SPECIAL REPORTS AND PROJECTS

How Carbon Markets are Exploiting Marginalised Communities in the Global South Instead of Uplifting them

Published

10 months agoon

The billion-dollar fiction of carbon offsets

Carbon markets are turning indigenous farming practices into corporate profit, leaving communities empty-handed.

For Janni Mithula, 42, a resident of the Thotavalasa village in Andhra Pradesh, cultivating the rich, red soil of the valley was her livelihood. On her small patch of land grow with coffee and mango trees, planted over decades with tireless care and ancestral knowledge. Yet, once a source of pride and sustainability, the meaning of these trees has been quietly redefined in ways she never agreed to.

Over a decade ago, more than 333 villages in the valley began receiving free saplings from the Naandi Foundation as part of a large-scale afforestation initiative funded by a French entity, Livelihoods Funds. Unbeknownst to Janni and her neighbours, these trees had transfigured into commodities in a global carbon market, their branches reaching far beyond the valley to corporate boardrooms, their roots tethered not to the soil of sustenance but to the ledger of profit and carbon offsets.

The project claims that it would offset nearly 1.6 million tonnes of carbon dioxide equivalent over two decades. On paper, it is a triumph for global climate efforts. In reality, the residents’ lives have seen little improvement. While the sale of carbon credits has reportedly fetched millions of dollars for developers, Janni’s rewards have been minimal: a few saplings, occasional training sessions, and the obligation to care for trees that she no longer fully owns. These invisible transactions pose a grave risk to marginalised communities, who practice sustainable agriculture out of necessity rather than trend.

Also Read | COP29: The $300 billion climate finance deal is an optical illusion

The very systems that could uplift them—carbon markets intended to fund sustainability—end up exploiting their resources without addressing their needs.

Earlier this year, the Centre for Science and Environment (CSE) and Down To Earth (DTE) released a joint investigative report on the functioning of the voluntary carbon market in India. The report critically analysed the impacts of the new-age climate solution, its efficacy in reducing carbon emissions, and how it affected the communities involved in the schemes.

The findings highlighted systemic opacity, with key details about the projects, prices, and beneficiaries concealed under confidentiality clauses. Developers also tended to overestimate their emission reductions while failing to provide local communities with meaningful compensation. The report stated that the main beneficiaries of these projects were the project developers, auditors and companies that make a profit out of the carbon trading system.

Carbon markets: The evolution

On December 11, 1997, the parties to the United Nations Framework Convention on Climate Change (UNFCC) convened and adopted the Kyoto Protocol with the exigence of the climate crisis bearing down on the world. The Kyoto Protocol, revered for its epochal impact on global climate policy, focused on controlling the emissions of prime anthropogenic greenhouse gases (GHGs). One of the key mechanisms introduced was the “Clean Development Mechanism”, which would allow developed countries to invest in emission reduction projects in developing countries. In exchange, the developed countries would receive certified emission reduction (CER) credits, or carbon credits as they are commonly known.

One carbon credit represents the reduction or removal of one tonne of CO2. Governments create and enforce rules for carbon markets by setting emission caps and monitoring compliance with the help of third-party organisations. For example, the European Union Emissions Trading System (EU-ETS) sets an overall cap on emissions and allocates allowances to industries. A financial penalty system was also put in place to prevent verifiers and consultants from falsifying emissions data. The impact of these renewable projects is usually verified through methods such as satellite imagery or on-site audits.

Companies such as Verra and Gold Standard have seized this opportunity, leading the designing and monitoring of carbon removal projects. Governments and corporations invest in these projects to meet their own net-zero pledges. The companies then issue carbon credits to the investing entity. Verra has stated that they have issued over 1 billion carbon credits, translating into the reduction of 1 billion tonnes of greenhouse gas emissions. However, countless case studies and reports have indicated that only a small fraction of these funds reach the local communities practising sustainability.

Article 6 under the Paris Agreement further concretised and regulated the crediting mechanism to enable countries interested in setting up carbon trading schemes. However, the parties failed to reach a consensus regarding the specifics of Article 6 at COP 27 and COP 28. So, climate finance experts and policymakers were very interested in the developments taking place at the COP 29 summit in Baku, Azerbaijan. Unlike its predecessors, the COP 29 summit has seen a diminished attendee list, with major Western political leaders including Joe Biden, Ursula von der Leyen, Olaf Scholz, and Emmanuel Macron failing to make it to the summit due to the increasingly turbulent climate within their own constituencies.

