SPECIAL REPORTS AND PROJECTS

WWF apologises for human rights abuse allegations and commits to an indigenous-led approach to global conservation

Published

4 years agoon

Gland, 26 May 2021 – IN LIGHT OF EVIDENCE OF SERIOUS HUMAN RIGHTS ABUSES, WWF commits to reparations for victims and to a long-term strategy which, for the first time, prioritizes indigenous people’s land rights and promotes community-led conservation across WWF-supported areas.

In January 2021, the WWF International Board began an internal revision of the remedial action taken by the organisation following the findings and recommendations of the Embedding Human Rights in Nature Conservation: From Intent to Action report. This process, supported by all 35 boards of WWF’s constituent members, has determined that WWF’s initial response to the Independent Panel’s investigation on alleged human rights abuses in and around WWF-supported areas failed to adequately compensate victims or deal with the shortcomings within WWF as well as partner organisations, that enabled these abuses. The widespread harm caused to local communities by WWF-supported conservation efforts suggests an ambitious project of reform is necessary to ensure WWF is able to protect Indigenous Peoples and Local Communities (IPLCs) rights everywhere we work.

“We need to radically transform the way we envision and approach conservation, moving away from “easy-fix” climate and environmental solutions that continue to harm indigenous people and frontline communities. This redesigning process must prioritize community-led conservation, placing IPLCs at the centre of conservation and land management initiatives. Indigenous people are the most effective environmental custodians which should make securing their rights over their customary lands our number one priority. It is not simply a matter of human rights and international law, but about supporting the best solution we have against this climate and ecological crisis” said Marco Lambertini, Director General, WWF International.

Conservation works best when local communities are put at the heart of it. Working to secure the community tenure of indigenous peoples and local communities will empower those best equipped to look after their local environment and is the best way to conserve all our planet’s natural wonders.

Acknowledging and apologising for The Independent Panel’s findings:

In April 2019 the World Wildlife Fund (WWF) commissioned a panel of global human rights and conservation experts to conduct a systemic review of WWF practices and provide recommendations in regards to alleged human rights abuses in and around protected areas supported by WWF in Cameroon, the Central African Republic, the Democratic Republic of Congo, the Republic of Congo, Nepal and India.

The report’s key findings:

- Allegations across the protected ares in question include multiple instances of murder, rape, torture, unlawful arrest and detention, physical beatings, corruption, complicity in poaching, and destruction and theft of personal property committed by WWF-supported ecoguards against IPLCs.

- WWF had knowledge of alleged human rights abuses in every protected area under review and failed to investigate credible allegations of abuse in half of those protected areas.

- WWF continued to fund, train and equip eco-guards alleged to have committed human rights abuses despite knowledge of those allegations and without taking adequate steps to operationalize safeguarding and human rights protection protocols designed to protect IPLCS.

- Where WWF did conduct investigations into these abuses they came several years after allegations were first made and only following pressure from the media and/or civil society.

- Where WWF was involved in the creation of protected areas, it failed to ensure the effective participation of IPLCs and thus violated their right to free,prior and informed consent.

- The Panel found no agreement in place between WWF and the local authorities responsible for park administration to ensure the upholding of the human rights and FPIC rights of IPLCS.

An official apology

In light of these findings, we unreservedly apologise to the indigenous peoples and local communities (IPLCs) of the areas under review, and to any other individual or community that has been subject to similar abuses in and around other WWF-supported protected areas.

Moreover, we want to take responsibility for the violent evictions of IPLCs carried out by WWF-supported ecoguards and for the impacts that their eviction from their lands has had on these IPLCs, including loss of culture and livelihoods, and increased malnutrition.

We also want to apologise to our supporters, donors, volunteers and readers for not having immediately disclosed allegations of human rights abuses in WWF affiliated parks. We have a responsibility of full transparency to all those who support and believe in our work.

Reparations

To adequately compensate victims of human-rights abuses carried out by WWF supported projects in the seven countries originally investigated in the Panel’s report, WWF have set aside $2 million dollars. The processing of reparations claims will be overseen by indigenous leaders and representatives from the communities affected.

We fear that the inadequate nature of our previous grievance procedures has prevented many other victims of human rights abuses from reporting injustices. Since we cannot at this stage be certain of the scale of abuses WWF programmes are implicated in we are setting aside a further $5 million for future claims.

Transforming our approach

The WFF international board has concluded that the scale and severity of the problems identified by the Panel in the protected areas reviewed demonstrate endemic flaws in WWF’s operational approach. These have resulted in the systematic eviction of indigenous people from their customary lands, their exclusion from leadership positions in local conservation projects and the militarisation of protected areas’ security forces.

Following the Panel’s recommendations and in compliance with our human rights commitments we have already started to take remedial action. The Management Response and initial measures taken can be found here. Below is a list of further measures we are committed to implement across all protected areas WWF supports, in order to turn the page and build a conservation model that safeguards local communities’ human rights and actively supports indigenous people’s claims to their customary lands.

In protected areas where rights abuses have been alleged we will:

- Commission independent indigenous peoples’ committees to review the original investigations.

