Land matters led by Justice Catherine Bamugemereire has only scratched the surface of the “land fund cash bonaza”. But the commission is still probing deeper with more people expected to be summoned as revelations of their greasy hands come to the fore.

“People who own the land didn’t get the money but it went to underserving people. At least 90 per cent of those who got the money are either middlemen or smart conmen in town,” a senior member of the commission told this newspaper in reference to what they have so far unearthed.

The official declined to be named and instead asked Saturday Monitor to quote their statements during the commission’s proceedings.

By the end of the ongoing investigations, the “land fund scandal” will share the same infamous podium with the 2012 Pension’s scandal in which taxpayers lost at least Sh169b and another at the Office of the Prime Minister where at least Shs50b was lost.

Similar corruption scandals that have raised eyebrows include one stemming from the 2007 Commonwealth Heads of Government Meeting (CHOGM), which is estimated to have cost the taxpayer in excess of Shs247b.

Another was Shs95b reportedly stolen in the Global Fund scandal in 2008, Shs19b under the National ID scandal of 2010, Shs4b under the local council Bicycle Scandal of 2011, and more than Shs60b under the Microfinance Scandal, and at least 169b in the controversial compensation to businessman Hassan Basajjabalaba in 2011.

Same old?

Corruption scandals in the country are a common occurrence and the aforementioned are just a tip of the iceberg, and many Ugandans will, most likely, not be surprised at a new one. However, many are likely to be baffled at the extent and length of time it took for some questions to be asked of those involved.

More importantly, it will be victims like, Teddy Nansubuga who was reportedly conned of more than Shs1.4b by her lawyer that will be left with more questions than answers.

Ms Nansubuga owned more than 200 hectares of land in Kibaale District. She inherited the land from her deceased parents.

In the course of the Bamugemereire commission hearings, it became apparent that Ms Nansubuga, who is illiterate, was taken advantage of by her lawyer, Mr Richard Buzibira, who convinced her to transfer her powers of attorney to him.

In explaining to Ms Nansubuga what had happened to her, the commission’s deputy lead counsel, Mr John Bosco Suuza, perhaps summarised it best.

“These thugs, these thieves, they took advantage of you – a poor lady with limited education and exposure. They lied to you and they conned you out of all those millions that I have told you. Not only that, they used your name and went to the highest office in the land and claimed to be acting on your behalf. Somewhere along the way, a minister [Ms Betty Amongi] got involved. More money was paid in your name and you know nothing about it, which is tragic,” he said.

Mr Lawrence Semakula, the Accountant General, has already apologised for his office’s failure to detect and avert the theft of public resources. From his submissions before the commission, it appeared, he could only do so much given the powerful individuals involved.

“It is not true that we don’t have the guidelines and laws in place. The guidelines and laws are there, but they are abused by individuals,” he said before issuing an apology.

Out of the Shs1.4b Mr Buzibira and others picked on behalf of Ms Nansubuga without her knowledge, she was only paid Shs260m. The rest of the money ended in the pockets of Mr Buzibira and others. The sad tale of what befell Ms Nansubuga pales when compared to the case of “businessman” Warren Mwesigye who allegedly, fraudulently, received Shs13b from the Land Fund.

The scheme reportedly starts with Mwesigye purchasing five square miles of land in 2015 from different people at Shs500m only to claim payment shortly after from the Land Fund.

The alleged scheme by Mr Mwesigye is only an extension of the allegations against Mr Buzibira and his associates at Frank Katusiime and Company Advocates. It was a chain according to revelations from the Bamugemereire-led land commission.

Lawyer Buzibira would allegedly trick the “illiterate” owners to grant him powers of attorney, he would then transfer ownership to Mwesigye who would then whip government bureaucracy into an unusual efficiency.

In the end, at least Shs13b was released from the Land Fund to Mr Mwesigye. That, however, was not the end of the string.

The actual beneficiaries of what now appears to be a fraudulent scheme were watching and waiting in Mr Mwesigye’s account for their share, at least by Mr Mwesigye’s confession.

He told the commission that money went directly to his creditors including Legacy Group owned by businessman Ben Kavuya. Mr Mwesigye did not name the other beneficiaries.

But Kavuya in an Interview with Saturday Monitor dismissed Mr Mwesigye’s claims.