From a post-colonial perspective, carbon markets have been viewed as perpetuating existing global hierarchies; wealthier countries and corporations fail to reduce their emissions and instead shift the burden of mitigation onto developing nations. | Photo Credit: Illustration by Irfan Khan

Sceptics questioned whether this iteration of the summit would lead to any substantial decisions being passed. However, on day-two of the summit, parties reached a landmark consensus on the standards for Article 6.4 and a dynamic mechanism to update them. Mukhtar Babayev, the Minister of Ecology and Natural Resources of Azerbaijan and the COP 29 President, said: “By matching buyers and sellers efficiently, such markets could reduce the cost of implementing Nationally Determined Contributions by 250 billion dollars a year.” He added that cross-border cooperation and compromise would be vital in fighting climate change.

India has positioned itself as an advocate for the Like-Minded Developing Countries (LMDCs) group, with Naresh Pal Gangwar, India’s lead negotiator at COP 29, saying, “We are at a crucial juncture in our fight against climate change. What we decide here will enable all of us, particularly those in the Global South, to not only take ambitious mitigation action but also adapt to climate change.”

The COP 29 decision comes in light of the Indian government’s adoption of the amended Energy Conservation Act of 2022, which enabled India to set up its own carbon market. In July 2024, the Bureau of Energy Efficiency (BEE), an agency under the Ministry of Power, released a detailed report containing the rules and regulations of the Carbon Credit Trading Scheme (CCTS), India’s ambitious plan for a compliance-based carbon market. The BEE has aimed to launch India’s carbon market in 2026.

CSE’s report highlighted the challenges and possible strategies that the Indian carbon market could adopt from other carbon markets around the world. Referring to this report, Parth Kumar, a programme manager at CSE, pointed out how low carbon prices and low market liquidity would be prominent challenges that the nascent Indian market would have to tackle.

The Global South should be concerned

Following the landmark Article 6.4 decision, climate activists called out the supervisory board for the lack of discussion in the decision-making process. “Kicking off COP29 with a backdoor deal on Article 6.4 sets a poor precedent for transparency and proper governance,” said Isa Mulder, a climate finance expert at Carbon Market Watch. The hastily passed decision reflects the pressure that host countries seem to face; a monumental decision must be passed for a COP summit to be touted as a success.

The science behind carbon markets is rooted in the ability of forests, soil, and oceans to act as carbon sinks by capturing atmospheric carbon dioxide. This process is known as carbon sequestration, and it is central to afforestation and soil health restoration projects. However, the long-term efficacy and scalability of these projects have been repeatedly questioned. The normative understanding of carbon markets as a tool to mitigate climate change has also come under scrutiny recently, with many activists calling the market-driven approach disingenuous to the goals of the climate movement.

From a post-colonial perspective, carbon markets have been viewed as perpetuating existing global hierarchies; wealthier countries and corporations fail to reduce their emissions and instead shift the burden of mitigation onto developing nations. Olúfẹ́mi O. Táíwò, Professor of Philosophy at Georgetown University, said, “Climate colonialism is the deepening or expansion of foreign domination through climate initiatives that exploit poorer nations’ resources or otherwise compromises their sovereignty.” Moreover, the effects of climate change disproportionately fall on the shoulders of marginalised communities in the Global South, even though industrialised nations historically produce the bulk of emissions.

There have also been doubts surrounding the claiming process of carbon credits and whether the buyer country or the country where the project is set can count the project towards its own Nationally Determined Contributions (NDCs). Provisions under Article 6 of the Paris Agreement state that countries cannot use any emission reductions sold to another company or country towards their own emissions targets. However, this has become a widespread issue plaguing carbon markets. The EU has recently been criticised for counting carbon credits sold to corporations under the Carbon Removal Certification Framework (CRCF) towards the EU’s own NDC targets. This has led to concerns over the overestimation of the impact of mission reduction projects.

