DEFENDING LAND AND ENVIRONMENTAL RIGHTS

Harvard’s billion-dollar farmland fiasco

Published

7 years agoon

One of the world’s major buyers of farmland is under fire for their involvement in land conflicts, environmental destruction and risky investments. A new report by GRAIN and Rede Social de Justiça e Direitos Humanos1 presents, for the first time, a comprehensive analysis of Harvard University’s controversial investments in global farmland.

The report finds that:

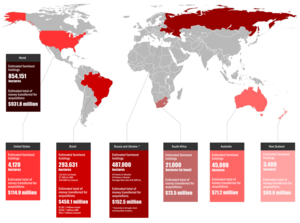

- Harvard’s endowment fund has spent around $1 billion to acquire control of an estimated 850,000 hectares of farmland around the world, making the University one of the world’s largest and most geographically diverse farmland investors.

- Harvard’s farmland acquisitions were undertaken without proper due diligence and have contributed to the displacement and harassment of traditional communities, environmental destruction and conflicts over water. The consequences of these deals are particularly dire in Brazil, where Harvard’s endowment fund has acquired nearly 300,000 hectares of land in the Cerrado, the world’s most biodiverse savannah.

- Harvard’s opaque farmland investments resulted in windfall remunerations for its fund managers and business partners but have failed as an investment strategy for the university.

The report urges Harvard’s students, faculty and alumni to:

- Demand that the University’s endowment fund ceases all its investments in farmland;

- Take immediate measures to resolve all land conflicts associated with its current land holdings, and

- Ensure that affected communities are adequately compensated for damages.

Palmerina Ferreira Lima outside her home in the village of Melancias, Piauí, Brazil. (Foto: Rosilene Miliotti / FASE)

Palmerina Ferreira Lima outside her home in the village of Melancias, Piauí, Brazil. (Foto: Rosilene Miliotti / FASE)

“Water. It’s finished.”

Palmerina Ferreira Lima is a 77-year old woman from the village of Melancias, which sits on the banks of the River Uruçuí Preto, in the Brazilian state of Piauí. For over 100 years, her community lived well on the fertile lands, lush savannahs and abundant waters that make up the northern part of Brazil’s biodiverse Cerrado region. But those good days are now a distant memory.2

A few years ago, powerful businessmen fenced off the lands surrounding the village and erected massive industrial soy plantations. Palmerina’s community was cut off from the lands they had depended upon for generations to feed their families and started suffering from new health problems caused by pesticides that have been aerially sprayed onto the farms and blown into homes. The pesticides also destroy their crops and pollute local water sources which now means that rivers and springs once abundant with fish, are now drying up because of deforestation and irrigation on the plantations.

“Water. It’s finished. There is very little left. We are here afraid of dying of thirst. If only these projects would stop, water would come back. But they don’t stop. No. They will probably stop when the river is all dried up,” says Palmerina.

Unbeknown to the people of Melancias, one of the farms inflicting damage upon them is owned by Harvard University. Harvard’s involvement is not obvious because the Ivy League university’s ownership is concealed behind a company managed by its local associates. Harvard contracted these businessmen to acquire the lands in Brazil and run the farm on its behalf. Few people also know that this same Brazilian business group acquired at least five other farms for Harvard in this area, with similar consequences for local people as in Melancias. Harvard has worked with a total of three Brazilian business groups to acquire nearly 300,000 hectares of farmland in the northeast region of the Brazilian Cerrado between 2008 and 2016, making the University one of the biggest foreign owners of farmland in the country.

Harvard’s Brazilian farmland holdings are just one piece of a much larger puzzle that is hidden behind an opaque web of companies buying up farmland on behalf of the University around the world. Our investigations revealed that, over the past decade, Harvard used multiple company structures to acquire vast farmland in Brazil, South Africa, Russia, the Ukraine, New Zealand, Australia and the United States. Shielded from public scrutiny, the University’s endowment fund quietly accumulated into one of the largest farmland portfolios of any financial company in the world in less than a decade.

Harvard’s splurge on global farmlands

Harvard University began buying farmlands in the immediate aftermath of the financial and food price crises of 2007 and 2008. It was one of several endowments, pension funds and other institutional investors that started to acquire farmland in the wake of the subprime crisis and the collapse of the housing market in the United States and Europe. While New York-based Teachers Insurance and Annuity Association (TIAA) took the lead in farmland acquisitions among pension funds, Harvard -with its $37.1 billion endowment fund- quickly established itself as the leading farmland buyer among universities (see Table 1).3

Table 1: Top US university endowment funds investing in farmland

| Endowment | Assets under management ($bn) | Current allocation to natural resources ($mn) | Farmland locations |

| University of Texas Investment Management Company | 40.3 | 4,978 | Australia, Latin America |

| Harvard Management Company | 36 | 4,644 | Africa, Oceania, Latin America, US |

| Princeton University Investment Company | 21.7 | 3,625 | Unknown |

| Stanford Management Company | 29.1 | 2,301 | Unknown |

| Yale University Endowment | 25.4 | 2,007 | Unknown |

| University of Michigan Endowment | 9.7 | 700 | Unknown |

| Emory University Endowment | 4.6 | 642 | Unknown |

| University of Pennsylvania Endowment | 10.7 | 642 | Unknown |

Source: Perqin, August 2017,http://docs.preqin.com/reports/Preqin-Special-Report-Natural-Resources-Top-100-August-2017.pdf

Harvard had already made major moves into the acquisition of global timberlands,4 so farmland was not an entirely new investment for the endowment and could fit in easily amongst its natural resources portfolio. The timber investments also provided contacts around the world, and a land investment model of offshore shell companies and obscure subsidiaries that could be replicated.

