WITNESS RADIO MILESTONES

Harvard’s Foreign Farmland Investment Mess

Published

7 years agoon

The university’s holdings in developing markets have proved to be more trouble than they’re worth.

Fourteen years ago, a Brazilian farmer named Ruthardo Grun says he was terrorized by armed thugs who shot at him, burned down his shack, and chased him from land he was preparing to farm. Little did he know his battle to get the property back would end up pitting him against a company controlled by the world’s richest school: Harvard University.

Over a decade, Harvard invested at least $1 billion in farmland, according to a just-released reportfrom the activist groups GRAIN, based in Barcelona, and the Network for Social Justice and Human Rights, based in Sao Paulo. The organizations came up with their estimate after a year-long investigation of tax returns and local property records, as well as on-the-ground interviews. Harvard’s holdings included vineyards in California, dairy farms in New Zealand, and operations producing cotton, soybeans, and sugar cane in countries such as Brazil, South Africa, Australia, Russia, and Ukraine, and totaled 854,000 hectares, though some assets have been sold.

In response to questions about its farmland holdings, Harvard says it considers the environmental and social implication of its endowment investments. The university said in a statement that it has “instituted a more proactive approach to working with managers of new and remaining assets—a partnership that provides more oversight and ensures that we can leave the land and community better than when we first invested.”

Narv Narvekar, the endowment’s chief executive officer hired from Columbia University in 2016 to overhaul operations, has retreated from direct investing. He’s spun out teams of managers overseeing assets from real estate to hedge funds, sending them to start their own businesses while investing with them. Yet Narvekar is still trying to hammer out the future of the troubled natural resources portfolio, even as he sells some investments, including the New Zealand dairy farm and a eucalyptus plantation in Uruguay.

Now, as a new school year begins, Harvard’s far-flung farmlands are facing criticism for, among other things, their impact on ancient burial grounds and impoverished populations. “Harvard’s farmland deals should be a cautionary tale for institutional investors,’’ writes Devlin Kuyek, a researcher at GRAIN, whose mission is to support small farmers and social movements in poorer countries.

Students, alumni, and environmentalists are targeting U.S. university endowments, saying their investing practices are often out of synch with schools’ professed values. These critics have pushed colleges to jettison stock in fossil fuel companies, private prisons, and companies that do business with Israel. Yale University’s investments in New Hampshire’s Great North Woods have drawn the school into disputes over clear-cutting and the development of a power line.

Harvard initially made hefty profits on its land investments, including by buying and selling New Zealand timberlands in the 2000s. But returns fell as emerging markets faltered, and much of the team spearheading the strategy left the endowment in 2015. Last year, Harvard wrote down its natural resources portfolio, which includes timber as well as farmland, by $1.1 billion, to $2.9 billion. Over the decade ended June 30, 2017, Harvard’s investment portfolio returned 4.4 percent a year, among the worst of its peers. In Brazil, in particular, the endowment’s holdings suffered from the country’s recent economic meltdown and political turmoil.

The report, titled “Harvard’s Billion-Dollar Farmland Fiasco,” shows why such investments are so risky. It highlights property Harvard bought in Australia through a company called Wealthcheck Funds Management. According to a government inquiry, the company harmed an Aboriginal burial site when it dug irrigation canals for a cotton farm. It also details conflicts between RussellStone Group, which managed the endowment’s farms in South Africa, and black families that were granted rights to some sites to graze cattle and access burial sites. Neither company returned calls or emails seeking comment.

But Brazil may be the most contentious of Harvard’s overseas adventures. A public prosecutor’s office in the northeastern state of Bahia, for instance, has said that it may sue to reclaim some of the 140,000-hectare farm owned by Harvard-backed Caracol Agropecuaria after finding that titles for about two-thirds of the property are invalid. In its most recent tax filing, Harvard valued its interest in Caracol at $87 million. Elsewhere in Bahia, villagers have protested the property titles of a farm that was in part sold to Harvard-backed Gordian Bioenergy, according to the report. The endowment has been seeking to end its relationship with Gordian, which is developing farms to produce both crops and energy, though it still controls assets it acquired through the company.

In the neighboring state of Piaui, a Harvard-controlled company called Sorotivo Agropecuaria has been battling with Grun and five other plaintiffs who say they lost their land in 2004. Earlier this year a judge dismissed the lawsuit and said Sorotivo could acquire a new title from the state for the 27,000-hectare farm it controls. However, in his decision he said that both the plaintiffs and Sorotivo practiced land-grabbing on title acquisitions. Accusations of land grabbing, which can date back decades, became epidemic as Brazil’s farm belt expanded and were often linked to speculators falsifying titles in order to steal and sell public property used by subsistence farmers.