Also Read | India needs climate justice, not just targets

Carbon offset projects, additionally, alienate local communities from their land as the idea of ownership and stewardship becomes muddled with corporate plans on optimally utilising the land for these projects. For example, in 2014, Green Resources, a Norwegian company, leased more than 10,000 hectares of land in Uganda, with additional land being leased in Mozambique and Tanzania. This land was used as a part of afforestation projects to practise sustainability and alleviate poverty in the area. However, interviews conducted with local Ugandan villagers revealed that the project forcibly evicted the local population without delivering its promises to improve access to health and education for the community. These concerns highlighted how the burden of adopting sustainable practices is placed on marginalised communities.

While carbon markets are rightfully criticised, they remain a key piece of the global climate adaptation puzzle. Addressing the issues surrounding transparency and equitable benefit-sharing with local communities could lead to carbon markets having a positive impact on climate change. The system must ensure that larger corporations and countries do not merely export their emissions, but instead implement measures to reduce their own emissions over time. It is also imperative to explore other innovative strategies such as circular economy approaches and nature-based solutions that are more localised, offering hope for a just and sustainable future.

Adithya Santhosh Kumar is currently pursuing a Master’s in Engineering and Policy Analysis at the Delft University of Technology in the Netherlands.

Source: frontline.thehindu.com

Related posts:

A new destructive business: Carbon credits from tree plantations

A new destructive business: Carbon credits from tree plantations

East Africa poised to monitor carbon emission

East Africa poised to monitor carbon emission

The Rush for Carbon Concessions: More Land Theft and Deforestation

The Rush for Carbon Concessions: More Land Theft and Deforestation

Uganda: Local communities claim they are not benefiting from Green Resources’ subsidiary’s carbon credit initiative; incl. company’s comments

Uganda: Local communities claim they are not benefiting from Green Resources’ subsidiary’s carbon credit initiative; incl. company’s comments