- Work alongside indigenous leaders to ensure the resolution of allegations by compensating victims and working with local authorities to prosecute the perpetrators.

- Establish externally supervised safeguards to prevent further abuses.

In all WWF- supported protected areas and conservation initiatives we commit to:

- Initiate independent reviews of the effects of protected areas on local communities’ rights.

- Freeze all funding towards protected areas and other conservation initiatives where human rights abuses have been reported until allegations have been resolved, externally supervised safeguard mechanisms established, and all victims adequately compensated.

- Adopt concrete measures to identify and hold accountable all members of the organization that have been responsible for WWF negligence, ineffective response and direct involvement in alleged human rights abuses, including staff members in individual countries, the WWF senior management team and board members.

- Work with local and indigenous communities to co-design accessible and inclusive pathways to submit complaints and report any issues with ongoing conservation initiatives through.

- Carry out new independent free, prior and Informed consent processes with impacted local communities in all current and proposed protected areas; empowering communities to decide how and whether they wish to work with WWF to support their own conservation efforts.

- Use WWF influence to actively support, at local, national and international levels indigenous people’s claims over their customary lands and their efforts to secure legal ownership rights and conservation responsibilities over such territories.

- Withdraw financial and practical support to partners and collaborators who fail to support indigenous people’s rights and claims to customary land.

Commenting on the internal revision, Pavan Sukhdev, President of WWF International, said:

“From the report’s findings it is clear that for decades our negligence, and in some instances direct involvement with episodes of violence and abuse, have caused serious emotional, physical and psychological harm to individuals and entire communities across the world. We need to acknowledge that and take responsibility for our role in these allegations. There is no excuse and a formal apology is not enough. We can and need to do better. We need to ensure that the measures that we commit to take forward go beyond minor changes and embody our first step towards a real transformation of our work and ethos.”

Open Letter to WWF

WWF, you are the most well-known environmental organisations in the world: you have great power and an even greater responsibility. However, time and again your projects have dispossessed and abused Indigenous and local communities. You claim that they endanger the ecosystems they have cared for long before you entered their lands. On the other hand, you collaborate with the very same corporations that actually destroy biodiversity, greenwashing their destructive practices. For the sake of justice and the survival of ecosystems worldwide, stop legitimising violence and human rights abuses in the name of conservation. Instead, become an ally to Indigenous people, local communities, and the Global Majority.

For too long you have been dividing humans from nature by building walls; imposing a colonial model called ‘Fortress conservation’, which places conservation in direct conflict with human rights.

You dictate who is “unauthorised” in the lands you enter. You fund, train and legitimise militarised eco-guards who violently evict local communities from their homes. You act on the dangerous and false colonial ideology that perceives human presence as a threat to the ecosystem, except if they are wealthy, predominantly white tourists. You demonise and prevent indigenous and local people from hunting sustainably to feed themselves, but have encouraged trophy hunting for super-rich tourists. This model, based on separation and colonial values, is a violent lie that supports white supremacy – it is, to put it simply, ecofascism.

Fortress conservation is putting us all in danger, as it is further destroying the connection between land and people. It is destroying the cultures who have taken care of and regenerated that land for hundreds of years. This makes you complicit in the historic colonial violence against local and indigenous communities. Their cultures hold rich and powerful counterstories that teach the interdependence and deep connection between humans, the earth and all beings, which so many of us need to rediscover.

This failure of WWF concerns us all because it directly affects both the people and the planet. A recent report by an independent panel of experts shows a shocking history of murder, rape, torture, and violence committed by the eco-guards that WWF funds, equips and manages. This report goes even further in revealing that you have had knowledge of this, yet you continue to fund them. This is simply appalling.

From the Republic of Congo to Nepal, and India to Cameroon, these are not a few ‘bad apples’ but inherent aspects of the oppressive colonial conservation model you employ, and that dominates the conservation sector. Communities are losing their lands, their homes and ways of life, threatening them with starvation, disease and the loss of their human dignity. Dividing communities from their land and livelihoods will always be violent.

Many of the people on your boards are financing, working or lobbying for some of the most environmentally destructive companies on Earth. How can the same people who are destroying the global ecosystem lead and fund its preservation? It’s absurd that we need to say this, but the people leading you should not be those profiting from ecocide.

You invest your supporters’ donations into heavily polluting industries, such as fossil fuels and agribusiness, and partner with them. You receive donations from logging and palm oil companies and let them cut through the same forests you claim to protect.

To put it bluntly, WWF has a profound conflict of interest, and is working with, rather than against, those destroying life on Earth. Rather than challenging those industries, you greenwash them, allowing them to expand their destruction. It is pitiful for an environmental organisation to simply ask companies to slow down their destruction of our home: you must join the global environmental movement in demanding they stop immediately!

WWF, you have betrayed the Global Family. In frontline communities your betrayal means violence. To your supporters your betrayal means broken promises and complicity.

Your organisation has sold us the image of being the ‘good guys’ in an evil world of environmental destruction. From an early age, your iconic panda has playfully filled our cultural consciousness; clambering into our classrooms; filling our shelves with fluffy tokenistic toys, and our minds with idealised imagery of the “pristine wilderness” that serves your marketing strategy.