“I absolutely disassociate myself from that fellow. We’re a legitimate business company and he has never even tried to borrow from us. What he did is very bad and he did it under oath,” Mr Kavuya said. He had also in an earlier interview with this newspaper asserted that his company had no records of ever lending to Mr Mwesigye.

Commission’s lead counsel Ebert Byenkya told Saturday Monitor, in an interview, that it was becoming clear each day that the people who benefitted were not entitled. He, however, explained that they would summon more people in the coming days over the fraudulent scheme.

Those accused of involvement in scam

Richard Buzibira, an associate at Frank Tumusiime and Company Advocates, is accused by the Commission of Inquiry into Land Matters of being the face of a scheme that fraudulently acquired more than Shs16 billion meant to compensate 20 claimants from the Land Fund since 2013.

Mr Buzibira and others, it is alleged, fraudulently acquired letters of attorney from their clients and working with senior government officials processed and received billions of shillings.

He stands accused of conspiracy and involvement in the questionable dealings, failure to act professionally, and other criminal acts.

“We began receiving instructions for Land Fund in 2013 and I acted as an agent and advocate. The clients came on referral basing on the number of cases I had handled. The money was paid quarterly in instalments and the vouchers show that Shs13.3 billion has since been paid and balances in the range of Shs5 billion is still pending,” Mr Buzibira testified.

Pr Daniel Walugembe, who doubles as a land dealer, is accused of defrauding government of more than Shs2.5b. He was arrested and detained after being quizzed by the commission.

Pr Walugembe of Internal Gospel Church in Kampala was dragged to the land commission by Elisabeth Musoke, a clinical psychologist, for allegedly selling land belonging to her family to the Uganda Land Commission (ULC) without consent. The land in dispute measures approximately 507 acres. Pr Walugembe denies the fraud charges. He says he paid Shs500m for the land he later sold to government at the amount.

Dennis Musinguzi

The former Kibaale District staff surveyor acquired more than 1,000 acres at Shs72,000 nominal fees and later sold the same land to ULC in 2014 at more than Shs1b.

He sold another portion of land to Hoima Sugar Ltd at Shs390m. He is also accused of aiding several government officials and other powerful individuals to acquire substantial pieces of land later sold to government through the scheme.

His role, it is alleged, was to check the accuracy of the survey files and also ensure the title was followed. He denied that he procured proprietorship of land occupied by other people to dupe government and acquire payment of Shs1b but admitted receiving the money and sharing it with other people whom he preferred revealing to the commission in a closed-door session. Mr Musinguzi, is currently a senior land management officer for Hoima District. He was arrested and released after recording a statement with the police.

James Sakka

The Executive Director of National Information Technology Authority-Uganda (NITA-U), is accused of selling a 640-acre piece of land at Bugangaizi, Kibaale District, at Shs928m obtained from the Land Fund. Part of his land is reportedly worthless. Mr James Sakka has since got a payment of Shs402m.

Mr Sakka was also faulted for selling land which did not qualify under the Land Fund, did not execute a sale agreement with ULC and did not qualify to be an absentee landlord as required by law.

The “worthless” land was valued at Shs480m while 70 per cent of the land that was occupied by squatters was valued at Shs448m.

In his testimony, Mr Sakka admitted receiving Shs402m in instalments out of total Shs927m. His land was valued at Shs15.2m.

Robert Mwesigwa Rukaari is accused of receiving Shs4.1b from the Land Fund in 2016 and 2017 for land on Plot 1 Block 123, Plot 2 Block 269 in Buyanda and Plot 3 Block 62 in Bugangaizi yet he neither owned land nor was an absentee landlord in the area.

“I first received Shs455m in 2016 and then in January 2017, I received Shs100m and in June I received Shs3.6b,” he told the commission.

He was accused of using his influence as chairman of NRM National Entrepreneur’s League and his American Procurement Company to receive the payments from government. Mwesigwa and Pr Walugembe used J.L. Oulanyah & Co Advocates owned by Deputy Speaker Jacob Oulanyah to receive at least Shs8.6b from the Fund.

Rogers Kweezi is the principal human resource officer of Kibaale District. He is accused of, among other things, corruption, connivance, conflict of interest and abuse of office in regard to acquisition of the land. He was quizzed by the commission and later arrested for his role in regards to various plots of land he acquired and sold to ULC at Shs3.7b upon investing only Shs210,000. He disputed valuation reports but admitted receiving more than 50 per cent of the total sale price and that part of the money was paid to his wife Carolyn Kisembo, who applied for one of the portions of land.