You may like

SPECIAL REPORTS AND PROJECTS

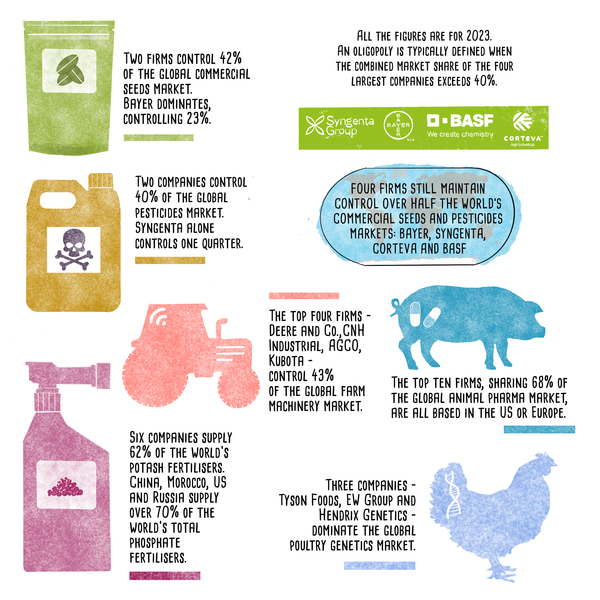

Top 10 agribusiness giants: corporate concentration in food & farming in 2025

Published

2 months agoon

August 28, 2025

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share 19

|

|

1

|

Bayer (Germany)20

|

11,613

|

23

|

|

2

|

Corteva (US)21

|

9,472

|

19

|

|

3

|

Syngenta (China/Switzerland)22

|

4,751

|

10

|

|

4

|

BASF (Germany)23

|

2,122

|

4

|

|

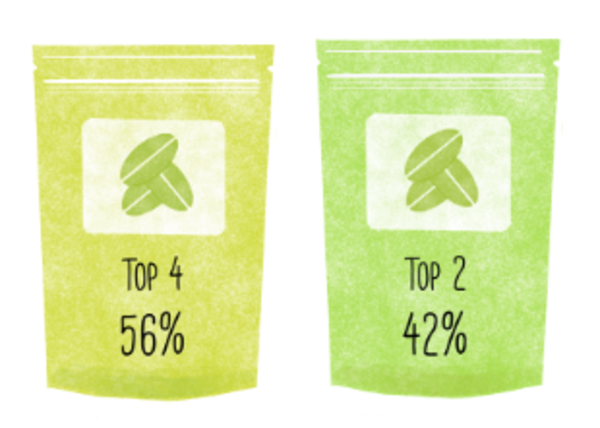

Total top 4

|

27,958

|

56

|

|

|

5

|

Vilmorin & Cie (Groupe Limagrain) (France)24

|

1,984

|

4

|

|

6

|

KWS (Germany)25

|

1,815

|

4

|

|

7

|

DLF Seeds (Denmark)26

|

838

|

2

|

|

8

|

Sakata Seeds (Japan)27

|

649

|

1

|

|

9

|

Kaneko Seeds (Japan)28

|

451

|

0.9

|

|

Total top 9

|

33,695

|

67

|

|

|

Total world market29

|

50,000

|

100%

|

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share

|

|

1

|

Syngenta (China/Switzerland)43

|

20,066

|

25

|

|

2

|

Bayer (Germany)44

|

11,860

|

15

|

|

3

|

BASF (Germany)45

|

8,793

|

11

|

|

4

|

Corteva (US)46

|

7,754

|

10

|

|

Total top 4

|

48,472

|

61

|

|

|

5

|

UPL (India)47

|

5,925

|

8

|

|

6

|

FMC (Germany)48

|

4,487

|

6

|

|

7

|

Sumitomo (Japan)49

|

3,824

|

5

|

|

8

|

Nufarm (Australia)50

|

2,056

|

3

|

|

9

|

Rainbow Agro (China)51

|

1,623

|

2

|

|

10

|

Jiangsu Yangnong Chemical Co., Ltd. (China)52

|

1,595

|

2

|

|

Total top 10

|

67,982

|

86

|

|

|

Total world market53

|

79,000

|

100

|

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share

|

|

1

|

Nutrien (Canada)72

|

15,673

|

8

|

|

2

|

The Mosaic Company (US)73

|

12,782

|

7

|

|

3

|

Yara (Norway)74

|

11,688

|

6

|

|

4

|

CF Industries Holdings, Inc, (US)75

|

6,631

|

3

|

|

Total top 4

|

46,774

|

24

|

|

|

5

|

ICL Group Ltd. (Israel)76

|

6,294

|

3

|

|

6

|

OCP (Morocco)77

|

5,967

|

3

|

|

7

|

PhosAgro (Russia)78

|

4,989

|

3

|

|

8

|

MCC EuroChem Joint Stock Company (EuroChem) (Switzerland/Russia)79

|

4,298

|

2

|

|

9

|

OCI (Netherlands)80

|

4,188

|

2

|

|

10

|

Uralkali (Russia)81

|

3,497

|

2

|

|

Total top 10

|

76,007

|

39

|

|

|

Total world market82

|

196,000

|

100

|

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share

|

|

1

|

Deere and Co. (US)89

|

26,790

|

15

|

|

2

|

CNH Industrial (UK/Netherlands)90

|

18,148

|

10

|

|

4

|

AGCO (US)91

|

14,412

|

8

|

|

3

|

Kubota (Japan)92

|

14,233

|

8

|

|

Total top 4

|

73,583

|

43

|

|

|

5

|

CLAAS (Germany)93

|

6,561

|

4

|

|

6

|

Mahindra and Mahindra (India)94

|

3,156

|

2

|

|

7

|

SDF Group (Italy)95

|

2,197

|

1

|

|

8

|

Kuhn Group (Switzerland)96

|

1,583

|

0.9

|

|

9

|

YTO Group (China)97

|

1,493

|

0.9

|

|

10

|

Iseki Group (Japan)98

|

1,057

|

0.6

|

|

Total top 10

|

89,629

|

52

|

|

|

Total world market99

|

173,000

|

100

|

|

Ranking

|

Company (Headquarters)

|

Sales in 2023

(US$ millions)

|

% Global market share

|

|

1

|

Zoetis (US)115

|

8,544

|

18

|

|

2

|

Merck & Co (MSD) (US)116

|

5,625

|

12

|

|

3

|

Boehringer Ingelheim Animal Health (Germany)117

|

5,100

|

11

|

|

4

|

Elanco (US)118

|

4,417

|

9

|

|

Total top 4

|

23,686

|

49

|

|

|

5

|

Idexx Laboratories (US)119

|

3,474

|

7

|

|

6

|

Ceva Santé Animale (France)120

|

1,752

|

4

|

|

7

|

Virbac (France)121

|

1,348

|

3

|

|

8

|

Phibro Animal Health Corporation (US)122

|

978

|

2

|

|

9

|

Dechra (UK)123

|

917

|

2

|

|

10

|

Vetoquinol (France)124

|

572

|

1

|

|

Total top 10

|

32,727

|

68

|

|

|

Total world market125

|

48,000

|

100

|

The genetic material used in the industrial production of meat, dairy and aquaculture is supplied by a small number of relatively unknown companies that are mostly privately owned. As detailed financial data is not publicly available for most of these companies, it is difficult to determine companies’ market shares and even the value of the global market. However, it was possible to arrive at some estimates for chicken, which tops global meat production (narrowly exceeding pigs).126