We entrusted you with the fight for the planet, raising tens of millions of pounds from our pockets as public donors in the UK alone. Yet rather than using this power to support the mobilisation of social and ecological movements of solidarity, you use the power of marketing; you sell us the ridiculous story that simply purchasing, petitioning and running marathons will “save the planet”! You reduce activism to mass consumption – the rotten core of the environmental crisis – making your supporters’ actions hollow and meaningless. You take the struggle for survival of life on earth and make it into a brand. You then use our money, our agency and our validation to make us complicit in outrageous acts of violence and human rights abuses against our brothers and sisters around the world. Through you, we too become tools of fortress conservation and capitalism’s violence.

However, we in the Minority World/Global North are not the real victims of your betrayal. Your failure to serve those with the capacity of preserving the ecosystems you claim to protect is your betrayal to humanity. Those communities are the heart of the resistance to ecocide.

The same people you are persecuting have been caring for the land, their home, for hundreds of years, and are essential to its flourishing. There is increasingly clear evidence on the key role of indigenous communities in already safeguarding 80% of the world’s remaining biodiversity, and therefore many conservation bodies call on all organisations to support their land rights. Often Indigenous and community-managed lands have even higher biodiversity and less deforestation than national parks and wildlife reserves. They don’t only slow down degradation, but actually improve the state of the ecosystem. By ignoring these scientific facts you are harming nature – the very thing you claim to be protecting. Why are you oppressing the people who are doing conservation better than you?

WWF, you must advocate for the land and human rights of local and indigenous communities, supporting their cultural, political and ecological work. Even if a community is degrading their ecosystem, any conservation initiative must be led by a dialogue among equals working together. It must support local livelihoods, and enable community-led learning for regeneration that is based on equity and justice. Ultimately, conservation works best when local communities are empowered at the heart of their local environments.

You are already taking steps in this direction in Latin America; so why do you attack communities elsewhere? You must not simply “involve” communities in an imposed neoliberal agenda based on ‘development’ and markets – the very same things that destroy our planet.

You must rethink your role as a supporting one: you are not the protagonist in this story. Right now, in fact, you’re the villain. Effective stories of conservation must be co-written and led by the visions, decisions, knowledge and guidance of indigenous and local communities.

WWF, you know the ecological catastrophe we face: yet its urgency must not be reacted to with your current eco-fascist ‘solutions’. If we do not challenge the crisis appropriately, the suffering and deaths will be devastating. You also know that Indigenous’ and local communities’ land rights and cultures are fundamental to the health of their ecosystems, and to their resistance to the corporations that degrade them. Greenwashing and small technical fixes won’t solve this crisis: we need a transformation of our global consciousness that decolonizes the ways we understand and promote conservation. If you keep attacking Indigenous and local communities, working with polluting industries and the governments who serve them, you will continue to be complicit in the ecological catastrophe and guilty of ecofascism. You will continue to fail to represent or be in solidarity with the global environmental and social justice movement.

The best hope for our survival and flourishing is for conservationists to unite with the Indigenous resistance movement, and fight the environmental destruction of governments and industry. Whose side are you on in this struggle for the survival of life on Earth?

We will not stop challenging the WWF to radically dismantle its colonial approach to conservation, until they join us in enacting the following demands:

1- STOP THE HARM:

Immediately stop dispossessing indigenous and local communities of their land. Cease any collaboration or support to organisations and security forces that evict local communities.

2- GROUND CONSERVATION IN JUSTICE:

Transition all your fortress conservation projects to the support of genuine indigenous-led and community-led conservation. Projects must actively advocate and be based upon: recognising land rights, local knowledge, local livelihoods, and social justice. Use your platform and financial leverage to advocate these changes across the whole conservation sector.

3- BE ACCOUNTABLE:

Be accountable by giving control of project funding to local communities, through their own democratic/collective processes. Be transparent through systems of direct people-to-people communication, such as people’s assemblies, between local communities and your supporters.

4- END TOXIC RELATIONSHIPS:

Stop the conflict of interests with those destroying ecosystems: cut financial links with large corporations; fire board members from polluting industries; use your platform to mobilize people to take action and demand an end to corporate ecocide.

Signed by:

Organisations:

- Survival International

- Centre for the Anthropology of Sustainability, University College London

- Association Okani

- Pan-African Living Cultures Alliance (PALCA)

- Integrated development Initiatives in Ngorongoro (IDINGO)

- Front Commun pour la Protection de l’Environnement et des Espaces Protégés

- Ole Siosiomaga Society Incorporated (OLSSI), SAMOA

- Fondation Internationale pour le Développement l’Education l’Entreprenariat et la Protection de l’Environnement (FIDEPE)

- Pastoral Peace Reconciliation Initiative (PPRI)

- XR Anti-Oppression Circle

- Rogerio Cumbane/MAKOMANE-ADM (Association for Community Development)

- XR Internationalist Solidarity Network (XRISN)

- Skogsupproret (Forest Rebellion)

People:

- Arturo Escobar (Professor of Anthropology)

- Katy Molloy (Flourishing Diversity)

- Fe Haslam (Global Justice Forum – GJF)

- Francis Shomet Olenaingi’sa

- Fiore Longo – Survival International

- Cathryn Townsend

- Fiu Mataese Elisara – Executive Director of OLSSI

- Romao Xavier – Programme and Advocacy Coordinator

- SHAPIOM NONINGO – Technical Secretary GTANW

- Jose Ines Loria Palma – President of the San Crisanto Foundation

- Elena Kreuzberg – Consultant on Environmental Issues

- Maurizio Farhan Ferrari – Senior Policy Adviser on Environmental Governance

- KOAGNE Clovis – Coordinateur Général Fondation Internationale pour le Développement l’Education l’Entreprenariat et la Protection de l’Environnement (FIDEPE)

- Milka Chepkorir

- Samuel Nangiria

- Kofi Mawuli Klu (XRISN)

- Esther Stanford-Xosei

- Jerome Lewis

Original Source: redd-monitor.org

Related posts:

Development financiers fuel human rights abuses – New Report

Development financiers fuel human rights abuses – New Report

Global Mobilisation to End the Criminalisation of Land Rights Defenders

Global Mobilisation to End the Criminalisation of Land Rights Defenders

Tech giants should join global campaign to seek land rights for all: experts

Tech giants should join global campaign to seek land rights for all: experts

Times for mitr phol, coca cola, nestle, mars wrigley and bonsucro to live up to their human rights responsibilities.

Times for mitr phol, coca cola, nestle, mars wrigley and bonsucro to live up to their human rights responsibilities.

You may like

SPECIAL REPORTS AND PROJECTS

Seizing the Jubilee moment: Cancel the debt to unlock Africa’s clean energy future

Published

1 day agoon

July 12, 2025

Africa has the resources and the vision for a just energy transition, but it is trapped in a financial system structured to take more than it gives. In this blog, we outline how debt burdens and climate impacts are holding the continent back, and looks at the role of institutions that shape the global financial order, like the World Bank, African Development Bank and IMF. As these institutions and governments meet in Seville for FfD4, we urge them to heed people’s calls for reform: cancel the debt, redistribute the wealth, and fund the just transition. — By Rajneesh Bhuee and Lola Allen

With 60% of the world’s best solar energy resources and 70% of the cobalt essential for electric vehicle batteries, the African continent has everything it needs to power its development and become a global reference point for sustainable energy production. That potential, however, remains largely untapped; Africa receives just 2% of global renewable energy investment. As the UNCTAD Secretary-General Rebeca Grynspan warns, too many countries are forced to “default on their development to avoid defaulting on their debt.”

The cost of servicing unsustainable debts, layered with new loan-based climate and development finance, leaves governments with little fiscal space to invest in clean energy, health or education. In 2022 alone, African countries spent more than $100 billion on debt servicing, over twice what they spent on health or education. Add to this the $90 billion lost annually to illicit financial flows, and the reality is stark: more money leaves the continent through financial leakages (also including unfair trade and extractive investment) than comes in through productive, equitable and development-oriented finance.

These are not isolated problems. They reflect a financial system that has been built to serve global markets rather than people. Between 2020 and 2025, four African countries defaulted on their external debts, that is, they failed to make scheduled repayments to creditors like the International Monetary Fund or bondholders, triggering fiscal crises and, in several cases, IMF interventions tied to austerity measures. Pope Francis’ Jubilee Report (2025) and hundreds of civil society groups argue that these defaults reflect the deeper crisis of unsustainable debt. Meanwhile, 24 more African countries are now in or near debt distress. None have successfully restructured their debts under the G20 Common Framework, a mechanism launched in 2020 to facilitate debt relief among public and private creditors. The Framework has been widely criticised for being slow, opaque and ineffective. According to Eurodad, without urgent systemic reforms, up to 47 Global South countries, home to over 1.1 billion people, face insolvency risks within five years if they attempt to meet climate and development goals.

How debt undermines the just energy transition

Debt has become both a driver and a symptom of climate injustice. Countries that did the least to cause the climate crisis now pay the highest price, twice over. First, they suffer the impacts. Second, they must borrow to rebuild.

This is happening just as concessional finance disappears. The US has withdrawn from the African Development Fund’s concessional window (worth $550m), yet maintains influence over private-sector lending. It has also opted out of the UN Financing for Development Conference (FfD4), a historic opportunity to confront the injustice of our financial system. Meanwhile, European governments, though now celebrating themselves as defenders of multilateralism, played a key role in weakening the outcome of FfD4, slashing aid budgets, redirecting funds toward militarisation, and systematically blocking proposals for a UN-led sovereign debt workout mechanism. With rising insecurity and geopolitical tensions, these actions send a troubling signal: at a moment when global cooperation is urgently needed, many Global North countries are stepping back from efforts to fix the very system that is preventing climate justice and clean energy for much of the Global South.

A role for the AfDB?

