SPECIAL REPORTS AND PROJECTS

Bill Gates is the biggest private owner of farmland in the United States. Why?

Published

4 years agoon

Gates has been buying land like it’s going out of style. He now owns more farmland than my entire Native American nation.

Bill Gates has never been a farmer. So why did the Land Report dub him “Farmer Bill” this year? The third richest man on the planet doesn’t have a green thumb. Nor does he put in the back-breaking labor humble people do to grow our food and who get far less praise for it. That kind of hard work isn’t what made him rich. Gates’ achievement, according to the report, is that he’s largest private owner of farmland in the US. A 2018 purchase of 14,500 acres of prime eastern Washington farmland – which is traditional Yakama territory – for $171m helped him get that title.

In total, Gates owns approximately 242,000 acres of farmland with assets totaling more than $690m. To put that into perspective, that’s nearly the size of Hong Kong and twice the acreage of the Lower Brule Sioux Tribe, where I’m an enrolled member. A white man owns more farmland than my entire Native nation!

The United States is defined by the excesses of its ruling class. But why do a handful of people own so much land?

Land is power, land is wealth, and, more importantly, land is about race and class. The relationship to land – who owns it, who works it and who cares for it – reflects obscene levels of inequality and legacies of colonialism and white supremacy in the United States, and also the world. Wealth accumulation always goes hand-in-hand with exploitation and dispossession. In this country, enslaved Black labor first built US wealth atop stolen Native land.

The 1862 Homestead Act opened up 270m acres of Indigenous territory – which amounts to 10% of US land – for white settlement. Black, Mexican, Asian, and Native people, of course, were categorically excluded from the benefits of a federal program that subsidized and protected generations of white wealth.

The billionaire media mogul Ted Turner epitomizes such disparities. He owns 2m acres and has the world’s largest privately owned buffalo herd. Those animals, which are sacred to my people and were nearly hunted to extinction by settlers, are preserved today on nearly 200,000 acres of Turner’s ranchland within the boundaries of the 1868 Fort Laramie Treaty territory in the western half of what is now the state of South Dakota, land that was once guaranteed by the US government to be a “permanent home” for Lakota people.

The gun and the whip may not accompany land acquisitions this time around. But billionaire class assertions that they are philosopher kings and climate-conscious investors who know better than the original caretakers are little more than ruses for what amounts to a 21st century land grab – with big payouts in a for-profit economy seeking “green” solutions.

Our era is dominated by the ultra-rich, the climate crisis and a burgeoning green capitalism. And Bill Gates’ new book How to Avoid a Climate Disaster positions himself as a thought leader in how to stop putting greenhouse gases into the atmosphere and how to fund what he has called elsewhere a “global green revolution” to help poor farmers mitigate climate change. What expertise in climate science or agriculture Gates possesses beyond being filthy rich is anyone’s guess.

When pressed during a book discussion on Reddit about why he’s gobbling up so much farmland, Gates claimed, “It is not connected to climate [change].” The decision, he said, came from his “investment group.” Cascade Investment, the firm making these acquisitions, is controlled by Gates. And the firm said it’s “very supportive of sustainable farming”.

It also is a shareholder in the plant-based protein companies Beyond Meat and Impossible Foods as well as the farming equipment manufacturer John Deere. His firm’s largest farmland acquisition happened in 2017, when it acquired 61 farming properties from a Canadian investment firm to the tune of $500m.

Arable land is not just profitable. There’s a more cynical calculation. Investment firms are making the argument farmlands will meet “carbon-neutral” targets for sustainable investment portfolios while anticipating an increase of agricultural productivity and revenue.

And while Bill Gates frets about eating cheeseburgers in his book – for the amount of greenhouse gases the meat industry produces largely for the consumption of rich countries – his massive carbon footprint has little to do with his personal diet and is not forgivable by simply buying more land to sequester more carbon.

The world’s richest 1% emit double the carbon of the poorest 50%, an 2020 Oxfam study found. According to Forbes, the world’s billionaires saw their wealth swell by $1.9tn in 2020, while more than 22 million US workers (mostly women) lost their jobs.