Pius Bigirimana

The Ministry of Gender Permanent Secretary, Mr Pius Bigirimana is accused of having received under unclear circumstances compensation for land in Zirobwe from the Fund yet he did not qualify for compensation.

He reportedly demanded for Shs504m from the Fund in 2016 for 50.5 acres of land on Plot 5 Bulemeezi Block 103 that had been encroached on by squatters.

In line with the request, Lands minister Betty Amongi wrote to the commission in 2016 authorising the initial payment of Shs50m by the Uganda Land Commission to Mr Bigirimana. He later received Shs150m in 2017 for the same land.

Mr Bigirimana pleaded that he never got to know he did not qualify for the compensation but if the commission thinks he did not qualify, he is ready to follow their recommendation.

Kasirivu Atwooki

The State minister in-charge of Economic Monitoring in the Office of the President was at one time a State minister for Lands. He has been named as one of the people who acquired large tracts of an unsurveyed land belonging to the Kibaale District Land Board.

It is alleged Mr Kasirivu and other district officials paid Shs70,000 nominal fees to acquire certificates of titles for thousands of acres of land in various parts of the district so as to enrich themselves. The commission termed his alleged activities as constituting “conflict of interest and abuse of office”.

Betty Amongi

Lands, Housing and Urban Development minister Betty Amongi has been questioned about her role in handling of the Land Fund and failure to manage the same. She has also been cited for overstepping her mandate in making directives to pay from the Fund, some well-connected individuals.

Patrick Zikasangisa

By 2013, Patrick Zikasangisa, a local businessman in Kagadi, had invested Shs15m to acquire land yet he is claiming Shs904m from the Fund. With help allegedly from his area MP and friend, Finance minister Matia Kasaija, Lands minister Amongi and ULC boss Baguma Isoke, he has received more than Shs100m from the Fund and was due to be paid more when the commission of inquiry intervened. He has been accused of fraud, speculation to get money from government and telling lies, among other things.

Ms Molly Kamukama

The Principal Private Secretary to President Museveni, Ms Molly Kamukama, was questioned by the commission for allegedly directing payments from the Land Fund. She, however, said her letters were meant to address the Lands authorities on concerns raised before the President and did not in any way imply directives.

Albert Jethro Mugumya

The Uganda Land Commission (ULC) undersecretary was gilled for his role in the management of the Fund, including effecting payments based on “special requests” of minister Amongi.

On November 23, 2016, for example, he effected payment of Shs620m to nine people on the directives of Ms Amongi. He also effected payments of Shs100m for Ms Victoria Kakoko-Sebagereka, Shs50m to Mr Kuriash Barinda of Isingiro District, and Shs675.8m to Yisaka Lwakana for land at Kooki, Katete.

Source: Daily Monitor

Related posts:

NITA boss cited in Shs 928m Land Fund mess

NITA boss cited in Shs 928m Land Fund mess

REVEALED: The Origin Of Namuganza’s War With Minister Betty Amongi, Bigirimana Pinned For Selling Air Worth 100 Million To Government

REVEALED: The Origin Of Namuganza’s War With Minister Betty Amongi, Bigirimana Pinned For Selling Air Worth 100 Million To Government

Man buys land at sh72,000, sells it to govt at sh1b

Man buys land at sh72,000, sells it to govt at sh1b

Minister Amongi faces land probe for the second time

Minister Amongi faces land probe for the second time

You may like

-

……Special Report abridged testimony…… How a pregnant woman was beaten by multinationals and local police over her land…

-

A tree planting Chinese Company, Formosa Limited in fresh illegal land eviction…

-

Electricity Transmission Company holds titles in Masaka as residents point to foul play

-

The World Bank and its partners flout business and human rights standards to evict hundreds of families

-

The New Forest Company is engaged in fresh tactics to intimidate affected community it evicted 10 years ago…

-

A long journey to freedom: Trial of 10 community members in Mityana flops

DEFENDING LAND AND ENVIRONMENTAL RIGHTS

Breaking: Witness Radio and Partners to Launch Human Rights Monitoring, Documentation, and Advocacy Project Tomorrow.

Published

5 months agoon

February 21, 2024

By Witness Radio Team.

Witness Radio, in collaboration with Dan Church Aid (DCA) and the National Coalition for Human Rights Defenders (NCHRD), is set to launch the Monitoring, Documentation, and Advocacy for Human Rights in Uganda (MDA-HRU) project tomorrow, 22nd February 2024, at Kabalega Resort Hotel in Hoima District.