The University began by buying farmland in Brazil, South Africa, and New Zealand in 2008. Then came a major investment in Russia and Ukraine, followed by several farm purchases in Australia and the United States. By June 2017, Harvard had injected over US$ 930 million into its various farmland subsidiaries and had acquired control of over 850,000 hectares of farmland around the world, making the University one of the world’s top farmland buyers.5

An opaque corporate structure

Harvard’s farmland acquisitions are channeled through complex company structures, making it difficult to ascertain its specific farmland holdings. Even the fund’s own Board of Overseers does not have a clear understanding of the farmland that the fund owns and manages.6

At the top of each farmland investment structure is one of the Boston-based, tax-exempt subsidiaries that manage different parts of the endowment’s investments. Those subsidiaries involved in farmland acquisitions are Blue Marble Holdings, Phemus, Demeter and Harvard Private Capital Realty.

Information contained in the tax filings of these Boston subsidiaries shows that Harvard channeled money for farmland investment through these companies to other subsidiaries registered in tax havens, such as the US state of Delaware or the Cayman Islands, and with obscure names, such as Guara LLC or Granary Investments.

From these tax haven companies, the money then flowed to subsidiaries in the target countries, which are managed by various local operators active in agribusiness and land acquisitions. These local business groups identified the lands, made the purchases and managed the farms. Harvard paid them millions of US dollars in fees for their services (see Box: Harvard’s nebulous farmland network).

Conflict and controversy

Harvard followed the path of other institutional investors that have acquired farmland; focussing on countries seen as less risky but with the potential for high returns. This did not, however, keep the University’s investments free of conflict or risks.

In Australia, a report by the Office of Environment and Heritage found that, in 2015, Harvard’s subsidiary had destroyed aboriginal burial sites and removed native vegetation without a permit on farmland it acquired in New South Wales. The Harvard-owned farm company reportedly failed to carry out an Aboriginal cultural survey before ploughing up the fields, despite the existence of dozens of sensitive sites being evident.18

In South Africa, Harvard acquired farms where the former black workers and their families had been granted rights of occupation under the post-apartheid land reform. Conflicts with the local communities are detailed in a report by a researcher who worked with Harvard’s South African farm manager, RussellStone.19 According to his report, once Harvard took over these farms in 2011, the managers moved to restrict the land use rights of these families, including for grazing their cattle and accessing family burial sites. Harvard’s farm managers are said to have pressured the families to sign a code of conduct and to have imposed a system of rules and penalties that could lead to the expulsion of a family if not adhered to. Tensions on the farm are reported to have escalated thereafter, to the point where Harvard was worried that it might cause unwanted international attention.

According to the same report, Harvard insisted that RussellStone find a mediated solution, despite RussellStone’s assurances that such tensions with occupant families were a normal part of large-scale farming in South Africa. The University sent a mediator to offer to relocate the families to other lands, but the families rejected the offer saying the lands offered were of poor quality and far from essential services. Frustrated with the situation and wary of the repercussions for its international image, the University is reported to have directed RussellStone in 2014 to sell all of its farmland holdings on which there were “occupant” families.

Harvard has also waded into conflicts with its US farmland deals. According to its tax filings, since 2012, the University has invested over US$115 million into acquiring land in California and establishing vineyards. These farms, in the Paso Robles region and Cuyama Valley, are located in areas where water shortages are threatening the viability of agriculture.20 Local residents and farmers worry that Harvard’s vineyard projects will jeopardise their access to water, and accuse Harvard of using devious tactics to make a financial play on control over the remaining water resources.

Cindy Steinbeck, whose family has farmed wine grapes in the area for decades, is leading an effort by several hundred other landowners in the area to secure their access to groundwater. In a letter to the CEO of the Harvard Management Company in March 2016, she wrote:

“The local perception, right or wrong, is that Harvard has been doing the following: making purchases using multiple layers of disregarded entities such that it would be difficult for the layperson to trace the purchase back to Harvard; using agents to push for formation of a local water district that would allow Harvard’s properties to ultimately benefit from government grants and taxpayer funds; inducing certain property owners to sell with offers that are many times the going market rates and using this method to acquire properties that contain public water infrastructure; and generally not being forthcoming with the local populace about how these investments could affect the most vital of resources—all in the name of returns on investment.”21

Harvard’s land grabs in Brazil’s Cerrado

Two women from the village of Santa Fé in the municipality of Santa Filomena display their land certificates, September 2017. The people of Santa Fé have lived in this part of the Brazilian state of Piauí for over 200 years but are now affected by a recent wave of land grabbing in the area, led by Brazilian businessmen and financed by foreign companies, such as Harvard’s endowment fund and the US-based pension fund manager TIAA. (Foto: Rosilene Miliotti / FASE)

Two women from the village of Santa Fé in the municipality of Santa Filomena display their land certificates, September 2017. The people of Santa Fé have lived in this part of the Brazilian state of Piauí for over 200 years but are now affected by a recent wave of land grabbing in the area, led by Brazilian businessmen and financed by foreign companies, such as Harvard’s endowment fund and the US-based pension fund manager TIAA. (Foto: Rosilene Miliotti / FASE)

Harvard’s most conflict-ridden farmland acquisitions occurred in Brazil. The University is one of several foreign financial companies from North America, Europe and Japan that have acquired lands in the northeast of Brazil’s Cerrado region over the past decade. This savannah biome, which contains 5% of the planet’s biodiversity, is critical to the preservation of the Amazon and a major water source for Brazil’s most important water basins. It is also home to over 80 indigenous ethnic groups, as well as a variety of “traditional” peoples whose status is recognised under Brazilian law, such as the Afro-Brazilian Quilombola communities.

But over the past couple of decades, this part of the Cerrado has been heavily deforested and ploughed up for one of the largest expansions of commodity crop production in recent history. The expansion began to the south and then, roughly ten years ago, began moving aggressively towards the northeast, into the states of Tocantins, Maranhão, Bahia, and Piauí.