Like wealth, land ownership is becoming concentrated into fewer and fewer hands, resulting in a greater push for monocultures and more intensive industrial farming techniques to generate greater returns. One per cent of the world’s farms control 70% of the world’s farmlands, one report found. The biggest shift in recent years from small to big farms was in the US.The land we all live on should not be the sole property of a few

The principal danger of private farmland owners like Bill Gates is not their professed support of sustainable agriculture often found in philanthropic work – it’s the monopolistic role they play in determining our food systems and land use patterns.

Small farmers and Indigenous people are more cautious with the use of land. For Indigenous caretakers, land use isn’t premised on a return of investments; it’s about maintaining the land for the next generation, meeting the needs of the present, and a respect for the diversity of life. That’s why lands still managed by Indigenous peoples worldwide protect and sustain 80% of the world’s biodiversity, practices anathema to industrial agriculture.

The average person has nothing in common with mega-landowners like Bill Gates or Ted Turner. The land we all live on should not be the sole property of a few. The extensive tax avoidance by these titans of industry will always far exceed their supposed charitable donations to the public.

The “billionaire knows best” mentality detracts from the deep-seated realities of colonialism and white supremacy, and it ignores those who actually know best how to use and live with the land. These billionaires have nothing to offer us in terms of saving the planet – unless it’s our land back.

Original Source: The Guardian.

Related posts:

Land Bill: From Being a Custodian To an Owner?

Land Bill: From Being a Custodian To an Owner?

Internet activists urge Parliament to pass Private and Data Protection Bill

Internet activists urge Parliament to pass Private and Data Protection Bill

The global farmland grab goes green

The global farmland grab goes green

How the Gates Foundation is driving the food system, in the wrong direction

How the Gates Foundation is driving the food system, in the wrong direction

You may like

-

The global farmland grab goes green

-

Court releases a tortured community land rights defender on bail

-

After being tortured by the army, the land rights defender is charged and remanded to prison

-

…….Special Report; abridged testimony……. ABDUCTION AND TORTURE: New methods used by multinationals and security agencies to grab land from the poor communities…

-

……Special Report abridged testimony…… How a pregnant woman was beaten by multinationals and local police over her land…