The genetic material used in the industrial production of meat, dairy and aquaculture is supplied by a small number of relatively unknown companies that are mostly privately owned. As detailed financial data is not publicly available for most of these companies, it is difficult to determine companies’ market shares and even the value of the global market. However, it was possible to arrive at some estimates for chicken, which tops global meat production (narrowly exceeding pigs).126Related posts:

CORPORATE AGRIBUSINESS GIANTS SWIM IN WEALTH AS MORE POOR PEOPLE GO HUNGRY AMID THE BITING COVID PANDEMIC.

CORPORATE AGRIBUSINESS GIANTS SWIM IN WEALTH AS MORE POOR PEOPLE GO HUNGRY AMID THE BITING COVID PANDEMIC.

A corporate cartel fertilises food inflation

A corporate cartel fertilises food inflation

The United Nations Food Systems Summit is a corporate food summit —not a “people’s” food summit

The United Nations Food Systems Summit is a corporate food summit —not a “people’s” food summit

Food inflation: The math doesn’t add up without factoring in corporate power

Food inflation: The math doesn’t add up without factoring in corporate power

SPECIAL REPORTS AND PROJECTS

Maasai demand Volkswagen pull out of carbon offset scheme on their lands

Published

3 months agoon

July 24, 2025

Maasai Indigenous people in Tanzania have called on Volkswagen (VW) to withdraw from a controversial carbon credits scheme which violates their rights and threatens to wreck their livelihoods.

In a statement, the Maasai International Solidarity Alliance (MISA) denounced the “loss of control or use” of vital Maasai grazing grounds, and accused VW of making “false and misleading claims” about Maasai participation in decision making about the project.

Many Maasai pastoralists have already been evicted from large parts of their grazing lands for national parks and game reserves, with highly lucrative tourist businesses operating in them. Now a major new carbon-credit generating project by Volkswagen ClimatePartner (VWCP) and US-based carbon offset company Soils for the Future Tanzania is taking control of large parts of their remaining lands, and threatening livelihoods by upending long-standing Maasai grazing practices.

The Maasai have not given their free, prior and informed consent for the project. They fear it will restrict their access to crucial refuge areas in times of drought, and threaten their food security.

Ngisha Sinyok, a Maasai community member from Eluai village, which is struggling to withdraw from the project, told Survival: “Our livestock is going to be depleted. We will end up not having a single cow.” Asked about VW’s involvement in the project, he replied, “It is not a solution to climate change. It is just a business for people to make money using our environment. It has nothing to do with climate change.”

Another Maasai man, who wished to remain anonymous for fear of reprisals, said: “They use their money to control us.” A third said: “Maasailand never had a price tag. In Maasailand, there is no privatization. Our land is communal.”

Survival International’s Director of Research and Advocacy, Fiona Watson, said today: “The carbon project that Volkswagen supports violates the Maasai’s rights and will be disastrous for their lives, all so the company can carry on polluting and greenwash its image. It takes away the Maasai’s control over their own lands and relies on the false and colonial assumption that they are destroying their lands — which is not supported by evidence.

“The Maasai have been grazing cattle on the plains of East Africa since time immemorial. They know the land and how to manage it better than carbon project developers seeking to make millions from their lands.”

VW’s investment in the project, whose official name is the “Longido and Monduli Rangelands Carbon Project”, is believed to run to several million dollars, and has contributed to corruption and tensions in northern Tanzania, according to MISA’s report on the project.

An adjacent project in southern Kenya, also run by Soils for the Future, is beset with similar problems, and has already sparked resistance from local communities.

Survival International’s Blood Carbon report revealed that the whole basis for these “soil carbon” projects is flawed, and unsupported by evidence. Survival documented similar problems with the highly controversial Northern Kenya Grasslands Carbon Project. That project suffered a blow in a Kenyan court and was suspended and put under review by Verra, the carbon credit verification agency, for an unprecedented second time.