This “new frontier” for the production of soybeans, sugarcane and other agricultural commodities is where Harvard and other foreign financial companies are targeting their investments. They are drawn to the area because of the relatively low price of farmland and the potential for it to increase in market value. Aside from Harvard, some of the main foreign companies acquiring land in this area include TIAA of the United States, ABP of the Netherlands, Sojitz of Japan and Valiance Asset Management of the United Kingdom. All of these companies operate through partnerships with local companies that handle the land acquisitions and farming operations.22

The surge in speculation on farmland by foreign companies has exacerbated land conflicts in the area. The World Bank, while not citing any specific companies, says that, with the rapid expansion of plantation agriculture into this part of the Cerrado, “the disorderly and illegal occupation of rural land (grilagem) is common.”23 Grilagem is a particular form of land grabbing that is widespread in the northeast part of the Cerrado in which land titles are falsified to legitimise the illegal occupation of public lands.24 The lands are fenced to give the appearance of a farm and the fraudulent titles are then sold at a huge profit to other companies, which are often connected to foreign investors.

These public lands are not vacant, as is typically claimed by the land grabbers (grileiros). For generations, the land has been home to local communities, such as in the case of the lowland areas, or used collectively by these communities for hunting, grazing, collecting firewood, and harvesting fruit and medicinal plants. This is why the grileiros so often resort to violence and intimidation to displace the local people and prevent them from accessing the lands.25

Harvard has channeled its funds for farmland acquisitions in the northeast of the Cerrado through three different local business groups (see Box: Harvard’s nebulous farmland network). Under the cover of these operators, the University quietly acquired around 300,000 hectares of land – an area larger than Luxembourg- in parts of the states of Piauí and Bahia where land conflicts are rife.

Recent reports have exposed how one of Harvard’s business partners in Brazil, the Granflor group, arranged for a Harvard-owned subsidiary to acquire over 120,000 hectares of land in the state of Bahia from a businessman who is a well-known grileiro in the state.26 Granflor pursued the acquisition of these lands despite having been warned by local residents that they were the subject of serious conflicts.27 According to a 2014 report by a Bahia state commission, the titles to the lands that Harvard’s subsidiary would subsequently acquire were derived through a “festival of irregular and illegal procedures which resulted in usurpation of public lands” and involved the violent displacement of numerous local families that had traditionally occupied and used these public lands. It also appears that Harvard’s land acquisitions in the area are in violation of Brazilian restrictions on foreign ownership, which limit the amount of land that a foreign company can acquire within a municipality.28 The prosecutor’s office in the state of Bahia is now considering whether to sue Harvard’s subsidiary and cancel the titles.29

There is similar evidence of grilagem undertaken by one of Harvard’s other Brazilian business partners to acquire lands in the neighbouring state of Piauí. The Insolo group facilitated Harvard’s acquisition of at least six farms covering over 116,000 hectares in the state of Piauí through several Harvard-owned Brazilian subsidiaries managed by the Insolo group.

Fazenda Ipê is a massive 58,000-hectare farm that Harvard purchased through the Insolo group by way of several different Brazilian-based Harvard subsidiaries. In a decision handed down on 16 May 2018, the Agrarian Court Judge of Piauí stated that one of these subsidiaries, Sorotivo Agroindustrial Ltda, had used the practice of grilagem to acquire around 27,000 hectares of land within Fazenda Ipê that were previously public lands.30

According to the judgement:

“In Piauí, land grabbing (grilagem) is one of the main causes of deforestation and land conflicts, as real estate transactions in the rural market happen outside of compliance with the rules regarding civil, environmental and agrarian legislation; making it impossible to hold those involved accountable. This discredited practice of grilagem is what was practiced by [Sorotivo Agroindustrial Ltda] in acquiring its land titles.”31

Aerial spraying of pesticides on a soybean plantation in Piauí, Brazil. (Foto: José Cícero Silva/Agência Pública)

Aerial spraying of pesticides on a soybean plantation in Piauí, Brazil. (Foto: José Cícero Silva/Agência Pública)

Near to Fazenda Ipê, the people from the community of Baixão Fechado claim that they were pushed off of lands they traditionally used to forage, raise livestock and hunt by another Harvard-owned farm managed by the same Insolo group.32 The Fazenda Fortaleza, which covers about 11,000 hectares, is situated next to a large farm owned by the US pension fund manager TIAA, which is named Fazenda Ludmilla.33 The residents of Baixão Fechado say that the deforestation caused by both farms, and the large amounts of water the farms use for irrigation, have badly affected their access to water which was previously plentiful and of good quality. The situation has become so bad that the village has had to start bringing in water by trucks. The villagers also say that pollution from the pesticides sprayed on the farms is behind the increase in health symptoms like coughing, dizziness, stomach aches, and low blood pressure that have been witnessed in the community, as well as a rise in cases of cancer. Pesticides used on these farms also have decimated the community’s fishing grounds and caused the destruction of their crops.34

“They use pesticides such as Roundup. It destroys all of our crops, including the broad bean crop. We used to be a top producer of broad beans in the region. Now we are losing all of our broad beans… They spray that poison from their airplanes and it contaminates everything. A bunch of pests appear, like the whitefly which we can’t kill, and they destroy everything,” says José Branco, a resident of the Baixão Fechado community.35

Through its third business partner in Brazil, the Gordian Bioenergy group (GBE), Harvard financed the acquisition of several more areas of farmland in Piauí, which were part of a massive agribusiness project that GBE has been pursuing in the district of Guadalupe since 2012. The GBE project, however, is still struggling to obtain the finances it needs to move into the implementation phase and, according to Bloomberg News, Harvard is now trying to exit from the project.36

But these are not the only farmland deals that GBE orchestrated for Harvard. In the district of Barra, in the state of Bahia, Harvard acquired a farm called Fazenda Boqueirão through a GBE managed Harvard subsidiary. The lands were acquired from the Brazilian company, Pro-Flora Agroflorestal Ltda, which is owned by a wealthy Brazilian business family from the state of Minas Gerais.37