-

Court orders eviction of prison

SPECIAL REPORTS AND PROJECTS

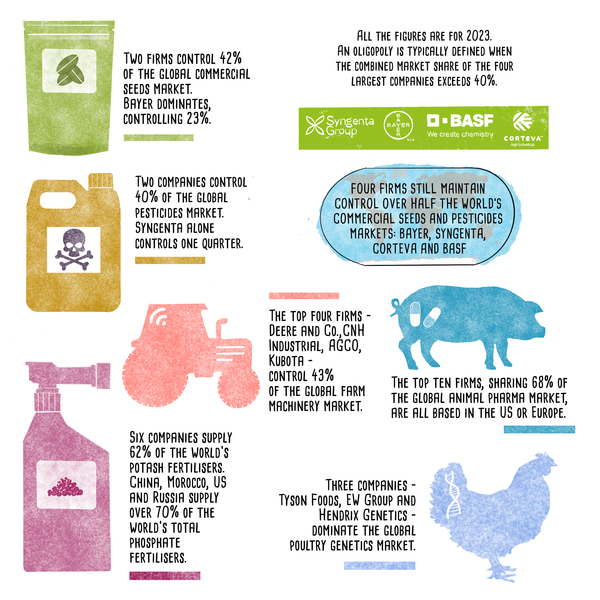

Top 10 agribusiness giants: corporate concentration in food & farming in 2025

Published

1 month agoon

August 28, 2025

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share 19

|

|

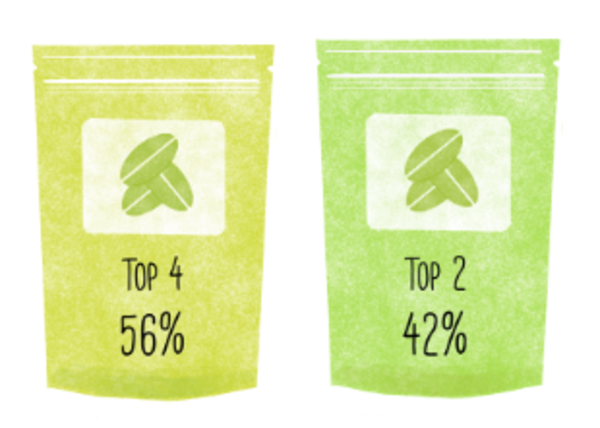

1

|

Bayer (Germany)20

|

11,613

|

23

|

|

2

|

Corteva (US)21

|

9,472

|

19

|

|

3

|

Syngenta (China/Switzerland)22

|

4,751

|

10

|

|

4

|

BASF (Germany)23

|

2,122

|

4

|

|

Total top 4

|

27,958

|

56

|

|

|

5

|

Vilmorin & Cie (Groupe Limagrain) (France)24

|

1,984

|

4

|

|

6

|

KWS (Germany)25

|

1,815

|

4

|

|

7

|

DLF Seeds (Denmark)26

|

838

|

2

|

|

8

|

Sakata Seeds (Japan)27

|

649

|

1

|

|

9

|

Kaneko Seeds (Japan)28

|

451

|

0.9

|

|

Total top 9

|

33,695

|

67

|

|

|

Total world market29

|

50,000

|

100%

|

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share

|

|

1

|

Syngenta (China/Switzerland)43

|

20,066

|

25

|

|

2

|

Bayer (Germany)44

|

11,860

|

15

|

|

3

|

BASF (Germany)45

|

8,793

|

11

|

|

4

|

Corteva (US)46

|

7,754

|

10

|

|

Total top 4

|

48,472

|

61

|

|

|

5

|

UPL (India)47

|

5,925

|

8

|

|

6

|

FMC (Germany)48

|

4,487

|

6

|

|

7

|

Sumitomo (Japan)49

|

3,824

|

5

|

|

8

|

Nufarm (Australia)50

|

2,056

|

3

|

|

9

|

Rainbow Agro (China)51

|

1,623

|

2

|

|

10

|

Jiangsu Yangnong Chemical Co., Ltd. (China)52

|

1,595

|

2

|

|

Total top 10

|

67,982

|

86

|

|

|

Total world market53

|

79,000

|

100

|

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share

|

|

1

|

Nutrien (Canada)72

|

15,673

|

8

|

|

2

|

The Mosaic Company (US)73

|

12,782

|

7

|

|

3

|

Yara (Norway)74

|

11,688

|

6

|

|

4

|

CF Industries Holdings, Inc, (US)75

|

6,631

|

3

|

|

Total top 4

|

46,774

|

24

|

|

|

5

|

ICL Group Ltd. (Israel)76

|

6,294

|

3

|

|

6

|

OCP (Morocco)77

|

5,967

|

3

|

|

7

|

PhosAgro (Russia)78

|

4,989

|

3

|

|

8

|

MCC EuroChem Joint Stock Company (EuroChem) (Switzerland/Russia)79

|

4,298

|

2

|

|

9

|

OCI (Netherlands)80

|

4,188

|

2

|

|

10

|

Uralkali (Russia)81

|

3,497

|

2

|

|

Total top 10

|

76,007

|

39

|

|

|

Total world market82

|

196,000

|

100

|

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share

|

|

1

|

Deere and Co. (US)89

|

26,790

|

15

|

|

2

|

CNH Industrial (UK/Netherlands)90

|

18,148

|

10

|

|

4

|

AGCO (US)91

|

14,412

|

8

|

|

3

|

Kubota (Japan)92

|

14,233

|

8

|

|

Total top 4

|

73,583

|

43

|

|

|

5

|

CLAAS (Germany)93

|

6,561

|

4

|

|

6

|

Mahindra and Mahindra (India)94

|

3,156

|

2

|

|

7

|

SDF Group (Italy)95

|

2,197

|

1

|

|

8

|

Kuhn Group (Switzerland)96

|

1,583

|

0.9

|

|

9

|

YTO Group (China)97

|

1,493

|

0.9

|

|

10

|

Iseki Group (Japan)98

|

1,057

|

0.6

|

|

Total top 10

|

89,629

|

52

|

|

|

Total world market99

|

173,000

|

100

|

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share

|

|

1

|

Zoetis (US)115

|

8,544

|

18

|

|

2

|

Merck & Co (MSD) (US)116

|

5,625

|

12

|

|

3

|

Boehringer Ingelheim Animal Health (Germany)117

|

5,100

|

11

|

|

4

|

Elanco (US)118

|

4,417

|

9

|

|

Total top 4

|

23,686

|

49

|

|

|

5

|

Idexx Laboratories (US)119

|

3,474

|

7

|

|

6

|

Ceva Santé Animale (France)120

|

1,752

|

4

|

|

7

|

Virbac (France)121

|

1,348

|

3

|

|

8

|

Phibro Animal Health Corporation (US)122

|

978

|

2

|

|

9

|

Dechra (UK)123

|

917

|

2

|

|

10

|

Vetoquinol (France)124

|

572

|

1

|

|

Total top 10

|

32,727

|

68

|

|

|

Total world market125

|

48,000

|

100

|