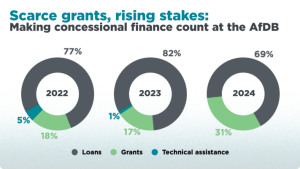

The African Development Bank (AfDB), under incoming president Sidi Ould Tah , has made progressive commitments of $10 billion to climate-resilient infrastructure and $4 billion to clean cooking. Between 2022 and 2024, one in five (20%) of its energy dollars were grants, far exceeding The World Bank ‘s 10% and the Asian Development Bank (ADB) ‘s 3.8%. The AfDB has also backed systemic reform: for example, calling for Special Drawing Rights (SDR) redistribution, launching an African Financial Stability Mechanism that could save up to $20 billion in debt servicing, and consistently advocating for fairer lending terms.

Yet, even progressive leadership struggles within a broken system. Recourse’s recent research shows that AfDB energy finance dropped 67% in 2024, from $992.7 million to just $329.6 million. Of this, a staggering 73% went to large-scale infrastructure like mega hydro dams and export-focused transmission lines, ‘false solutions’ that bypass the energy-poor and displace communities. Meanwhile, support for locally-appropriate, decentralised renewable energy systems such as mini-grids, solar appliances, and clean cookstoves plummeted by over 90%, from $694.5 million to just $61 million, with only five of 13 projects directly addressing energy access in 2024.

Africa received just 2.8% of global climate finance in 2021–22, and what is labelled as “climate finance” is often little more than a Trojan horse: resource-backed loans, debt-for-nature swaps, and blended finance instruments that shift risk to the public while offering little real benefit to local communities. These mechanisms, promoted as “innovative” or “green”, often entrench financial dependency and fail to deliver meaningful change for energy-poor or climate-vulnerable groups.

Meanwhile, initiatives that could build green industry and renewable capacity across Africa are falling short in both scale and speed. Flagship projects, such as the EU’s Global Gateway, have failed to drive green industrialisation in Africa, and carbon markets continue to delay real emissions reductions, subsidise fossil fuel interests, and entrench elite control over land and resources.

Mission 300: Ambition or another missed opportunity?

In this constrained context, the AfDB and World Bank launched Mission 300, an ambitious plan to connect 300 million Africans to electricity by 2030. Pragmatic goals like electrification are crucial, but the story beneath the surface of Mission 300 raises concern. Far from serving households, many projects under the initiative appear more aligned with export markets and large-scale energy users, echoing decades of infrastructure that bypasses those most in need.

Mission 300 can still be transformative, but only if it centres people, not profits. Energy access must begin with those who need it most: women and youth, especially in rural communities. Across Africa, many women cook over open fires, walk hours to gather fuel, and care for families in homes without light or clean air. This is not just an inconvenience, it is structural violence and policy failure.

Yet most energy finance still flows to centralised grids, mega-projects, and sometimes fossil gas (misleadingly called a “transition fuel”). These do little to address energy poverty. Locally appropriate decentralised renewable energy solutions, solar-powered appliances, clean cookstoves, and mini-grids can deliver faster, cheaper, and more equitable impact. Mission 300 must invest in such solutions, without adding to existing debt problems. It should support national policy design, for example, by ensuring that energy policy is responsive to women’s needs, making use of gender-disaggregated data and community consultation.

The Jubilee: A year for action

In a year already marked as a Jubilee moment, African leaders have demanded reform: including a sovereign debt workout mechanism and a UN Tax Convention to end illicit financial flows. Yet as AFRODAD has documented, these demands were blocked at the FfD4 negotiations by wealthy nations—notably the EU and UK—even as climate impacts grow and fiscal space shrinks.

This is not just about finance. It is about reclaiming sovereignty. The incoming AfDB president and all the multilateral development banks face a choice: continue financing extractive, large-scale projects that serve foreign interests, or invest in decentralised, gender-responsive, pro-people solutions that shift power and ownership.

Africa has the resources. What it needs is fiscal space, public-led finance, and global rules that prioritise people and planet over profit. The Jubilee call is clear: cancel the debt, redistribute the wealth, and fund the just transition.

Source: Recourse through LinkedIn Account Recourse.

Related posts:

Statement: The Energy Sector Strategy 2024–2028 Must Mark the End of the EBRD’s Support to Fossil Fuels

Statement: The Energy Sector Strategy 2024–2028 Must Mark the End of the EBRD’s Support to Fossil Fuels

African Development Bank decides not to fund Kenya coal project

African Development Bank decides not to fund Kenya coal project

Africa must unlock the power of its women to save climate change

Africa must unlock the power of its women to save climate change

PFZW scraps funding from Total and others for failure to transition into a cleaner energy mix.

PFZW scraps funding from Total and others for failure to transition into a cleaner energy mix.

SPECIAL REPORTS AND PROJECTS

Activism on Trial: Despite the increasing repressive measures, Uganda’s EACOP protesters are achieving unexpected victories in the country’s justice systems.

Published

5 days agoon

July 8, 2025

Special report by the dedicated and thorough Witness Radio team, offering a comprehensive and in-depth overview of the situation.