Fazenda Boqueirão is at the centre of a land conflict between the owners of Pro-Flora and about 400 families living in the area. After the owners of Pro-Flora acquired Fazenda Boqueirão in 2004, they moved to claim rights over an expanded 70,000 hectares area of land which covered lands that the peasant families have collectively grazed their cattle on since at least 1935.38 The families refused to give up their lands, and tensions between the two sides escalated.39 Finally, in 2011, the Bahia State authority stepped in and agreed with the families that the company’s claims to the lands were invalid. However, in a concession to the company, it decided to provide Pro-Flora with a private title to a 27,800-hectare parcel that the communities were said not to be using.40 This private title was formalised in 2014, by which time Pro-Flora had already sold Fazenda Boqueirão to Harvard’s local GBE subsidiary for US$3 million.41

Meanwhile, Cloves dos Santos Araujo, a lawyer with the Rural Workers’ Lawyers’ Association (AATR) of Bahia, says that the state has still not formalised titles for the families covering the remaining 42,000 hectares, leaving them vulnerable to a new round of land grabbing by Fazenda Boqueirão’s owners.42 Indeed, in June 2017, the lawyer representing Pro-Flora initiated a petition with the state for the recognition of the company’s rights to the full 70,000 hectares area.43

Brazil’s Pastoral Land Commission (Comissão Pastoral da Terra – CPT) is closely following the case and supporting the communities to defend their traditional lands. It argues that the agreement giving Pro-Flora, and subsequently Harvard, a private title to the 27,800 hectares of land is unconstitutional and in violation of Brazil’s agrarian reform policies. For the CPT, it’s another unfortunate incidence of the government putting the interests of big agribusiness above those of local people.44

A dismal harvest

Harvard’s decade of farmland deals has generated many casualties, from Brazilian peasants to South African farm workers to rural Californians. The students and faculty of Harvard could also be viewed as casualties of these investments. The endowment fund’s investments are meant to support the educational and research goals of the University, but its billion-dollar farmland deals have performed badly. Last year, the endowment’s new chief, N.P. “Narv” Narvekar, re-evaluated the fund’s investments in timber and farmland which led to the entire natural resources portfolio being written down from $4 billion to $2.9 billion.

In Brazil, where Harvard made its most ambitious and costly farmland investments, much of the 300,000 hectares that the fund acquired is in partial production or not in production at all. The GBE project in Piauí is on the verge of collapse without having planted a single crop. The 124,000 hectares of land of Caracol’s Campo Largo are mostly lying idle, and there is barely anything planted on several of the large farms acquired through the Insolo group in Piauí, such as Fazenda Nazaré, Fazenda Galileia and Fazenda Fortaleza.45

The Boston-based fund managers that orchestrated the University’s controversial move into global farmland have all recently exited from the endowment. During their time at the fund, the top fund managers amassed hundreds of millions of dollars in compensation payments — a stunning US$242 million between 2010 to 2014.46 As noted by institutional investment analyst Charles Skorina, the compensation payments for the managers of the natural resources portfolio were largely based on valuations for farmlands and timberlands that were controlled by the managers themselves. According to Skorina, the recent write-down in the value of these assets indicates that those valuations were inflated in ways that benefitted these managers.47 Several of these former Harvard managers have recently founded a new company called Folium Capital, where they are once again raising funds from institutional investors to acquire farmland in South America.48

Seu Juarez, from the village of Melancias, examining a local stream affected by Harvard’s Fazenda Galileia in the municipality of Baixa Grande do Ribeiro, Piauí, Brazil. (Foto: José Cícero Silva/Agência Pública)

Seu Juarez, from the village of Melancias, examining a local stream affected by Harvard’s Fazenda Galileia in the municipality of Baixa Grande do Ribeiro, Piauí, Brazil. (Foto: José Cícero Silva/Agência Pública)

Harvard cannot plead ignorance. It pursued these investments in farmland despite years of public criticism and demands for greater due diligence.49 Some of this criticism was internal. On 22 May 2018, one of the overseers of the Harvard endowment fund, Kat Taylor, resigned in protest over the fund’s “opaque” investments in unethical activities, including “land purchases that may not respect indigenous rights [and] water holdings that threaten the human right to water.”50

“After six years of Harvard’s inaction during my tenure, and many more that preceded my participation as an Overseer, I am today speaking publicly about our failure to act. We have neither a moral nor a financial narrative to stand behind,” she wrote. “Over the last decade, Harvard’s endowment has severely underperformed financially compared to its peers, even as we have continued to invest in activities and products that undermine the well-being of our communities, nation and planet.”

Taylor says that even as a member of the Board of Overseers, she was unable to know definitively what the endowment was invested in and only had “some indication” that the fund held “African land, Amazon River Delta properties and, potentially, water resource assets”.

“All three of those suggest that we should be aware of whether those holdings are respectful of indigenous rights, the possibility of land ownership that’s not traditionally documented, assets that are particularly sensitive from a climate standpoint and the possibility of water rights being sold out of market to the detriment of local ecologies and local economies,” she said in an interview with the specialised news outlet Agri Investor.51

Our investigations of Harvard’s farmland deals in Brazil suggest that the University did not proceed with the necessary level of due diligence to ensure that the lands it purchased were free of land conflict nor based on clear legal titles. Given that it was investing hundreds of millions of US dollars to acquire farmland in an area well known for land conflicts and land grabbing, it should have exercised much greater vigilance.