The genetic material used in the industrial production of meat, dairy and aquaculture is supplied by a small number of relatively unknown companies that are mostly privately owned. As detailed financial data is not publicly available for most of these companies, it is difficult to determine companies’ market shares and even the value of the global market. However, it was possible to arrive at some estimates for chicken, which tops global meat production (narrowly exceeding pigs).126

The genetic material used in the industrial production of meat, dairy and aquaculture is supplied by a small number of relatively unknown companies that are mostly privately owned. As detailed financial data is not publicly available for most of these companies, it is difficult to determine companies’ market shares and even the value of the global market. However, it was possible to arrive at some estimates for chicken, which tops global meat production (narrowly exceeding pigs).126Related posts:

CORPORATE AGRIBUSINESS GIANTS SWIM IN WEALTH AS MORE POOR PEOPLE GO HUNGRY AMID THE BITING COVID PANDEMIC.

CORPORATE AGRIBUSINESS GIANTS SWIM IN WEALTH AS MORE POOR PEOPLE GO HUNGRY AMID THE BITING COVID PANDEMIC.

A corporate cartel fertilises food inflation

A corporate cartel fertilises food inflation

The United Nations Food Systems Summit is a corporate food summit —not a “people’s” food summit

The United Nations Food Systems Summit is a corporate food summit —not a “people’s” food summit

Food inflation: The math doesn’t add up without factoring in corporate power

Food inflation: The math doesn’t add up without factoring in corporate power

SPECIAL REPORTS AND PROJECTS

Maasai demand Volkswagen pull out of carbon offset scheme on their lands

Published

2 months agoon

July 24, 2025

Maasai Indigenous people in Tanzania have called on Volkswagen (VW) to withdraw from a controversial carbon credits scheme which violates their rights and threatens to wreck their livelihoods.

In a statement, the Maasai International Solidarity Alliance (MISA) denounced the “loss of control or use” of vital Maasai grazing grounds, and accused VW of making “false and misleading claims” about Maasai participation in decision making about the project.

Many Maasai pastoralists have already been evicted from large parts of their grazing lands for national parks and game reserves, with highly lucrative tourist businesses operating in them. Now a major new carbon-credit generating project by Volkswagen ClimatePartner (VWCP) and US-based carbon offset company Soils for the Future Tanzania is taking control of large parts of their remaining lands, and threatening livelihoods by upending long-standing Maasai grazing practices.

The Maasai have not given their free, prior and informed consent for the project. They fear it will restrict their access to crucial refuge areas in times of drought, and threaten their food security.

Ngisha Sinyok, a Maasai community member from Eluai village, which is struggling to withdraw from the project, told Survival: “Our livestock is going to be depleted. We will end up not having a single cow.” Asked about VW’s involvement in the project, he replied, “It is not a solution to climate change. It is just a business for people to make money using our environment. It has nothing to do with climate change.”

Another Maasai man, who wished to remain anonymous for fear of reprisals, said: “They use their money to control us.” A third said: “Maasailand never had a price tag. In Maasailand, there is no privatization. Our land is communal.”

Survival International’s Director of Research and Advocacy, Fiona Watson, said today: “The carbon project that Volkswagen supports violates the Maasai’s rights and will be disastrous for their lives, all so the company can carry on polluting and greenwash its image. It takes away the Maasai’s control over their own lands and relies on the false and colonial assumption that they are destroying their lands — which is not supported by evidence.