As Uganda moves forward with the controversial East African Crude Oil Pipeline (EACOP), a wave of arrests, intimidation, and court cases has targeted youth and environmental activists opposing the project. However, there is a noticeable and encouraging shift within Uganda’s justice systems, with a growing support for the protesters, potentially signaling a change in the legal landscape.

The EACOP project, stretching 1,443 kilometers from Uganda to Tanzania, has been hailed by the government as a development milestone. However, human rights groups and environmental watchdogs have consistently warned that the project poses serious risks to communities, biodiversity, and the climate. Concerns over land grabbing, inadequate compensation, and ecological degradation have mobilized a new generation of Ugandan activists.

Since 2022, as opposition to EACOP grew louder, Ugandan authorities have intensified a campaign of arrests and legal harassment. Police, military, and currently the Special Forces Command, a security unit tasked with protecting Uganda’s president, have been involved in brutal crackdowns on these activists.

Yuda Kaye, the mobilizer for students against EACOP, believes the criminalization is an attempt by the government to weaken their cause and silence them from speaking out about the project’s negative impacts.

“We are arrested just for raising the project concerns, which affect our future, the local communities, and the environment at large. Oftentimes, we are arrested without reason. They just round us up at once and brutally arrest us, Mr. Kaye reveals, in an interview with Witness Radio’s research team.

Activists have faced a litany of charges, including unlawful assembly, incitement to violence, public nuisance, and criminal trespass. Many of these charges have lacked substantive evidence and have been dismissed by the courts or had their files closed by the police after prolonged delays.

A case review conducted by Witness Radio Uganda reveals that Uganda’s justice system is being used to suppress the activities of youth activists opposing the project, rather than convicting them. However, despite the system being used to silence them, it has often found no merit in these cases.

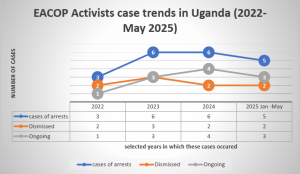

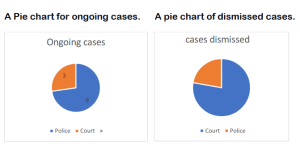

Of a sample of 20 documented cases since 2022 involving the arrest of over 180 activists, 9 case files against the activists have either been dismissed by courts or closed by the police due to a lack of prosecution, another signal indicating the relevance of their work, while 11 cases remain ongoing.

The chart below shows trends in arrests, dismissed cases, and ongoing cases involving EACOP activists in Uganda from 2022 to May 2025.

The review was conducted with support from the activists themselves and their lawyers. It involved a desk review and analysis of Witness Radio articles concerning the arrests of defenders and activists opposing the EACOP project.

Witness Radio’s analysis reveals a concerning trend as the majority of cases involving these activists are stalling at the police level rather than progressing to the courts of law. This suggests that the police have not only criminalized activism but are also playing a syndicate role in deliberately prolonging these cases under the excuse of ongoing investigations.

“While both the police and judiciary are being used to suppress dissent, the courts have at least demonstrated a degree of fairness, having dismissed at least 78% of cases that fall within their jurisdiction. In contrast, the police continue to hold 73% of activist cases in limbo, citing investigations as justification for indefinite delays.” The research team discovered.

Witness Radio’s analysis further shows that in most of these cases, the state has failed to produce witnesses or evidence to convict the activists, adding that the charges are often just tools of intimidation. Additionally, this is accompanied by more extended periods during which decisions are being made.

Despite the intense crackdown, it is evident that these activists are winning, as no proven record of sentencing has been observed. Instead, these cases are often marred by delays in court or at the police, and in the end, some have been dismissed. This implies that protest marches and petition deliveries serve a purpose; the state just needs to listen to their concerns and formulate possible solutions to address them,” said Tonny Katende, Witness Radio Uganda’s Research, Media and Documentation Officer.

According to Article 29(1)(d) of the Constitution of Uganda, every individual has the right to “assemble and demonstrate together with others peacefully and unarmed and to petition.” Additionally, Article 20 emphasizes that fundamental rights and freedoms “are inherent and not granted by the State.” Yet activists report that police regularly deny them the right to exercise their rights as guaranteed.

At a February 2025 press conference, EACOP activists strongly condemned the police’s continued unlawful arrests of demonstrators exercising their constitutional rights and case delays. This followed escalating crackdowns that added to the tally of over 100 activists arrested in 2024 alone.

“We strongly condemn these arrests. Detaining demonstrators does not address the concerns affecting grassroots communities impacted by oil and gas projects,” declared the group, led by Bob Barigye, who remains in prison on another charge still linked to his opposition to EACOP.

An interview with Mr. Yuda Kaye, a mobilizer from the Students Against EACOP Movement, confirmed that the ongoing dismissals only reaffirm the legitimacy of their resistance.

“These cases are dismissed because the government and its justice systems don’t have any grounds to convict us. This justifies the fact that the issues we’re discussing are real. We only seek accountability, but since the government has power, they criminalize us and silence us,” Mr. Kaye added.

According to Kaye, the intimidation is real, but so is their commitment. “We are called enemies of progress, but we’re only protecting our future and that of our country. We’ve often proposed alternatives, but the government doesn’t want them.” He re-echoes.