Making amends

Harvard’s farmland deals should be a cautionary tale for institutional investors currently contemplating getting involved in the sector. The risks Harvard’s fund managers took have not paid off financially for the University, and have instead left it with a legacy of land and water conflicts to deal with. While Harvard has been rethinking its farmland investment strategy over the past year and trying to sell off some of its farms, the University has yet to announce any moves to restrict future farmland deals nor to introduce new internal rules, guidelines, or systems of oversight for such investments.52 The priority that it continues to place on its controversial farmland investments in Brazil is further demonstrated by the fund’s hiring of the architect of TIAA’s Brazilian farmland investments to head its natural resources portfolio, in August 2016.53

Harvard’s students, faculty and alumni should demand a full, independent assessment of Harvard’s global farmland acquisitions. This should include an accounting of how much was spent acquiring the land, including the payments to fund managers and business associates, and how much has been returned to the fund through on-farm production and farm sales. It should also involve an inventory of the damages caused to local communities through displacement, conflicts, chemical pollution and environmental destruction, as well as clear recommendations for how Harvard can best compensate these communities. Harvard should not be allowed to relinquish its responsibilities by simply selling off its farmlands to another company or outsourcing its farmland acquisitions to external managers.

Harvard was one of a small number of institutional investors that pioneered the move into global farmland investing after the 2008 financial crash. These corporations, more than any other, are responsible for having made farmland a new “asset class” for financial investors who are eager to find real assets, or so-called “alternatives”, that they can buy to hedge against volatility in the stock markets. With real estate and stock markets once again at highly inflated levels, the same tendencies we saw post-2008 could reappear, generating a new rush of risky farmland investments by institutional funds, and another spike in land conflicts. Harvard University can help make amends. by declaring an end to its global farmland acquisitions.

Box: Harvard’s nebulous farmland network

In the case of South Africa, Harvard’s farm acquisitions were handled by the RussellStone Group; a privately-owned Pretoria-based investment house that entered the business of acquiring farms in southern Africa for foreign investors in 2008. Aside from its dealing with Harvard, RussellStone also managed a controversial farmland acquisition for Vanderbilt University in Mozambique.7 Between June 2008 and June 2016, Harvard transferred US$ 73.5 million via a Mauritius-based subsidiary to a South African subsidiary managed by RussellStone. With these funds, RussellStone acquired several farm properties in the South African provinces of KwaZulu-Natal, Mpumalanga, Limpopo, Free State and Gauteng. Over these years, RussellStone received at least US$ 5.1 million from Harvard for investment management services.

Harvard turned to a similar investment house for its farmland purchases in Australia; a company called Wealthcheck “that sources opportunities to invest in the Australian Agricultural Property Sector.”8 In Eastern Europe, Harvard partnered with NCH Capital, a New York-based company specialising in the privatisation of assets in the former Soviet block. NCH’s strategy is to acquire rights to thousands of small plots of land, mainly in Russia and Ukraine, and to amalgamate these into large-scale operations.9 Through a Cayman Islands subsidiary, Harvard spent over US$150 million between June 2009 and June 2016 to take a 59% stake in NCH’s first farmland fund, which NCH used to establish 58 large-scale farms covering around 490,000 hectares in Russia and Ukraine.10 Harvard paid NCH US$12.9 million for investment services over this period.

In Brazil, Harvard’s farmland deals were orchestrated through three different structures involving three local operators.

1. The Ioschpes

Brazilian autoparts magnate Ivoncy Ioschpe is said to have learned about the potential for making money from agriculture in the Cerrado in 2000. He soon started acquiring farmland in the northern state of Piauí and contracted a group of local agronomists, who had formed a company called Insolo, to convert these lands into massive soybean and cotton plantations. In 2008, Ioschpe took over Insolo, placed his son Salomão in charge, and remade the company into a vehicle for channelling money from Harvard’s endowment fund into the acquisition of large areas of farmland in Piauí.11 This company, now named Insolo Agroindustrial S/A, is 95.8% owned by Harvard, by way of its fund management company Phemus Corp and several subsidiaries in Delaware and Brazil. Between June 2008 and June 2016, Harvard injected at least US$138.7 million into Insolo Agroindustrial S/A which then acquired at least six farms covering over 115,000 hectares in Piauí. Harvard also paid a company connected to the Ioschpe group US$3 million a year in consultancy fees for “investment services”, from June 2009 to June 2017.12

2. Gordian Bioenergy

Gordian Bioenergy, known as GBE, is a private equity company run in part by Greek-Brazilian businessman Diomedes Christodoulou, the former CEO of Enron’s South American operations, as well as several of his former Enron colleagues; Roberto Hukai, John Novak and Steven Madrid.13 In 2007, Christodoulou and his team went looking for US and European investors to back a US$150 million sugarcane plantation and ethanol refinery project they were planning to build in Brazil.14 They connected with the Harvard endowment and the two sides set up a corporate structure, running through a Cayman Islands company to channel money from Harvard into the venture. GBE then set about to acquire farmland in and around the town of Guadalupe in Piauí, where it proposed to build its sugarcane operations, as well as a large-scale tomato farm.15 Lands were also acquired in neighbouring states for reasons that are not apparent. One of the companies working with GBE in acquiring the lands for Harvard was Pro-Flora Agroflorestal Ltda, a company owned by Brazilian businessman Antônio Pontes da Fonseca; one of the largest farmland owners in the state of Minas Gerais.16 Between June 2008 and June 2015, Harvard transferred over US$246 million to GBE for farmland acquisitions.17 How much of this was provided to GBE for investment management and other services is unclear.

3. Granflor

Harvard’s entry into Brazilian agriculture was preceded by investments in timber. Some of these deals were orchestrated by two Brazilian businessmen from the forestry sector, Romualdo Maestri and Victor Hugo Silveira Boff, who are the co-founders of the company Granflor Agroflorestal. In 2008, Harvard and these two businessmen established a company in the Brazilian city of Porto Alegre called Caracol Agropecuaria. This company, 100% owned by Harvard through a set of Delaware-registered subsidiaries, received over US$60 million from Harvard’s fund management company Blue Marble Holdings between June 2008 and June 2016 for the acquisition of farmland, primarily in the state of Bahia. During this same period, Harvard appears to have paid Maestri and Silveira Boff over US$10 million for investment services through their company Mb – Gestão e Projetos.