“The Maasai have been grazing cattle on the plains of East Africa since time immemorial. They know the land and how to manage it better than carbon project developers seeking to make millions from their lands.”

VW’s investment in the project, whose official name is the “Longido and Monduli Rangelands Carbon Project”, is believed to run to several million dollars, and has contributed to corruption and tensions in northern Tanzania, according to MISA’s report on the project.

An adjacent project in southern Kenya, also run by Soils for the Future, is beset with similar problems, and has already sparked resistance from local communities.

Survival International’s Blood Carbon report revealed that the whole basis for these “soil carbon” projects is flawed, and unsupported by evidence. Survival documented similar problems with the highly controversial Northern Kenya Grasslands Carbon Project. That project suffered a blow in a Kenyan court and was suspended and put under review by Verra, the carbon credit verification agency, for an unprecedented second time.

Source: Survival International

Related posts:

Kenya: Court halts flagship carbon offset project used by Meta, Netflix and British Airways over unlawfully acquiring community land without consent

Kenya: Court halts flagship carbon offset project used by Meta, Netflix and British Airways over unlawfully acquiring community land without consent

East Africa poised to monitor carbon emission

East Africa poised to monitor carbon emission

Carbon offset projects exacerbate land grabbing and undermine small farmers’ independence – GRAIN report

Carbon offset projects exacerbate land grabbing and undermine small farmers’ independence – GRAIN report

SPECIAL REPORTS AND PROJECTS

Seizing the Jubilee moment: Cancel the debt to unlock Africa’s clean energy future

Published

3 months agoon

July 12, 2025

Africa has the resources and the vision for a just energy transition, but it is trapped in a financial system structured to take more than it gives. In this blog, we outline how debt burdens and climate impacts are holding the continent back, and looks at the role of institutions that shape the global financial order, like the World Bank, African Development Bank and IMF. As these institutions and governments meet in Seville for FfD4, we urge them to heed people’s calls for reform: cancel the debt, redistribute the wealth, and fund the just transition. — By Rajneesh Bhuee and Lola Allen

With 60% of the world’s best solar energy resources and 70% of the cobalt essential for electric vehicle batteries, the African continent has everything it needs to power its development and become a global reference point for sustainable energy production. That potential, however, remains largely untapped; Africa receives just 2% of global renewable energy investment. As the UNCTAD Secretary-General Rebeca Grynspan warns, too many countries are forced to “default on their development to avoid defaulting on their debt.”

The cost of servicing unsustainable debts, layered with new loan-based climate and development finance, leaves governments with little fiscal space to invest in clean energy, health or education. In 2022 alone, African countries spent more than $100 billion on debt servicing, over twice what they spent on health or education. Add to this the $90 billion lost annually to illicit financial flows, and the reality is stark: more money leaves the continent through financial leakages (also including unfair trade and extractive investment) than comes in through productive, equitable and development-oriented finance.

These are not isolated problems. They reflect a financial system that has been built to serve global markets rather than people. Between 2020 and 2025, four African countries defaulted on their external debts, that is, they failed to make scheduled repayments to creditors like the International Monetary Fund or bondholders, triggering fiscal crises and, in several cases, IMF interventions tied to austerity measures. Pope Francis’ Jubilee Report (2025) and hundreds of civil society groups argue that these defaults reflect the deeper crisis of unsustainable debt. Meanwhile, 24 more African countries are now in or near debt distress. None have successfully restructured their debts under the G20 Common Framework, a mechanism launched in 2020 to facilitate debt relief among public and private creditors. The Framework has been widely criticised for being slow, opaque and ineffective. According to Eurodad, without urgent systemic reforms, up to 47 Global South countries, home to over 1.1 billion people, face insolvency risks within five years if they attempt to meet climate and development goals.

How debt undermines the just energy transition

Debt has become both a driver and a symptom of climate injustice. Countries that did the least to cause the climate crisis now pay the highest price, twice over. First, they suffer the impacts. Second, they must borrow to rebuild.