The judge, Heliomar Rios Ferreira, says that the state agency from which the plaintiffs said they got their titles didn’t have any records of the grants. He also says Sorotivo improperly extended a boundary of its vast farm, though this was in an area unrelated to the lawsuit.

The plaintiffs’ lawyer says their property titles are legitimate and that they will appeal. Harvard controls Sorotivo through a Brazilian farming company called Insolo Agroindustrial, which didn’t return calls and emails seeking comment. A spokesman for Harvard declined to comment on the litigation.

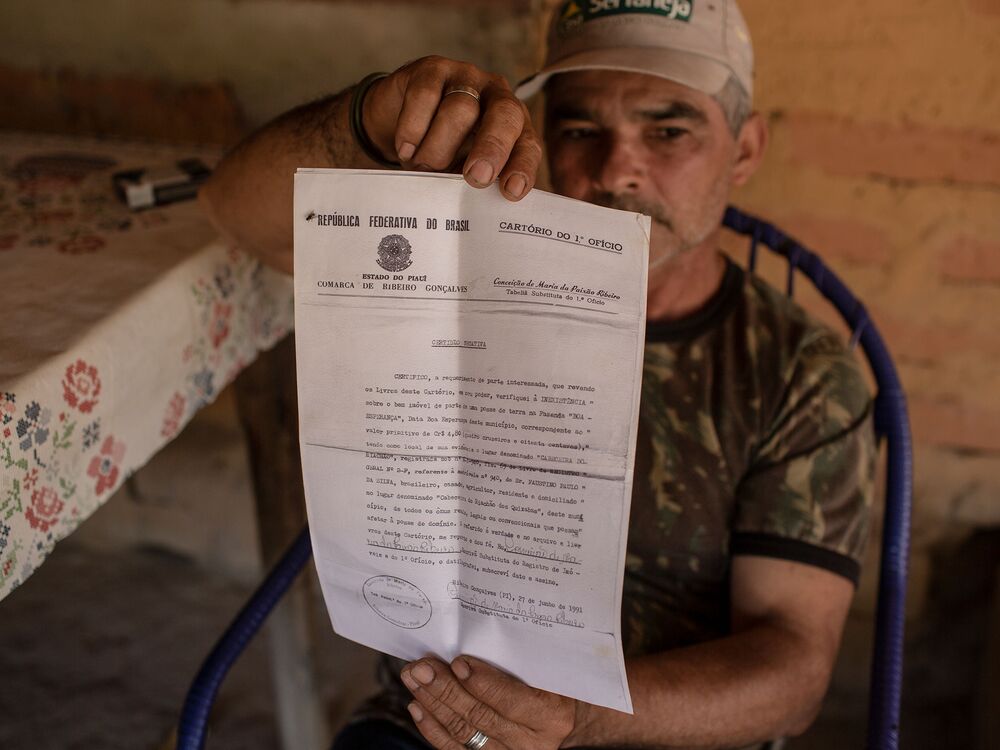

While Grun relocated, people who for generations have made their home in the region known as the Cerrado are living with the consequences of the dispute. Eurotides Paulo da Silva resides in a village below Insolo’s vast farm, which stretches on for miles and miles and evokes a moonscape when it’s between harvest and seasonal plantings. His son works on the farm. But locals, who hunted and collected honey and medicinal plants on the plateaus, say their way of life has been hemmed in over the last decade with the arrival of industrial farms.

Silva produces a document dated from 1991 that he says shows his grandfather also owned land on the plateau. His cousin, Alberto Pereira da Silva, makes a similar claim, saying they never challenged the loss of the properties because they felt intimidated. Says the cousin: “We feel like we are trapped without a way out.” —With Lianne Milton

You may like

-

Six cattlemen opposed to the Tilenga oil project-related forced land eviction have been granted bail but will remain in prison…

-

Global agribusiness continues to displace rural communities

-

Court releases a tortured community land rights defender on bail

-

Breaking! Kiryandongo human rights situation is presented before the United Nations…

-

After being tortured by the army, the land rights defender is charged and remanded to prison

-

…….Special Report; abridged testimony……. ABDUCTION AND TORTURE: New methods used by multinationals and security agencies to grab land from the poor communities…

WITNESS RADIO MILESTONES

Top 10 agribusiness giants: corporate concentration in food & farming in 2025

Published

2 weeks agoon

June 19, 2025

Today a handful of agribusiness corporations have consolidated unprecedented control over the world’s food supply, with devastating consequences for farmers, consumers and the planet. A new report by ETC Group and GRAIN examines the state of corporate concentration in six sectors critical to agriculture: commercial seeds, pesticides, synthetic fertilisers, farm machinery, animal pharmaceuticals and livestock genetics.