Related posts:

You may like

-

The global farmland grab goes green

-

A new pattern of senior UPDF officers’ involvement in the land grab

-

Fresh violence in Kiryandongo as a project affected family head narrowly survived death

-

Dwindling number of Africans own land.

-

Renewing demand for justice; the 28 land rights defenders have applied for bail

-

A tree planting Chinese Company, Formosa Limited in fresh illegal land eviction…

DEFENDING LAND AND ENVIRONMENTAL RIGHTS

Crackdown on EACOP protesters intensifies: 35 Activists arrested in just four months.

Published

2 months agoon

April 30, 2025

By Witness Radio team.

Ugandan authorities’ ongoing crackdown on anti-EACOP protest marches is spreading rapidly like wildfires. The East African Crude Oil Pipeline (EACOP) Project, a significant oil infrastructure development, has been a point of contention. Recently, Witness Radio warned that criminalizing the activities of individual activists and environmental defenders opposed to this project, which aims to transport crude oil from Hoima in Uganda to the Port of Tanga in Tanzania, will be regarded as the most disastrous and insensitive to communities’ concerns in Uganda’s history.

In just four months, a series of arrests targeting environmental activists opposing the mega oil project that transports crude oil from Hoima in Uganda to the Port of Tanga in Tanzania has resulted in a scene of crime. No one is allowed to express their concerns peacefully about it and push back on its adverse negative impacts.

While activists view the peaceful marches as a rightful and brave effort to protect the environment and the communities affected by the project, the authorities, including the Uganda police and Prosecutor’s office, regard these actions as attempts to sabotage development projects and resort to criminalization.

Activists and civil society organizations’ reports indicate that the project will likely damage the environment and has displaced thousands of local communities in Uganda and Tanzania.

Despite growing concerns and an intensified crackdown, project financiers and shareholders remain unwavering in supporting the EACOP project. This steadfast support underscores the urgency of the situation. However, environmental and human rights defenders stand firm, resolutely demanding the project’s halt, showing a glimmer of hope in this challenging situation.

Over last weekend, eleven (11) environmental activists were arrested, charged, and sent to prison. They were arrested and detained by police at Kenya Commercial Bank (KCB) premises while attempting to deliver a petition urging the bank to halt its financial support for the 1,444-kilometer heated pipeline project.

The arrest of the eleven activists comes less than a month after nine activists were detained on April 02 outside the Stanbic Bank headquarters while attempting to deliver a petition urging the bank to halt its funding for the project.

The eleven include Bob Barigye, Augustine Tukamashaba, Gilbert Ayebare, Umar Kasimbe, Joseph Ssengozi, Keith Namanya, Raymond Bituhanga, Mohammed Ssentongo, Paul Ssekate, Misach Saazi and Phionah Nalusiba.

KCB Bank Uganda is one of the banks that recently joined the race to fund the EACOP project. Last month, On March 26, 2025, EACOP Ltd., the company in charge of the construction and future operation of the EACOP project, announced that it had acquired additional financing provided by a syndicate of financial institutions, including regional banks such as KCB Bank.

Other banks in the syndicate include the Stanbic Bank Uganda, the African Export-Import Bank (Afreximbank), the Standard Bank of South Africa Limited, and the Islamic Corporation for the Development of the Private Sector (ICD).

The activists appeared before the Nakawa Chief Magistrate Court on April 25. They were charged with criminal trespass. According to section 302 of the Penal Code, a person convicted of criminal trespass is liable to a maximum sentence of one year in prison. This detail underscores the weight of the situation.

The activists are currently on remand at Luzira Maximum Prison and are expected to appear again before the court on May 08, 2025, for mention.

Related posts:

The latest: Another group of anti-EACOP activists has been arrested for protesting Stanbic Bank’s financing of the EACOP Project.

The latest: Another group of anti-EACOP activists has been arrested for protesting Stanbic Bank’s financing of the EACOP Project.

Another group of eleven environmental activists have been charged with common nuisance and remanded to Luzira Prison for opposing the EACOP project.

Another group of eleven environmental activists have been charged with common nuisance and remanded to Luzira Prison for opposing the EACOP project.

Breaking: Eight (8) environmental activists have been arrested by police over protesting against the EACOP project.

Breaking: Eight (8) environmental activists have been arrested by police over protesting against the EACOP project.

Breaking: 15 Anti-EACOP Activists Arrested in Kampala While Marching to Parliament

Breaking: 15 Anti-EACOP Activists Arrested in Kampala While Marching to Parliament

DEFENDING LAND AND ENVIRONMENTAL RIGHTS

Witness Radio Petitions ODPP urgently to review and withdraw criminal charges against Buvuma Community Land Defenders.

Published

3 months agoon

April 14, 2025

By Witness Radio team.

As Ugandan courts increasingly become tools of oppression, Witness Radio is deeply concerned about the growing trend of weaponizing the justice systems against communities, land, and environmental defenders who resist land grabbing and other harmful land-based investments.

In a well-calculated tactic, land grabbers and investors continue to collude with security agencies, particularly the police, to arrest violently and courts of law to maliciously prosecute hundreds of these defenders for either fighting back against the land-grabbing schemes or criticizing harmful land-based investments in Uganda.

This trend of persecution is not isolated to Buvuma but is a continuous threat in many other parts of Uganda. Buvuma, in particular, is a hotbed of injustice, where the government of Uganda, in collaboration with BIDCO, is implementing the National Oil Palm Project (NOPP) to expand palm oil growing in Uganda.

In our article dated March 5th this year, Witness Radio revealed how community land defenders in Buvuma continued to face judicial harassment on trumped charges simply for defending their land from being grabbed for palm oil plantations.

The accused defenders are residents of the Magyo and Bukula villages in the Buvuma district.

