MEDIA FOR CHANGE NETWORK

Food inflation: The math doesn’t add up without factoring in corporate power

Published

2 years agoon

Large farmers’ protests broke out in at least 65 countries over the past year. From India to Kenya through Colombia and France, desperation has hit a breaking point. Farmers warn that without better prices and more protection, their future is at risk. Peasant movements like La Via Campesina, for over three decades now, have denounced the World Trade Organisation and the growing number of bilateral free trade agreements for destroying their livelihoods.

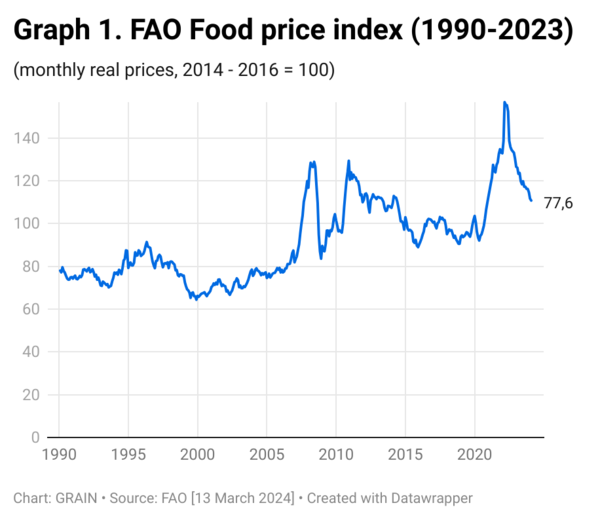

However, these protests unfold against the backdrop of record-high global food prices. The prices spiked first during the pandemic and then again at the start of the war in Ukraine hitting an all-time high in 2022. Food prices have been rising faster than other products: if the global general consumer price index (CPI) doubled between 2021 and 2022, the food CPI inflation almost tripled. According to the World Food Organisation (FAO) food price index, even if international prices have moderated in 2023, they are still higher than in 2019 (see Graph 1). And all indications are that this is a crisis of prices, and not a food shortage at the global level. For the past 20 years, world grain production has exceeded available stocks.

The impact of these food price increases on millions of people, especially the poor, is devastating. In 2022, 9.2% of the world’s population was chronically hungry, an increase of 122 million people since 2019.

But, as this year’s farmers’ protests make clear, the increase in food prices is not going into their pockets. So, who is benefiting from these food price rises?

Volatility by design

The FAO and corporate executives have attributed recent food price increases to disruptive supply chains for oil, gas, fertilisers and staple goods. This is a half truth, and thus deceptive. They don’t mention how the current structure of the food system encourages and amplifies such disruptions.

For decades, the World Bank and the International Monetary Fund (IMF) have promoted structural adjustment policies, and green revolution technologies (hybrid seeds + chemical pesticides and fertilisers) across the world. We now have a global food system designed around the production of a small number of agricultural commodities (wheat, rice, maize, soybeans, palm oil) in a few areas of the world totally devoted to the massive industrial production of monocultures dependent on the supply of inputs, and concentrated in the hands of a few companies. Any disruptions within this global system, be it war or drought, can have major impacts on people’s access to food.

This is particularly acute in countries of the global South that are now highly dependent on food imports because of policies imposed on them through multilateral banks and free trade agreements. Moreover, we are entering a period of intense climate crisis, water crisis, geopolitical tensions, and declining crop yield gains that are set to generate more frequent and more severe disruptions.

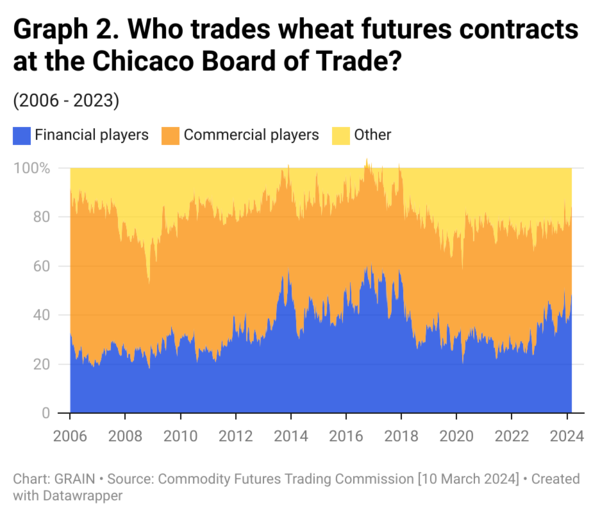

For some, however, this volatility is an opportunity. Because of deliberate policies implemented since the 1980s (see box), there is today a large and growing part of the financial sector that profits from shifts in food prices using what are called “derivatives”. In theory, the use of these instruments helps buyers and sellers to lock in prices and protect themselves against the risk of price fluctuations. The most common and important of these instruments are futures contracts, which are agreements to buy or sell agricultural commodities at a specified future date. In futures markets, it is not the agricultural product itself that is traded, but the contract. The price of the contract changes according to supply and demand. But price variations on the futures markets have a direct influence on price fluctuation of the goods to which the futures contract relate. For example, if the price of a wheat futures contract rises, this indicates that the estimated future price of wheat is high. Consequently, the real current price of wheat rises. With increased activity in the financial futures markets, food trading has come to be referenced to futures prices. In a vicious circle, the volatility of food prices attracts more speculative money into the commodity futures market. This, in turn, amplifies the volatility of the futures markets and pushes up or down real food prices.