Despite this, activists say their rights are routinely violated. Witness Radio Uganda attempted to contact the police spokesperson, Mr. Kituuma Rusooke, but known numbers were unreachable, and messages sent to him went unanswered.

In a separate interview with Mr. James Eremye Mawanda, the Judiciary Spokesperson, he acknowledged the pattern of dismissals and delays.

“As the Judiciary, we listen to cases, and where there is no evidence to support the case, a decision is made. When a crime is allegedly committed and an individual is brought before the court, the courts upholding the rule of law shall administer justice,” he said.

According to Witness Radio’s analysis, 2025 has seen the most dismissals so far, with six cases concluding, reinforcing the view that criminalization is used more for intimidation than as a means of legal redress. “Whereas the arrests took place in separate years, most of the dismissals have happened in 2025,” the research team further highlighted.

Mr. Brighton Aryampa, the team lead of Youth for Green Communities, one of the organizations that provide legal representation for Stop-EACOP activists, highlighted that the criminalization of Ugandan activists undermines Uganda’s democratic principles of free expression and open discourse.

“The government, in bed with oil corporations Total Energies and CNOOC, is deliberating using legal action against Stop EACOP activists to suppress dissent, free speech, right to peaceful protest, and against public participation. This is tainting Uganda as a country that undermines the democratic principles of free expression and open discourse, as hundreds of Stop EACOP activists have been arrested, charged, and some tried by a competent court. However, no one has been found guilty of the fabricated offense usually slapped on them.” He said in an interview with Witness Radio.

Counsel Aryampa further advised that the practice of powerful companies and businesses blackmailing and corrupting the Ugandan government to develop harmful projects while ignoring all social warnings and human rights abuses must be stopped.

The pressure exerted by these activists, both locally and internationally, has slowed the EACOP project. It has also led to bankers and insurers withdrawing from financing or insuring the project. According to Stop EACOP campaigners, more than 40 international banks and 30 global insurance firms, including Chubb, have distanced themselves from the controversial pipeline project, citing human rights and climate concerns raised by these activists.

Meanwhile, as the activism grows, the number of arrests is rising. Within just the first six months of 2025, over 40 activists have been criminalized for their activism. Among them is KCB 11, a group of eleven activists that was arrested at the KCB offices in April 2025. The group has spent over two months on remand, despite their lawyers’ pleas for bail to be granted.

Related posts:

EACOP activism under Siege: Activists are reportedly criminalized for opposing oil pipeline project in Uganda.

EACOP activism under Siege: Activists are reportedly criminalized for opposing oil pipeline project in Uganda.

EACOP: The trial of 20 environmental activists failed to take off, and now they want the case dismissed for lack of prosecution.

EACOP: The trial of 20 environmental activists failed to take off, and now they want the case dismissed for lack of prosecution.

Milestone: Another case against the EACOP activists is dismissed due to the want of prosecution.

Milestone: Another case against the EACOP activists is dismissed due to the want of prosecution.

The latest: Another group of anti-EACOP activists has been arrested for protesting Stanbic Bank’s financing of the EACOP Project.

The latest: Another group of anti-EACOP activists has been arrested for protesting Stanbic Bank’s financing of the EACOP Project.

SPECIAL REPORTS AND PROJECTS

‘Left to suffer’: Kenyan villagers take on Bamburi Cement over assaults, dog attacks

Published

4 months agoon

March 22, 2025

- The victims are aged between 24 and 60, and one of them has since passed on.

- Many were severely injured and hospitalized following brutal attacks, unlawful detention, and physical assault by Bamburi’s security personnel.

Editor’s note: Read the petition here.

Their hopes for justice seemed to be slipping away after initially taking on a multinational corporation and failing to hold it accountable for the brutal injuries they suffered.

The death of one of their own cast a shadow of despair, making it seem unlikely that they would ever bring the corporation to justice for the crimes they alleged.

However, 11 victims of dog attacks, assaults, and other severe human rights violations are now challenging Bamburi Cement PLC’s role in these abuses in court.

They are represented by the Kenya Human Rights Commission (KHRC), which on January 29, 2025, filed a legal claim before a constitutional court in Kenya, seeking to hold the multinational accountable for the harm suffered by the victims—residents of land parcels in Kwale that Bamburi claims ownership of. KHRC worked with the Kwale Mining Alliance (KMA) to bring this case.

The victims, aged between 24 and 60, include Mohamed Salim Mwakongoa, Ali Said, Abdalla Suleiman, Hamadi Jumadari, Abdalla Mohammed, and Omari Mbwana Bahakanda. Others are Shee Said Mbimbi, Omar Mohamed, Omar Ali Kalendi (deceased), Abdalla Jumadari, and Bakari Nuri Kassim.

Bamburi had hired a private security firm and deployed General Service Unit (GSU) officers to guard three adjoining land parcels, covering approximately 1,400 acres in Denyenye, Kwale. The GSU established a camp on the land, which has historically been accessed by residents who have long used established routes to reach the forest and the Indian Ocean.