More than a dozen smallholder farmers in these villages situated in Nairambi Sub-county are facing violent evictions from their land and unending persecution. They have been framed with criminal charges for refusing to give away their land for palm oil growing.

The victims are legal owners of bibanja duly registered by Buganda Land Board and recognized as tenants by Buganda Land Board.

Buvuma College school is claiming ownership of the land, while Buvuma district officials, under the guise of protecting Kirigye Forest Reserve, also claim the same land on which these individuals have settled lawfully for decades.

Several community members have been arrested and charged with false criminal offenses.

Among them include community land rights defender Ssentongo, who is currently battling with cases CRB:301/2023, accused of illegally occupying Kirigye forest land (offense of carrying out prohibited activities in forest reserve).

CRB 232/2024 with complainant Kabale Denis (District Forest Officer) charged with carrying out prohibited activities in the forest reserve and CRB 098/2023 on criminal trespass with Buvuma College administration, the complainant.

Others facing persecution are Steven Kyeswa, Kisekwa Richard, and Kibondwe Chrysostom on CRB 141/2024 with assault occasioning actual bodily harm vide Criminal Case No 075 of 2024, among other cases.

As part of efforts to end the ongoing oppression of community defenders in Buvuma, Witness Radio has petitioned the Office of the Director of Public Prosecutions to urgently intervene, review, and withdraw the charges unjustly brought against these defenders.

According to the petition dated March 7th, 2025, the sole intention of these charges is to grab community land without any merits as criminal charges. Sarah Adong, one of the staff attorneys and Head of Witness Radio Legal Aid, reveals that the matters against the accused persons before the court point to the question of land ownership, which can only be answered through civil suits and not criminal charges. It is an apparent injustice.

“Upon thoroughly examining the facts, evidence, and circumstances surrounding these charges, it is evident that they have no merit whatsoever. They amount to vexatious and frivolous prosecution that serves no genuine interest of justice,” the petition by the Land and Environmental Rights Watchdog mentioned.

In an unusual turn of events, the Witness Radio Legal Aid team observed that some of the defenders, including Sentongo, have been charged with criminal trespass twice by the same complainant vide CC No 325 of 2020 and are now facing the same charge by the same party vide CC No 062/2023. This repeated persecution is a heavy burden on these defenders.

“The charges against our client undermine the accused person’s rights under Article 29 (9) of the Constitution of the Republic of Uganda. It has proven that the cases brought against our clients are frivolous and vexatious as they are instituted in a manner that constitutes abuse of court processes,” the petition further read.

Therefore, the organization strongly urges the office of the DPP to exercise its prosecutorial discretion under relevant legal provisions. This is crucial for the prevalence of equity, justice, and good conscience and reaffirming the prosecution process’s integrity and objectivity.

Related posts:

Witness Radio petitions chief prosecutor: Want 34 community land rights defenders and activists released from prison.

Witness Radio petitions chief prosecutor: Want 34 community land rights defenders and activists released from prison.

Palm Oil project investor in Landgrab: Witness Radio petitions Buganda Land Board to save its tenants from being forcefully displaced palm oil plantation.

Palm Oil project investor in Landgrab: Witness Radio petitions Buganda Land Board to save its tenants from being forcefully displaced palm oil plantation.

Court charges and remands two community land rights defenders and eight farmers to prison

Court charges and remands two community land rights defenders and eight farmers to prison

Uganda: Targeting community land and environmental defenders with criminal offenses is rising as two community land rights defenders arrested in a hotspot district of forced land evictions.

Uganda: Targeting community land and environmental defenders with criminal offenses is rising as two community land rights defenders arrested in a hotspot district of forced land evictions.

DEFENDING LAND AND ENVIRONMENTAL RIGHTS

Milestone: Another case against the EACOP activists is dismissed due to the want of prosecution.

Published

3 months agoon

April 8, 2025

By Witness Radio team.

The Buganda Road Chief Magistrate has dismissed another case against 20 anti-EACOP activists due to want of prosecution.

Yesterday, on April 7, 2024, her worship, Jalia Basajjabalaba, dismissed the case against the 20 activists. The case was dismissed after the state failed to produce witnesses pinning the activists on a common nuisance charge after close to 9 months of case trial.

On August 26, 2024, the 20 activists, including Pitua Robert, Okwai Stephen, Kothurach Margret, Omirambe Moses, Owonda Rogers, Alimange Joseph, and Wabiyona Wicklyf, among others, were arrested while peacefully marching to the Ministry of Energy to deliver a petition opposing EACOP and other oil projects. On August 27, 2024, they were arraigned before Court and charged by the Buganda Road Magistrate with common nuisance.

After nearly nine months of trial, the state failed to present a single witness, prompting the magistrate to close the case file.

Although the case against the activists has been dismissed, they remain deeply dissatisfied with the continued pattern of arrests and charges, which often collapse in Court due to a lack of evidence.

Bob Barigye, one of the activists whose case was dismissed, expressed concern over what he described as deliberate attempts to frustrate and silence voices critical of the EACOP project.

“We are saddened that it was just dismissed after eight months of pacing up and down to Court.

We are disappointed that the magistrate did not award us any cost or compensation for the dismissed case, meaning that the state failed to prove that we were a public nuisance and that we were citing violence as activists. Many of us have been forced to travel long distances from our villages to attend court sessions in Kampala — only for the state to produce no evidence against us. It’s a clear waste of our time, energy, and resources. But beyond that, it’s an attempt to discourage us from speaking the truth about the dangers of the EACOP project,” Barigye said.

Barigye added that the activists are already engaging their lawyers to explore further legal remedies in higher courts, demonstrating their unwavering commitment to justice and their cause.

“It is frustrating and deeply disappointing that we are dragged to Court and disrespected every time we stand up against this deadly pipeline, the East African Crude Oil Pipeline (EACOP). But we were ready to face this battle in Court because we knew we had committed no crime by delivering a petition,” Barigye said, expressing the activists’ exasperation with the legal process.