Corporate consolidation is increasing in most of these sectors and four of them– seeds, pesticides, agricultural machinery and animal pharmaceuticals– now meet the definition of an oligopoly, in which four companies control more than 40% of a market. Concentration can be even higher at the national level, as is the case with synthetic fertilisers.

Top findings from the report include:

- Oligopolies dominate key sectors: Bayer, Corteva, Syngenta, and BASF control 56% of the global commercial seeds market, and 61% of the pesticides market.

- Profiteering amid global crises: Agribusiness giants have exploited crises like the Ukraine war and the COVID-19 pandemic to inflate prices. Fertiliser companies, for instance, saw revenues soar by 57% from 2020 to 2023, with some accused of price gouging.

- Digital and biotech expansion: Corporations are rapidly integrating AI, gene editing, and digital platforms into agriculture through partnerships with Big Tech companies. These technologies enable data extraction from farmers, facilitate carbon credit schemes, and tighter control over food systems—while raising concerns about biosafety, privacy, and corporate monopolies.

Source: grassrootsonline

Related posts:

A corporate cartel fertilises food inflation

A corporate cartel fertilises food inflation

Food inflation: The math doesn’t add up without factoring in corporate power

Food inflation: The math doesn’t add up without factoring in corporate power

African governments are giving in to corporate pressure and undermining local seed systems – report

African governments are giving in to corporate pressure and undermining local seed systems – report

The United Nations Food Systems Summit is a corporate food summit —not a “people’s” food summit

The United Nations Food Systems Summit is a corporate food summit —not a “people’s” food summit

WITNESS RADIO MILESTONES

Land grabbers evict 360,000 Ugandans in 2024

Published

7 months agoon

November 20, 2024

A staggering 363,021 Ugandans were displaced due to forced land evictions between January and June 2024, according to a new report by Witness Radio Uganda.

The report documented 90 cases of land evictions during this period, with nearly four incidents occurring weekly, affecting over 15,126 people and threatening 5,060 hectares of land nationwide.

The Central region was the epicenter, recording 52 eviction cases, followed by 24 in the Western region, eight in the Northern region, and six in the Eastern region. Alarmingly, the report estimated that 2,160 Ugandans face eviction daily, with 723 hectares of land at risk of being grabbed every day.

VIOLENCE AND HUMAN RIGHTS VIOLATIONS

Despite government promises and directives from President Museveni to halt evictions, land grabbers have routinely ignored these orders, often resorting to violence. Armed security forces, private militias, and police were reported to have carried out the majority of the evictions.

Of the reported cases, 37 were enforced by armed gangs on behalf of evictors, 25 involved Uganda Police, five were carried out with the participation of UPDF soldiers, and four were linked to private security companies.

“The egregious levels of impunity exhibited by land grabbers have left communities defenseless, creating an environment where their human rights are trampled without consequence,” said Jeff Wokulira Ssebaggala, country director of Witness Radio Uganda.

He called for accountability and justice, warning that the unchecked power of influential individuals and entities leaves marginalized communities vulnerable and without recourse.

DRIVERS OF EVICTIONS: INDUSTRIALIZATION AND LAND-BASED INVESTMENTS

The report identified the government’s push for industrialization and land-based investments as the primary drivers of forced evictions. Land is increasingly targeted for oil and gas extraction, mining, agribusiness and tree plantations for carbon offsets. While some of this land is already under development, other parcels remain vacant but are guarded by military personnel and private security firms.

Ssebaggala emphasized that industrialization must balance economic development with the protection of smallholder farmers’ rights to land and food security.

TRAGIC STORIES

The report highlighted harrowing cases that underscore the human toll of forced evictions. In Nakasongola, smallholder farmer Dan Ssebyala was ambushed and killed by armed men following a confrontation over disputed land. The district has become a hotspot for violent evictions involving absentee landlords and powerful investors.