The project, funded by the European Union, aims to promote the protection and respect for human rights, and enable access to remedy where violations occur especially in the Mid-Western and Karamoja sub-regions where private sector actors are increasingly involved in land-based investments (LBIs) through improved documentation, and evidence-based advocacy.

The three-year project, which commenced in October 2023, focuses its activities in the Mid-Western sub-region, covering Bulisa, Hoima, Masindi, Kiryandongo, Kikuube, Kagadi, Kibale, and Mubende districts, and Karamoja sub-region, covering Moroto, Napak, Nakapiripirit, Amudat, Nabilatuk, Abim, Kaabong, Kotido, and Karenga districts.

The project targets individuals and groups at high risk of human rights violations, including Human Rights Defenders (HRDs) and Land and Environmental Defenders (LEDs). It also engages government duty bearers such as policymakers and implementers in relevant ministries and local governments, recognizing their crucial role in securing land and environmental rights. Additionally, the project involves officials from institutional duty bearers including the Uganda Human Rights Commission (UHRC), Equal Opportunities Commission, and courts, among others.

Representatives from the international community, faith leaders, and business actors are also included in the project’s scope, particularly those involved in land-based investments (LBIs) impacting the environment.

The project was initially launched in Moroto for the Karamoja region on the 19th of this month with the leadership of the National Coalition for Human Rights Defenders (NCHRD).

According to the project implementors, the action is organized into four activity packages aimed at; enhancing the capacity and skills of Human Rights Defenders (HRDs) and Land and Environmental Defenders (LEDs) in monitoring, documentation, reporting (MDR), and protection, establishing and reinforcing reporting and documentation mechanisms for advocacy and demand for corporate and government accountability; providing response and support to HRDs and marginalized communities; and lastly facilitating collaboration and multi-stakeholder engagements that link local and national issues to national and international frameworks and spaces.

Related posts:

Breaking: over 350,000 acres of land were grabbed during Witness Radio – Uganda’s seven months ban.

Breaking: over 350,000 acres of land were grabbed during Witness Radio – Uganda’s seven months ban.

Kiryandongo leadership agree to partner with Witness Radio Uganda to end rampant forced land evictions in the district.

Kiryandongo leadership agree to partner with Witness Radio Uganda to end rampant forced land evictions in the district.

Human Rights Defenders not safe in Uganda – Unwanted Witness report

Human Rights Defenders not safe in Uganda – Unwanted Witness report

Breaking Alert: Uganda passes the National Action Plan (NAP) on Business and Human Rights

Breaking Alert: Uganda passes the National Action Plan (NAP) on Business and Human Rights

DEFENDING LAND AND ENVIRONMENTAL RIGHTS

Kiryandongo leadership agree to partner with Witness Radio Uganda to end rampant forced land evictions in the district.

Published

7 months agoon

January 4, 2024

By Witness Radio team.

Kiryandongo district leaders have embraced Witness Radio’s collaboration with the Kiryandongo district aimed at ending the rampant violent and illegal land evictions that have significantly harmed the livelihoods of the local communities in the area.

The warm welcome was made at the dialogue organized by Witness Radio Uganda, Uganda’s leading land and environmental rights watchdog at the Kiryandongo district headquarters, intended to reflect on the plight of land and environmental rights defenders, local and indigenous communities and the role of responsible land-based investments in protecting people and the planet.

Speaking at the high-level dialogue, that was participated in by technical officers, policy implementers, religious leaders, leaders of project affected persons (PAPs), politicians, media, Civil Society Organizations (CSOs), and development partners that support land and environment rights as well as the Land Based Investments (LBIs) Companies in the Kiryandongo district, the leaders led by the District Local Council 5 Chairperson, Ms. Edith Aliguma Adyeri appreciated the efforts taken by Witness Radio organization to organize the dialogue meeting aimed at bringing together stakeholders to safeguard community land and environmental rights in order address the escalating vice of land grabbing in the area.

During the dialogue, participants shared harrowing accounts of the impacts of land evictions and environmental degradation, including tragic deaths, families torn asunder, young girls forced into marriage, a surge in teenage pregnancies, limited access to education, and significant environmental damage which have profoundly affected the lives of the local population in Kiryandongo.

Participants attending the dialogue.