Shortly after their last Court appearance on February 20, the 20 accused activists, during a press briefing, demanded that the judiciary stop delaying hearings of their case related to the EACOP project and called for the dismissal of their case if the Court lacks sufficient evidence to prosecute them.

“The courts of law should not be used as tools of oppression. They should not waste any time. If we have a case to answer, let them prosecute us on April 7, which they have scheduled. If they fail again, they should dismiss the case instead of wasting our time and resources,” the activists emphasized, reiterating their demand for a fair and expedited legal process.

This is the second milestone achieved by the Stop EACOP activists in less than two months in their continued campaign against the EACOP pipeline. In February 2025, the Court also dismissed a common nuisance case against the 15 EACOP activists due to the lack of prosecution.

“The state doesn’t present a single witness in all the cases that have always been preferred against us. No witnesses have come along to say that these people were unruly. As activists, we want to investigate this further and go to the Constitutional Court to learn what constitutes a nuisance. Whoever is demonstrating peacefully is arrested and charged with a public nuisance. This charge is coronial and very demeaning. We want to go ahead and challenge this,” Barigye revealed, outlining the activists’ proactive plans to challenge the charge of public nuisance.

The EACOP project has long been controversial, with environmental activists arguing that it poses a significant environmental risk and has already left a trail of human rights abuses in the communities hosting it in Uganda and Tanzania.

The EACOP is a 1,443-kilometer heated pipeline transporting crude oil from Hoima, Uganda, to Tanga, Tanzania. The first 296 kilometers run through Uganda, while the remaining 1,147 kilometers pass through Tanzania. The project is a joint venture between TotalEnergies, the Uganda National Oil Company (UNOC), the Tanzania Petroleum Development Corporation (TPDC), and the China National Offshore Oil Corporation (CNOOC).

Related posts:

Another group of eleven environmental activists have been charged with common nuisance and remanded to Luzira Prison for opposing the EACOP project.

Another group of eleven environmental activists have been charged with common nuisance and remanded to Luzira Prison for opposing the EACOP project.

Breaking: The Bail Application for the 15 EACOP Activists flops for the second time, as the trial magistrate is reported to have been transferred.

Breaking: The Bail Application for the 15 EACOP Activists flops for the second time, as the trial magistrate is reported to have been transferred.

Breaking: Buganda Road Court grants bail to 15 stop EACOP activists after 30 days in prison.

Breaking: Buganda Road Court grants bail to 15 stop EACOP activists after 30 days in prison.

EACJ’s Appellate Court will hear an appeal on the dismissed Case against EACOP development.

EACJ’s Appellate Court will hear an appeal on the dismissed Case against EACOP development.

Communities Under Siege: New Report Reveals World Bank Failures in Safeguard Compliance and Human Rights Oversight in Tanzania

A decade of displacement: How Uganda’s Oil refinery victims are dying before realizing justice as EACOP secures financial backing to further significant environmental harm.

Carbon Markets Are Not the Solution: The Failed Relaunch of Emission Trading and the Clean Development Mechanism

Govt launches Central Account for Busuulu to protect tenants from evictions

Uganda’s top Lands Ministry official has been arrested and charged with Corruption and Abuse of Office, a significant event that will have far-reaching implications for land governance in the country.

A decade of displacement: How Uganda’s Oil refinery victims are dying before realizing justice as EACOP secures financial backing to further significant environmental harm.

Govt launches Central Account for Busuulu to protect tenants from evictions

Environmentalists raise red flags over plan to expand oil palm fields in Kalangala

Innovative Finance from Canada projects positive impact on local communities.

Over 5000 Indigenous Communities evicted in Kiryandongo District

Petition To Land Inquiry Commission Over Human Rights In Kiryandongo District

Invisible victims of Uganda Land Grabs

Resource Center

- LAND GRABS AT GUNPOINT REPORT IN KIRYANDONGO DISTRICT

- RESEARCH BRIEF -TOURISM POTENTIAL OF GREATER MASAKA -MARCH 2025

- The Mouila Declaration of the Informal Alliance against the Expansion of Industrial Monocultures

- FORCED LAND EVICTIONS IN UGANDA TRENDS RIGHTS OF DEFENDERS IMPACT AND CALL FOR ACTION

- 12 KEY DEMANDS FROM CSOS TO WORLD LEADERS AT THE OPENING OF COP16 IN SAUDI ARABIA

- PRESENDIANTIAL DIRECTIVE BANNING ALL LAND EVICTIONS IN UGANDA

- FROM LAND GRABBERS TO CARBON COWBOYS A NEW SCRAMBLE FOR COMMUNITY LANDS TAKES OFF

- African Faith Leaders Demand Reparations From The Gates Foundation.

Legal Framework

READ BY CATEGORY

Newsletter

Trending

-

MEDIA FOR CHANGE NETWORK1 week ago

MEDIA FOR CHANGE NETWORK1 week agoA decade of displacement: How Uganda’s Oil refinery victims are dying before realizing justice as EACOP secures financial backing to further significant environmental harm.

-

MEDIA FOR CHANGE NETWORK2 weeks ago

MEDIA FOR CHANGE NETWORK2 weeks agoGovt launches Central Account for Busuulu to protect tenants from evictions

-

WITNESS RADIO MILESTONES2 weeks ago

WITNESS RADIO MILESTONES2 weeks agoTop 10 agribusiness giants: corporate concentration in food & farming in 2025

-

MEDIA FOR CHANGE NETWORK2 weeks ago

MEDIA FOR CHANGE NETWORK2 weeks agoCarbon Markets Are Not the Solution: The Failed Relaunch of Emission Trading and the Clean Development Mechanism

-

NGO WORK22 hours ago

NGO WORK22 hours agoCommunities Under Siege: New Report Reveals World Bank Failures in Safeguard Compliance and Human Rights Oversight in Tanzania