Source: Survival International

Related posts:

Kenya: Court halts flagship carbon offset project used by Meta, Netflix and British Airways over unlawfully acquiring community land without consent

Kenya: Court halts flagship carbon offset project used by Meta, Netflix and British Airways over unlawfully acquiring community land without consent

East Africa poised to monitor carbon emission

East Africa poised to monitor carbon emission

Carbon offset projects exacerbate land grabbing and undermine small farmers’ independence – GRAIN report

Carbon offset projects exacerbate land grabbing and undermine small farmers’ independence – GRAIN report

SPECIAL REPORTS AND PROJECTS

Seizing the Jubilee moment: Cancel the debt to unlock Africa’s clean energy future

Published

3 months agoon

July 12, 2025

Africa has the resources and the vision for a just energy transition, but it is trapped in a financial system structured to take more than it gives. In this blog, we outline how debt burdens and climate impacts are holding the continent back, and looks at the role of institutions that shape the global financial order, like the World Bank, African Development Bank and IMF. As these institutions and governments meet in Seville for FfD4, we urge them to heed people’s calls for reform: cancel the debt, redistribute the wealth, and fund the just transition. — By Rajneesh Bhuee and Lola Allen

With 60% of the world’s best solar energy resources and 70% of the cobalt essential for electric vehicle batteries, the African continent has everything it needs to power its development and become a global reference point for sustainable energy production. That potential, however, remains largely untapped; Africa receives just 2% of global renewable energy investment. As the UNCTAD Secretary-General Rebeca Grynspan warns, too many countries are forced to “default on their development to avoid defaulting on their debt.”

The cost of servicing unsustainable debts, layered with new loan-based climate and development finance, leaves governments with little fiscal space to invest in clean energy, health or education. In 2022 alone, African countries spent more than $100 billion on debt servicing, over twice what they spent on health or education. Add to this the $90 billion lost annually to illicit financial flows, and the reality is stark: more money leaves the continent through financial leakages (also including unfair trade and extractive investment) than comes in through productive, equitable and development-oriented finance.

These are not isolated problems. They reflect a financial system that has been built to serve global markets rather than people. Between 2020 and 2025, four African countries defaulted on their external debts, that is, they failed to make scheduled repayments to creditors like the International Monetary Fund or bondholders, triggering fiscal crises and, in several cases, IMF interventions tied to austerity measures. Pope Francis’ Jubilee Report (2025) and hundreds of civil society groups argue that these defaults reflect the deeper crisis of unsustainable debt. Meanwhile, 24 more African countries are now in or near debt distress. None have successfully restructured their debts under the G20 Common Framework, a mechanism launched in 2020 to facilitate debt relief among public and private creditors. The Framework has been widely criticised for being slow, opaque and ineffective. According to Eurodad, without urgent systemic reforms, up to 47 Global South countries, home to over 1.1 billion people, face insolvency risks within five years if they attempt to meet climate and development goals.

How debt undermines the just energy transition

Debt has become both a driver and a symptom of climate injustice. Countries that did the least to cause the climate crisis now pay the highest price, twice over. First, they suffer the impacts. Second, they must borrow to rebuild.

This is happening just as concessional finance disappears. The US has withdrawn from the African Development Fund’s concessional window (worth $550m), yet maintains influence over private-sector lending. It has also opted out of the UN Financing for Development Conference (FfD4), a historic opportunity to confront the injustice of our financial system. Meanwhile, European governments, though now celebrating themselves as defenders of multilateralism, played a key role in weakening the outcome of FfD4, slashing aid budgets, redirecting funds toward militarisation, and systematically blocking proposals for a UN-led sovereign debt workout mechanism. With rising insecurity and geopolitical tensions, these actions send a troubling signal: at a moment when global cooperation is urgently needed, many Global North countries are stepping back from efforts to fix the very system that is preventing climate justice and clean energy for much of the Global South.

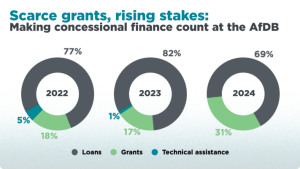

A role for the AfDB?