This is happening just as concessional finance disappears. The US has withdrawn from the African Development Fund’s concessional window (worth $550m), yet maintains influence over private-sector lending. It has also opted out of the UN Financing for Development Conference (FfD4), a historic opportunity to confront the injustice of our financial system. Meanwhile, European governments, though now celebrating themselves as defenders of multilateralism, played a key role in weakening the outcome of FfD4, slashing aid budgets, redirecting funds toward militarisation, and systematically blocking proposals for a UN-led sovereign debt workout mechanism. With rising insecurity and geopolitical tensions, these actions send a troubling signal: at a moment when global cooperation is urgently needed, many Global North countries are stepping back from efforts to fix the very system that is preventing climate justice and clean energy for much of the Global South.

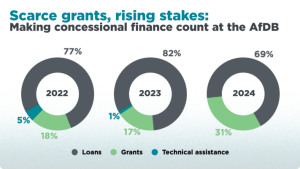

A role for the AfDB?

The African Development Bank (AfDB), under incoming president Sidi Ould Tah , has made progressive commitments of $10 billion to climate-resilient infrastructure and $4 billion to clean cooking. Between 2022 and 2024, one in five (20%) of its energy dollars were grants, far exceeding The World Bank ‘s 10% and the Asian Development Bank (ADB) ‘s 3.8%. The AfDB has also backed systemic reform: for example, calling for Special Drawing Rights (SDR) redistribution, launching an African Financial Stability Mechanism that could save up to $20 billion in debt servicing, and consistently advocating for fairer lending terms.

Yet, even progressive leadership struggles within a broken system. Recourse’s recent research shows that AfDB energy finance dropped 67% in 2024, from $992.7 million to just $329.6 million. Of this, a staggering 73% went to large-scale infrastructure like mega hydro dams and export-focused transmission lines, ‘false solutions’ that bypass the energy-poor and displace communities. Meanwhile, support for locally-appropriate, decentralised renewable energy systems such as mini-grids, solar appliances, and clean cookstoves plummeted by over 90%, from $694.5 million to just $61 million, with only five of 13 projects directly addressing energy access in 2024.

Africa received just 2.8% of global climate finance in 2021–22, and what is labelled as “climate finance” is often little more than a Trojan horse: resource-backed loans, debt-for-nature swaps, and blended finance instruments that shift risk to the public while offering little real benefit to local communities. These mechanisms, promoted as “innovative” or “green”, often entrench financial dependency and fail to deliver meaningful change for energy-poor or climate-vulnerable groups.

Meanwhile, initiatives that could build green industry and renewable capacity across Africa are falling short in both scale and speed. Flagship projects, such as the EU’s Global Gateway, have failed to drive green industrialisation in Africa, and carbon markets continue to delay real emissions reductions, subsidise fossil fuel interests, and entrench elite control over land and resources.

Mission 300: Ambition or another missed opportunity?

In this constrained context, the AfDB and World Bank launched Mission 300, an ambitious plan to connect 300 million Africans to electricity by 2030. Pragmatic goals like electrification are crucial, but the story beneath the surface of Mission 300 raises concern. Far from serving households, many projects under the initiative appear more aligned with export markets and large-scale energy users, echoing decades of infrastructure that bypasses those most in need.

Mission 300 can still be transformative, but only if it centres people, not profits. Energy access must begin with those who need it most: women and youth, especially in rural communities. Across Africa, many women cook over open fires, walk hours to gather fuel, and care for families in homes without light or clean air. This is not just an inconvenience, it is structural violence and policy failure.

Yet most energy finance still flows to centralised grids, mega-projects, and sometimes fossil gas (misleadingly called a “transition fuel”). These do little to address energy poverty. Locally appropriate decentralised renewable energy solutions, solar-powered appliances, clean cookstoves, and mini-grids can deliver faster, cheaper, and more equitable impact. Mission 300 must invest in such solutions, without adding to existing debt problems. It should support national policy design, for example, by ensuring that energy policy is responsive to women’s needs, making use of gender-disaggregated data and community consultation.

The Jubilee: A year for action

In a year already marked as a Jubilee moment, African leaders have demanded reform: including a sovereign debt workout mechanism and a UN Tax Convention to end illicit financial flows. Yet as AFRODAD has documented, these demands were blocked at the FfD4 negotiations by wealthy nations—notably the EU and UK—even as climate impacts grow and fiscal space shrinks.