Ismael Bwowe, a disabled father of 20, recounted how his land was confiscated after he demanded fair compensation. He faced intimidation, arrests and false charges from state authorities, including being accused of robbing an influential individual. Bwowe claimed that Total Energies offered legal support and representation on the condition that he accept their compensation terms.

“I refused,” he said, adding that the pressure to relinquish his land remains intense. The report underscores the urgent need for reforms to address forced evictions, ensure accountability, and protect the rights of vulnerable communities. Without meaningful intervention, Uganda risks deepening inequality and undermining the livelihoods of smallholder farmers who are essential to the country’s food security.

FAMILY JAILED AMID LAND DISPUTE

The plight of Richard Ssebagala, his wife Prossy Namande, and their relative Anania Ngabirano, residents of Kabubu-Kabongo village in Nansana Municipality, Wakiso district, highlights the human toll of Uganda’s ongoing land disputes. The family spent nine months in prison following their arrest on January 10, 2024, under controversial circumstances.

ARREST AND ALLEGATIONS

The arrests occurred at 1am, during a raid by officers from Luweero police station. Police reportedly banged on the doors and forcefully detained the family, accusing them of aggravated robbery. However, the family believes the arrest was a tactic linked to a land dispute with Benon Ntambi, a man who allegedly grabbed their land.

Before the arrests, Ntambi had reportedly destroyed crops, including tomatoes, potatoes, and bananas, on the contested land. While the family was incarcerated, a new building was constructed on their land, which is now occupied, raising further questions about the motivations behind their detention.

CALLS FOR JUSTICE

The case has drawn attention from Witness Radio Uganda, which has urged the government to take immediate action to address land grabbing and illegal evictions. The organization emphasized the need to strengthen land laws and protect vulnerable communities from abuses.

It also called for greater accountability in institutions such as the Uganda Police Force, the army and land registries, which are often accused of corruption and favoritism toward the wealthy.

“The government must prioritize justice for victims of illegal evictions and address systemic corruption that leaves the poor defenseless against land grabbers,” Witness Radio Uganda stated.

BROADER CONTEXT

This case underscores the broader issue of land conflicts in Uganda, where vulnerable families are often caught in disputes with powerful individuals or entities. Advocacy groups warn that the failure to address these issues not only erodes public trust but also perpetuates inequality and injustice.

As the government faces mounting pressure to act, the story of Ssebagala and his family serves as a stark reminder of the urgent need for reforms to protect land rights and ensure justice for those impacted by land disputes.

Source: The Observer

Related posts:

Local land grabbers evict villagers at night; foreign investors cultivate the same lands the next day

Local land grabbers evict villagers at night; foreign investors cultivate the same lands the next day

Uganda: Land-grab victim communities will join counterparts in commemorating the 2024 International Day of Struggle Against Industrial Plantations.

Uganda: Land-grab victim communities will join counterparts in commemorating the 2024 International Day of Struggle Against Industrial Plantations.

Mubende Land Grab: Witnessradio.org presents another petition to Land Inquiry Commission, Wants All Titles being used to evict Natives to be Investigated

Mubende Land Grab: Witnessradio.org presents another petition to Land Inquiry Commission, Wants All Titles being used to evict Natives to be Investigated

A Nullity? Ugandans Query Constitutional Land Amendment Bill

A Nullity? Ugandans Query Constitutional Land Amendment Bill

WITNESS RADIO MILESTONES

Uganda: Community members violently evicted by security forces, allegedly related to EACOP; incl. co. responses

Published

7 months agoon

November 18, 2024

On 10 February 2023, more than 2,500 community members were forcibly evicted from their land in Kapapi village in Hoima district in Western Uganda by security forces, receiving no compensation or resettlement.

Witness Radio, an Ugandan non-profit organisation comprised of human rights investigative journalists, lawyers, and social workers, said that many people were wounded during the eviction, women were raped, and houses were destroyed.

Witness Radio said its investigations found that this eviction occurred to clear the path for the Tilenga feeder pipeline, part of the East African Crude Oil Pipeline (EACOP). According to Witness Radio, in 2022 Kapapi community members’ land was surveyed for the Tilenga pipeline and people were informed they would be compensated for the land. Instead, they were forcibly evicted, which Witness Radio allege was backed and financed by Swacoff Intertrade Company Limited, known to TotalEnergies. They also allege that guards from private security company Magnum Security were involved. Witness Radio has also found that dozens of local farmers who were evicted have been arbitrarily arrested and face criminal charges.