For decades, these routes provided them with access to resources such as firewood, crops, and fish, which they relied on for their livelihoods. However, five years ago, when they attempted to collect firewood, harvest crops, and access the ocean through the land, Bamburi accused them of trespassing. The company’s private guards and GSU officers responded with force, setting dogs on them and assaulting them.

Many were severely injured and hospitalized following brutal attacks, unlawful detention, and physical assault by Bamburi’s security personnel. These incidents occurred despite the lack of clearly defined boundaries and the fact that the traditional access routes had never been contested.

According to the petition, GSU officers and private guards inflicted serious injuries by kicking, punching, and beating the victims with batons. Those who were arrested were neither taken to a police station nor charged with any offense. Despite their injuries, they were denied emergency medical care.

These actions were intended to intimidate residents, prevent them from accessing the beach, and suppress any historical claims to the land, the victims tell the court. Local police in Kwale failed to investigate the abuses, visit the crime scenes, or arrest any of the perpetrators, they add.

Now, the victims are seeking compensation for these violations. They have also asked the court to declare that their rights were violated through torture inflicted by Bamburi’s guards and GSU officers. Additionally, they want the court to rule that releasing guard dogs to attack them during arrests constituted an extreme and unlawful use of force.

Source: khrc.or.ke

Related posts:

Breaking: Over 600 attacks against defenders have been recorded in the year 2023 globally- BHRRC report.

Breaking: Over 600 attacks against defenders have been recorded in the year 2023 globally- BHRRC report.

Kaweeri Coffee land grabbing case re-trial resumes as evictees continue to suffer gross human rights violations.

Kaweeri Coffee land grabbing case re-trial resumes as evictees continue to suffer gross human rights violations.

Criminalization of planet, land, and environmental defenders in Uganda is on the increase as 2023 recorded the soaring number of attacks.

Criminalization of planet, land, and environmental defenders in Uganda is on the increase as 2023 recorded the soaring number of attacks.

Local land grabbers evict villagers at night; foreign investors cultivate the same lands the next day

Local land grabbers evict villagers at night; foreign investors cultivate the same lands the next day

Land Grabbing Crisis Escalates in Uganda: Mayiga Urges Citizens to Secure Land Documents

Seizing the Jubilee moment: Cancel the debt to unlock Africa’s clean energy future

Activism on Trial: Despite the increasing repressive measures, Uganda’s EACOP protesters are achieving unexpected victories in the country’s justice systems.

Communities Under Siege: New Report Reveals World Bank Failures in Safeguard Compliance and Human Rights Oversight in Tanzania

A decade of displacement: How Uganda’s Oil refinery victims are dying before realizing justice as EACOP secures financial backing to further significant environmental harm.

Govt launches Central Account for Busuulu to protect tenants from evictions

Activism on Trial: Despite the increasing repressive measures, Uganda’s EACOP protesters are achieving unexpected victories in the country’s justice systems.

Top 10 agribusiness giants: corporate concentration in food & farming in 2025

Innovative Finance from Canada projects positive impact on local communities.

Over 5000 Indigenous Communities evicted in Kiryandongo District

Petition To Land Inquiry Commission Over Human Rights In Kiryandongo District

Invisible victims of Uganda Land Grabs

Resource Center

- LAND GRABS AT GUNPOINT REPORT IN KIRYANDONGO DISTRICT

- RESEARCH BRIEF -TOURISM POTENTIAL OF GREATER MASAKA -MARCH 2025

- The Mouila Declaration of the Informal Alliance against the Expansion of Industrial Monocultures

- FORCED LAND EVICTIONS IN UGANDA TRENDS RIGHTS OF DEFENDERS IMPACT AND CALL FOR ACTION

- 12 KEY DEMANDS FROM CSOS TO WORLD LEADERS AT THE OPENING OF COP16 IN SAUDI ARABIA

- PRESENDIANTIAL DIRECTIVE BANNING ALL LAND EVICTIONS IN UGANDA

- FROM LAND GRABBERS TO CARBON COWBOYS A NEW SCRAMBLE FOR COMMUNITY LANDS TAKES OFF

- African Faith Leaders Demand Reparations From The Gates Foundation.

Legal Framework

READ BY CATEGORY

Newsletter

Trending

-

SPECIAL REPORTS AND PROJECTS5 days ago

SPECIAL REPORTS AND PROJECTS5 days agoActivism on Trial: Despite the increasing repressive measures, Uganda’s EACOP protesters are achieving unexpected victories in the country’s justice systems.

-

NGO WORK2 weeks ago

NGO WORK2 weeks agoCommunities Under Siege: New Report Reveals World Bank Failures in Safeguard Compliance and Human Rights Oversight in Tanzania

-

SPECIAL REPORTS AND PROJECTS1 day ago

SPECIAL REPORTS AND PROJECTS1 day agoSeizing the Jubilee moment: Cancel the debt to unlock Africa’s clean energy future

-

MEDIA FOR CHANGE NETWORK1 day ago

MEDIA FOR CHANGE NETWORK1 day agoLand Grabbing Crisis Escalates in Uganda: Mayiga Urges Citizens to Secure Land Documents