This is not just about finance. It is about reclaiming sovereignty. The incoming AfDB president and all the multilateral development banks face a choice: continue financing extractive, large-scale projects that serve foreign interests, or invest in decentralised, gender-responsive, pro-people solutions that shift power and ownership.

Africa has the resources. What it needs is fiscal space, public-led finance, and global rules that prioritise people and planet over profit. The Jubilee call is clear: cancel the debt, redistribute the wealth, and fund the just transition.

Source: Recourse through LinkedIn Account Recourse.

Related posts:

Statement: The Energy Sector Strategy 2024–2028 Must Mark the End of the EBRD’s Support to Fossil Fuels

Statement: The Energy Sector Strategy 2024–2028 Must Mark the End of the EBRD’s Support to Fossil Fuels

African Development Bank decides not to fund Kenya coal project

African Development Bank decides not to fund Kenya coal project

Africa must unlock the power of its women to save climate change

Africa must unlock the power of its women to save climate change

PFZW scraps funding from Total and others for failure to transition into a cleaner energy mix.

PFZW scraps funding from Total and others for failure to transition into a cleaner energy mix.

Land actors warn of looming violent conflicts due to escalating land grabbing in Sebei and Bugisu sub-regions.

Uganda is on a mission to plant over 40 million trees by October 3, 2025, a crucial step in combating the alarming decline in its forest cover.

The EAC Seed & Plant Varieties Bill, 2025, is a potential threat to smallholder farmers, as it aims to disengage them from the agriculture business, according to experts.

Road to COP30: Climate justice is achievable if young people have secure land tenure as a mitigation measure against migration.

Youths from around the world are urgently convening to engage in crucial discussions about land and climate solutions, a matter of pressing concern ahead of COP30, set to take place in Brazil.

A German Bank is under intense scrutiny for its irresponsible banking practices, which have been directly linked to displacement and human rights abuses.

Financial Institutions from Africa have made a monumental commitment of $100 billion to Africa’s green industrialization, a decision of immense significance that has the potential to shape Africa’s future.

A new report, exposing irresponsible banking by the German Development Bank, is set to be released.

Innovative Finance from Canada projects positive impact on local communities.

Over 5000 Indigenous Communities evicted in Kiryandongo District

Petition To Land Inquiry Commission Over Human Rights In Kiryandongo District

Invisible victims of Uganda Land Grabs

Resource Center

- LAND GRABS AT GUNPOINT REPORT IN KIRYANDONGO DISTRICT

- THOSE OIL LIARS! THEY DESTROYED MY BUSINESS!

- RESEARCH BRIEF -TOURISM POTENTIAL OF GREATER MASAKA -MARCH 2025

- The Mouila Declaration of the Informal Alliance against the Expansion of Industrial Monocultures

- FORCED LAND EVICTIONS IN UGANDA TRENDS RIGHTS OF DEFENDERS IMPACT AND CALL FOR ACTION

- 12 KEY DEMANDS FROM CSOS TO WORLD LEADERS AT THE OPENING OF COP16 IN SAUDI ARABIA

- PRESENDIANTIAL DIRECTIVE BANNING ALL LAND EVICTIONS IN UGANDA

- FROM LAND GRABBERS TO CARBON COWBOYS A NEW SCRAMBLE FOR COMMUNITY LANDS TAKES OFF

Legal Framework

READ BY CATEGORY

Newsletter

Trending

-

MEDIA FOR CHANGE NETWORK1 week ago

MEDIA FOR CHANGE NETWORK1 week agoUganda is on a mission to plant over 40 million trees by October 3, 2025, a crucial step in combating the alarming decline in its forest cover.

-

MEDIA FOR CHANGE NETWORK1 week ago

MEDIA FOR CHANGE NETWORK1 week agoThe EAC Seed & Plant Varieties Bill, 2025, is a potential threat to smallholder farmers, as it aims to disengage them from the agriculture business, according to experts.

-

MEDIA FOR CHANGE NETWORK3 days ago

MEDIA FOR CHANGE NETWORK3 days agoLand actors warn of looming violent conflicts due to escalating land grabbing in Sebei and Bugisu sub-regions.