The African Development Bank (AfDB), under incoming president Sidi Ould Tah , has made progressive commitments of $10 billion to climate-resilient infrastructure and $4 billion to clean cooking. Between 2022 and 2024, one in five (20%) of its energy dollars were grants, far exceeding The World Bank ‘s 10% and the Asian Development Bank (ADB) ‘s 3.8%. The AfDB has also backed systemic reform: for example, calling for Special Drawing Rights (SDR) redistribution, launching an African Financial Stability Mechanism that could save up to $20 billion in debt servicing, and consistently advocating for fairer lending terms.

Yet, even progressive leadership struggles within a broken system. Recourse’s recent research shows that AfDB energy finance dropped 67% in 2024, from $992.7 million to just $329.6 million. Of this, a staggering 73% went to large-scale infrastructure like mega hydro dams and export-focused transmission lines, ‘false solutions’ that bypass the energy-poor and displace communities. Meanwhile, support for locally-appropriate, decentralised renewable energy systems such as mini-grids, solar appliances, and clean cookstoves plummeted by over 90%, from $694.5 million to just $61 million, with only five of 13 projects directly addressing energy access in 2024.

Africa received just 2.8% of global climate finance in 2021–22, and what is labelled as “climate finance” is often little more than a Trojan horse: resource-backed loans, debt-for-nature swaps, and blended finance instruments that shift risk to the public while offering little real benefit to local communities. These mechanisms, promoted as “innovative” or “green”, often entrench financial dependency and fail to deliver meaningful change for energy-poor or climate-vulnerable groups.

Meanwhile, initiatives that could build green industry and renewable capacity across Africa are falling short in both scale and speed. Flagship projects, such as the EU’s Global Gateway, have failed to drive green industrialisation in Africa, and carbon markets continue to delay real emissions reductions, subsidise fossil fuel interests, and entrench elite control over land and resources.

Mission 300: Ambition or another missed opportunity?

In this constrained context, the AfDB and World Bank launched Mission 300, an ambitious plan to connect 300 million Africans to electricity by 2030. Pragmatic goals like electrification are crucial, but the story beneath the surface of Mission 300 raises concern. Far from serving households, many projects under the initiative appear more aligned with export markets and large-scale energy users, echoing decades of infrastructure that bypasses those most in need.

Mission 300 can still be transformative, but only if it centres people, not profits. Energy access must begin with those who need it most: women and youth, especially in rural communities. Across Africa, many women cook over open fires, walk hours to gather fuel, and care for families in homes without light or clean air. This is not just an inconvenience, it is structural violence and policy failure.

Yet most energy finance still flows to centralised grids, mega-projects, and sometimes fossil gas (misleadingly called a “transition fuel”). These do little to address energy poverty. Locally appropriate decentralised renewable energy solutions, solar-powered appliances, clean cookstoves, and mini-grids can deliver faster, cheaper, and more equitable impact. Mission 300 must invest in such solutions, without adding to existing debt problems. It should support national policy design, for example, by ensuring that energy policy is responsive to women’s needs, making use of gender-disaggregated data and community consultation.

The Jubilee: A year for action

In a year already marked as a Jubilee moment, African leaders have demanded reform: including a sovereign debt workout mechanism and a UN Tax Convention to end illicit financial flows. Yet as AFRODAD has documented, these demands were blocked at the FfD4 negotiations by wealthy nations—notably the EU and UK—even as climate impacts grow and fiscal space shrinks.

This is not just about finance. It is about reclaiming sovereignty. The incoming AfDB president and all the multilateral development banks face a choice: continue financing extractive, large-scale projects that serve foreign interests, or invest in decentralised, gender-responsive, pro-people solutions that shift power and ownership.

Africa has the resources. What it needs is fiscal space, public-led finance, and global rules that prioritise people and planet over profit. The Jubilee call is clear: cancel the debt, redistribute the wealth, and fund the just transition.

Source: Recourse through LinkedIn Account Recourse.

Related posts:

Statement: The Energy Sector Strategy 2024–2028 Must Mark the End of the EBRD’s Support to Fossil Fuels

Statement: The Energy Sector Strategy 2024–2028 Must Mark the End of the EBRD’s Support to Fossil Fuels

African Development Bank decides not to fund Kenya coal project

African Development Bank decides not to fund Kenya coal project

Africa must unlock the power of its women to save climate change

Africa must unlock the power of its women to save climate change

PFZW scraps funding from Total and others for failure to transition into a cleaner energy mix.