In recent years, Kiryandongo district has been embroiled in violent land evictions orchestrated to accommodate multinational large-scale agriculture plantations and wealthy individuals leaving the poor marginalized.

According to various reports, including findings from Witness Radio’s 2020 research Land Grabs at a Gun Point, the forceful land acquisitions in Kiryandongo have significantly impacted the livelihoods of local communities. It is estimated that nearly 40,000 individuals have been displaced from their land to make room for land-based investments in the Kiryandongo district. However, leaders in the district also revealed in the dialogue that women and children are affected most.

The Kiryandongo Deputy Resident District Commissioner, Mr. Jonathan Akweteireho, emphasized that all offices within the Kiryandongo district are actively involved in addressing the prevalent land conflicts. He also extended a welcome to Witness Radio, acknowledging their collaborative efforts in tackling and resolving land and environmental issues in the district.

“Ladies and gentlemen, we all know that the land rights together with environmental rights have been violated in our district, but because we don’t know what our rights are, because we have not directly done what we could to safeguard our rights and now this is the time that Witness Radio has brought us together to safeguard our rights. I want to welcome you in Kiryandongo and be rest assured that we shall give you all the necessary support to help us manage these rampant cases,” Ms. Adyeri said in her remarks during the dialogue meeting.

The team leader at Witness Radio Uganda, Mr. Geoffrey Wokulira Ssebaggala expressed gratitude to the participants for their active involvement in the dialogue and revealed that Witness Radio’s objective is to find a holistic solution to the escalating land disputes in Kiryandongo district serving as an example to other districts.

“We are here to assist Kiryandongo district in attaining peace and stability because it stands as a hotspot for land grabbers in Uganda. Mismanagement of land conflicts in Uganda could potentially lead to a significant internal conflict. Everywhere you turn, voices are lamenting the loss of their land and property. Kiryandongo, abundant with ranches, suffers from a lack of a structured framework, which amplifies these land conflicts. The influx of wealthy investors further complicates the situation,” Mr. Ssebaggala disclosed.

Within the dialogue, Mr. Ssebaggala emphasized the need for the Kiryandongo district council to pass a by-law aimed at curbing land evictions as an initial step in addressing the prevalent land injustices.

Related posts:

Breaking: over 350,000 acres of land were grabbed during Witness Radio – Uganda’s seven months ban.

Breaking: over 350,000 acres of land were grabbed during Witness Radio – Uganda’s seven months ban.

Why Are Evictions Still Happening In Kiryandongo: Witness Radio Petitions Government.

Why Are Evictions Still Happening In Kiryandongo: Witness Radio Petitions Government.

Uganda: Targeting community land and environmental defenders with criminal offenses is rising as two community land rights defenders arrested in a hotspot district of forced land evictions.

Uganda: Targeting community land and environmental defenders with criminal offenses is rising as two community land rights defenders arrested in a hotspot district of forced land evictions.

The Executive Director of Witness Radio Uganda talks about the role played by Witness Radio in protecting communities affected by large-scale agribusinesses in Kiryandongo district in an interview with the ILC.

The Executive Director of Witness Radio Uganda talks about the role played by Witness Radio in protecting communities affected by large-scale agribusinesses in Kiryandongo district in an interview with the ILC.

WITNESS RADIO MILESTONES

Kiryandongo authorities decry rising cases of land disputes

Published

7 months agoon

January 3, 2024

The LC5 chairperson of Kiryandongo, Ms Edith Aliguma Adyeri, has saidnland dispute has impacted on people’s lives, dignity and children’s education in the district.

Just like other parts of Uganda, conflicts over land in Kiryandongo arise when individuals – who often are blood relatives – compete for use of the same parcel of land or when members of the community lay claim over ownership of unutilised government land.

Ms Adyeri further said land and environmental rights affect people both directly and indirectly, “and we are not hearing it from afar. It is already together with us [here], it has already affected us!”

She was speaking at a meeting which sought to discuss alternative remedies to salvage the appalling land and environmental rights situation in Kiryandongo at the district headquarters on Thursday.

The one-day dialogue was aimed at reflecting on the plight of land and environmental rights defenders, local and indigenous communities and the role of responsible land-based investments in protecting people and the planet.

It was attended by private companies, members of civil society and local government officials and organised by Witness Radio – an advocate for land and environmental rights in Uganda – in partnership with Oxfam, and Kiryandongo District leadership.