The Business & Human Rights Resource Centre invited TotalEnergies, Swacoff Intertrade Company Limited, and Magnum Security to respond to the allegations. TotalEnergies responded and stated that no land eviction activities had been carried out by or on behalf of TotalEnergies EP Uganda (TEPU) and EACOP Ltd and that none of the affected people are Tilenga or EACOP Project Affected Persons. Swacoff responded and said that the company has never engaged in forceful eviction of any sort and asserts that these allegations are completely false. Their full responses and rejoinders from Witness Radio are available below. Magnum Security did not respond.

Related posts:

Uganda: NGO claims Agilis Partners & Great Seasons violently evicted locals to pave the way for agribusiness; Agilis Partners responds

Uganda: NGO claims Agilis Partners & Great Seasons violently evicted locals to pave the way for agribusiness; Agilis Partners responds

A son of the community defender is shot dead, another critically injured in a retaliatory attack by security guards evicting locals off their land to give way to large-scale sugarcane growing.

A son of the community defender is shot dead, another critically injured in a retaliatory attack by security guards evicting locals off their land to give way to large-scale sugarcane growing.

Breaking: Criminal trial for seven community defenders opposed to EACOP/Tilenga project forced land eviction has been fixed.

Breaking: Criminal trial for seven community defenders opposed to EACOP/Tilenga project forced land eviction has been fixed.

Uganda: CSOs claim Agilis Partners forcibly evicting local communities to pave way for agribusiness; company did not respond

Uganda: CSOs claim Agilis Partners forcibly evicting local communities to pave way for agribusiness; company did not respond

A decade of displacement: How Uganda’s Oil refinery victims are dying before realizing justice as EACOP secures financial backing to further significant environmental harm.

Carbon Markets Are Not the Solution: The Failed Relaunch of Emission Trading and the Clean Development Mechanism

Govt launches Central Account for Busuulu to protect tenants from evictions

Top 10 agribusiness giants: corporate concentration in food & farming in 2025

Uganda’s top Lands Ministry official has been arrested and charged with Corruption and Abuse of Office, a significant event that will have far-reaching implications for land governance in the country.

A decade of displacement: How Uganda’s Oil refinery victims are dying before realizing justice as EACOP secures financial backing to further significant environmental harm.

Govt launches Central Account for Busuulu to protect tenants from evictions

Environmentalists raise red flags over plan to expand oil palm fields in Kalangala

Innovative Finance from Canada projects positive impact on local communities.

Over 5000 Indigenous Communities evicted in Kiryandongo District

Petition To Land Inquiry Commission Over Human Rights In Kiryandongo District

Invisible victims of Uganda Land Grabs

Resource Center

- LAND GRABS AT GUNPOINT REPORT IN KIRYANDONGO DISTRICT

- RESEARCH BRIEF -TOURISM POTENTIAL OF GREATER MASAKA -MARCH 2025

- The Mouila Declaration of the Informal Alliance against the Expansion of Industrial Monocultures

- FORCED LAND EVICTIONS IN UGANDA TRENDS RIGHTS OF DEFENDERS IMPACT AND CALL FOR ACTION

- 12 KEY DEMANDS FROM CSOS TO WORLD LEADERS AT THE OPENING OF COP16 IN SAUDI ARABIA

- PRESENDIANTIAL DIRECTIVE BANNING ALL LAND EVICTIONS IN UGANDA

- FROM LAND GRABBERS TO CARBON COWBOYS A NEW SCRAMBLE FOR COMMUNITY LANDS TAKES OFF

- African Faith Leaders Demand Reparations From The Gates Foundation.

Legal Framework

READ BY CATEGORY

Newsletter

Trending

-

MEDIA FOR CHANGE NETWORK1 week ago

MEDIA FOR CHANGE NETWORK1 week agoA decade of displacement: How Uganda’s Oil refinery victims are dying before realizing justice as EACOP secures financial backing to further significant environmental harm.

-

MEDIA FOR CHANGE NETWORK1 week ago

MEDIA FOR CHANGE NETWORK1 week agoGovt launches Central Account for Busuulu to protect tenants from evictions

-

WITNESS RADIO MILESTONES2 weeks ago

WITNESS RADIO MILESTONES2 weeks agoTop 10 agribusiness giants: corporate concentration in food & farming in 2025

-

MEDIA FOR CHANGE NETWORK1 week ago

MEDIA FOR CHANGE NETWORK1 week agoCarbon Markets Are Not the Solution: The Failed Relaunch of Emission Trading and the Clean Development Mechanism