PFZW scraps funding from Total and others for failure to transition into a cleaner energy mix.

Know Your Land rights and environmental protection laws: a case of a refreshed radio program transferring legal knowledge to local and indigenous communities to protect their land and the environment at Witness Radio.

Gov’t Seeks Land to Establish Palm Oil Mill and Nursery in Busoga

New! The Eyes on a Just Energy Transition in Africa Program is now live on Witness Radio.

RDCs, Local Leaders Accused of Grabbing 70-Acre Ancestral Land

Uganda is on a mission to plant over 40 million trees by October 3, 2025, a crucial step in combating the alarming decline in its forest cover.

The 4th African Forum on Business and Human Rights: The rapidly escalating investment in Africa is urgently eroding environmental conservation and disregarding the dignity, the land, and human rights of the African people.

Oil palm tree growing in Uganda: The National Oil Palm Project is threatening to evict hundreds of smallholder farmers to expand its operations.

The 4th African Forum on Business and Human Rights: The African continent is lagging, with only a few member states having adopted the National Action Plan (NAP) on Business and Human Rights.

Innovative Finance from Canada projects positive impact on local communities.

Over 5000 Indigenous Communities evicted in Kiryandongo District

Petition To Land Inquiry Commission Over Human Rights In Kiryandongo District

Invisible victims of Uganda Land Grabs

Resource Center

- REPARATORY AND CLIMATE JUSTICE MUST BE AT THE CORE OF COP30, SAY GLOBAL LEADERS AND MOVEMENTS

- LAND GRABS AT GUNPOINT REPORT IN KIRYANDONGO DISTRICT

- THOSE OIL LIARS! THEY DESTROYED MY BUSINESS!

- RESEARCH BRIEF -TOURISM POTENTIAL OF GREATER MASAKA -MARCH 2025

- The Mouila Declaration of the Informal Alliance against the Expansion of Industrial Monocultures

- FORCED LAND EVICTIONS IN UGANDA TRENDS RIGHTS OF DEFENDERS IMPACT AND CALL FOR ACTION

- 12 KEY DEMANDS FROM CSOS TO WORLD LEADERS AT THE OPENING OF COP16 IN SAUDI ARABIA

- PRESENDIANTIAL DIRECTIVE BANNING ALL LAND EVICTIONS IN UGANDA

Legal Framework

READ BY CATEGORY

Newsletter

Trending

-

MEDIA FOR CHANGE NETWORK2 weeks ago

MEDIA FOR CHANGE NETWORK2 weeks agoThe 4th African Forum on Business and Human Rights: The rapidly escalating investment in Africa is urgently eroding environmental conservation and disregarding the dignity, the land, and human rights of the African people.

-

MEDIA FOR CHANGE NETWORK6 days ago

MEDIA FOR CHANGE NETWORK6 days agoOil palm tree growing in Uganda: The National Oil Palm Project is threatening to evict hundreds of smallholder farmers to expand its operations.

-

MEDIA FOR CHANGE NETWORK2 weeks ago

MEDIA FOR CHANGE NETWORK2 weeks agoThe 4th African Forum on Business and Human Rights: The African continent is lagging, with only a few member states having adopted the National Action Plan (NAP) on Business and Human Rights.

-

MEDIA FOR CHANGE NETWORK2 weeks ago

MEDIA FOR CHANGE NETWORK2 weeks agoThe EAC Seed and Plant Varieties Bill 2025 targets organic seeds, aiming to replace them with modified seeds, say smallholder farmers.

-

MEDIA FOR CHANGE NETWORK4 days ago

MEDIA FOR CHANGE NETWORK4 days agoNew! The Eyes on a Just Energy Transition in Africa Program is now live on Witness Radio.

-

MEDIA FOR CHANGE NETWORK2 weeks ago

MEDIA FOR CHANGE NETWORK2 weeks agoUse COP30 in Belém, Brazil, to fix the historical injustices meted out against Afro-descendant and Indigenous Peoples – CSOs demand.

-

NGO WORK2 weeks ago

NGO WORK2 weeks agoThe Oakland Institute Calls on the Tanzanian Presidential Land Commissions to Respect & Ensure Rights of Maasai Living in the Ngorongoro Conservation Area

-

NGO WORK2 weeks ago

NGO WORK2 weeks agoDocumenting killings and disappearances of land and environmental defenders