“Some people have even died, families are broken up, and brothers are not seeing eye-to-eye because of land rights. Access to justice is equally becoming very difficult because when you hire one lawyer that

lawyer will talk to learned friends, and they agree. They leave you in suspense,” Ms Adyeri said.

According to her, some children have not accessed education because of land and environmental rights.

Mr Jonathan Akweteireho, the deputy Resident District Commissioner of Kiryandongo, said enlightened people especially should be sensitive to the historical injustice of this area.

“We can never handle the Bonyoro land question without thinking about that history. It will be an injustice to the incomers, to the government and to the leaders who don’t understand,” he said.

“We had 38 ranches here which on the guidance of these international organisations, especially the World Bank, the government restructured them, allowing people to settle there, they were never given titles and up to today, there are big problems in all those ranches,” he added.

Mr Jeff Wokulira Ssebaggala, the executive director of Witness Radio, said that a well-functional land sector supports land users or holders and investors, reduces inefficiencies and provides mechanisms to resolve land disputes.

Mr David Kyategeka, the secretary to the Kiryandongo District Land Board, said the issue of land rights is very clear but the major challenge has been sensitising the locals to know what rights he or she expects to enjoy out of this very important resource.

Source: www.monitor.co.ug

Related posts:

Witnessradio.org’s Petition to Land Inquiry Commission over Human rights in Kiryandongo district

Witnessradio.org’s Petition to Land Inquiry Commission over Human rights in Kiryandongo district

Kiryandongo District Authorities are on spot by the commission of inquiry into land matters

Kiryandongo District Authorities are on spot by the commission of inquiry into land matters

Land grabs victims in Uganda meet amid escalating cases of illegal evictions and rights violations

Land grabs victims in Uganda meet amid escalating cases of illegal evictions and rights violations

Uganda: Targeting community land and environmental defenders with criminal offenses is rising as two community land rights defenders arrested in a hotspot district of forced land evictions.

Uganda: Targeting community land and environmental defenders with criminal offenses is rising as two community land rights defenders arrested in a hotspot district of forced land evictions.

Oil activities in Murchison Falls National Park threaten Wildlife Conservation – AFIEGO study reveals.

A Financial gap: Can China be stopped from financing the EACOP?

NEMA suspend operations to evict the World Bank project-affected community and other residents accused of being located in wetlands.

Farmers count losses as dry spell scorches maize gardens

Sexual violence as a tool to grab land: a local woman accuses industrial agriculture investor Agilis Partners Limited of sexual violence.

Thirty-six (36) groups from all over the world have written to industrial agriculture investors, Agilis Partners Limited to stop human rights violations/abuses against thousands of indigenous/local communities, settle grievances, and return the grabbed land.

CSOs, oil host communities, and concerned citizens have petitioned the President of Uganda to stop oil drilling in the Murchison Falls National Park.

Enemies of the State: Resistance to the EACOP becomes a deadly task

Innovative Finance from Canada projects positive impact on local communities.

Over 5000 Indigenous Communities evicted in Kiryandongo District

Petition To Land Inquiry Commission Over Human Rights In Kiryandongo District

Invisible victims of Uganda Land Grabs

Resource Center

Legal Framework

READ BY CATEGORY

Newsletter

Trending

-

MEDIA FOR CHANGE NETWORK5 days ago

MEDIA FOR CHANGE NETWORK5 days agoNEMA suspend operations to evict the World Bank project-affected community and other residents accused of being located in wetlands.

-

FARM NEWS2 weeks ago

FARM NEWS2 weeks agoStrengthening Small-Scale Farming in Uganda through Farmer Field Schools.

-

MEDIA FOR CHANGE NETWORK2 days ago

MEDIA FOR CHANGE NETWORK2 days agoOil activities in Murchison Falls National Park threaten Wildlife Conservation – AFIEGO study reveals.

-

NGO WORK1 week ago

NGO WORK1 week agoThe mothers and daughters of the global south cannot celebrate the World Bank’s 80-year legacy of harm.

-

FARM NEWS5 days ago

FARM NEWS5 days agoFarmers count losses as dry spell scorches maize gardens

-

MEDIA FOR CHANGE NETWORK5 days ago

MEDIA FOR CHANGE NETWORK5 days agoNEMA hindering environment restoration in Wakiso – leaders

-

MEDIA FOR CHANGE NETWORK3 days ago

MEDIA FOR CHANGE NETWORK3 days agoA Financial gap: Can China be stopped from financing the EACOP?