They have some important advantages over purely financial players. For one, as ‘commercial actors’ they are not subject to the same restrictions or regulations of financial actors on commodity trading markets. Also, because of their global presence they have the most in-depth and up-to-date information about the availability of products and are the first to know about poor harvests or bumper crops. A study by SOMO found that the largest agricultural commodity trading companies ADM, Bunge, Cargill, COFCO International and Louis Dreyfus (usually referred to as “ABCCD”) control 73% of the global grain and oilseed trade as well as a combined 1 million hectares of farmland.

A perverse and well prepared alignment of the stars in the 1980s

Three parallel developments in the 1980s were key to financialising the global food system. First, the liberalisation of agricultural markets was promoted by the World Bank and other international agencies. Until then, governments in different regions had adopted policies to protect farmers from production risks. Second, financial markets were deregulated in the United States and investment banks and commodity trading firms began marketing index funds that tracked the prices of various commodities. In addition, large institutional investors (such as pension funds) sought to diversify their investments. To hedge their risks, they increased their investments in commodity derivatives and physical assets. As a result, a growing number of financial players began to speculate on food prices.

Third, like other companies, agribusiness companies experienced a dramatic shift in ownership with the entry of large asset management firms. CEO salaries became linked to the value of shares, creating a strong incentive to restructure companies in ways that generated more profit for shareholders. To this end, mergers and acquisitions multiplied, laying the foundations for today’s deep corporate concentration in the agri-food sector.

Source: Jennifer Clapp and S. Ryan Isakson, “Speculative Harvests: Financialization, Food, and Agriculture”, Agrarian Change & Peasant Studies, 2021.

Price manipulation and sellers’ inflation

Financial markets are not the only space where big agribusiness and food companies have an impact on food prices. A growing number of voices, such as the economist Isabella Weber, point to the monopoly power of corporations as a major factor in recent price inflation, including with food. What they call “sellers’ inflation” happens in contexts of supply-chain bottlenecks and cost shocks. When price hikes in upstream sectors (such as the gas needed for fertilisers) spread along the supply chain, companies in downstream sectors pass on cost increases to protect margins and even take the opportunity to increase margins. They can raise prices knowing that all their competitors will do the same.

Such strategies are only possible in contexts where a handful of companies have the power to set prices, as is the case in the food and agriculture sector. For example, just four companies, Bayer, Corteva, Syngenta and BASF control half of the seed market and 75% of the global agrochemicals market. Since 2018, their profits have nearly doubled. On the fertilisers side, the global market is controlled by a small number of companies. Four of them control a third of all nitrogen fertiliser production. From 2018 to 2022, the profits of the top 9 fertiliser corporations more than tripled, as they increased prices far beyond the production costs. Another example can be found in the world’s second largest meat processor, Tyson. The company more than doubled its margins and profits at the end of 2021. This was due to price increases it initiated and then continued to raise to protect margins against cost pressures from grain prices. A similar strategy was followed by large branders as Nestlé, Unilever and Mondelez who increased prices and ended by recording high profits in 2022.

This combination of monopoly power and unregulated activity in financial markets allows agricultural commodity traders, big agribusiness and food companies to make huge profits from food price rises.

Countering corporate power in food systems

The big culprit when it comes to today’s high food prices for consumers and low prices for farmers is corporate power. The climate crisis will only make this situation worse, unless urgent actions are taken to dismantle corporate power and shift to more localised food systems, based on diversified food production and catered to people’s food needs. The struggle against free trade agreements, at the forefront of many of today’s farmers’ protests, is therefore critical.

At the same time, actions are needed to reign in the power of those actors in the casino economy who are amplifying food price volatility and increases. When it comes to financial speculation, an important driver in food price volatility, regulations need to be tightened. And, to tackle the so-called “sellers’ inflation”, we need measures to prevent profiteering, which could include taxes on windfall profits anti-trust measures, and, more importantly public controls over food prices and programmes that ensure a fair, equitable and secure distribution of nutritious foods to everyone.

Source: grain.org

Related posts:

World food prices rise for 2nd consecutive month: FAO

World food prices rise for 2nd consecutive month: FAO

WTO negotiations: In the face of the food crisis, public stocks are legitimate and necessary

WTO negotiations: In the face of the food crisis, public stocks are legitimate and necessary

African farmers and agribusinesses need fair access to markets

African farmers and agribusinesses need fair access to markets

Food Sovereignty is the only solution and way forward.

Food Sovereignty is the only solution and way forward.

-

TXJCX1 Jason Kelly, a trader in the Wheat Options pit at the CME Group throws up his arms as traders toss confetti at the closing bell for the year on December 31, 2009 in Chicago. UPI/Brian Kersey

You may like

MEDIA FOR CHANGE NETWORK

Why govt is launching a comprehensive digital land registry

Published

2 days agoon

January 31, 2026

COMMENT | DAVID MUWONGE | Land has historically symbolized wealth and power. In the past, kingdoms expanded their influence by acquiring new territories.

This pursuit continued into the colonial era, spanning the 15th to the 20th centuries, with European powers scrambling for control over Africa. They were driven by a desire not just for human labour but also for large amounts of agricultural land, political power, and the raw materials needed to fuel the Industrial Revolution in the West. As a result, the distribution and management of land became increasingly complex.

In Uganda, the colonial era ushered in the 1900 Buganda Agreement, a turning point in the nation’s land history. Among its key provisions was land reform. It introduced the mailo system at the center of it all. Under this agreement, large estates were divided. About 8,000 square miles were granted to roughly 1,000 chiefs and landowners, establishing a unique land tenure system. These changes have had lasting effects on Uganda’s approach to land ownership and governance.

Over time, this structure evolved into the four land tenure systems recognized by the 1995 Uganda Constitution: customary (traditional communal or family-based ownership), freehold (absolute ownership), mailo (a system with distinct rights for owners and tenants), and leasehold (land held for a fixed term under a lease agreement, often with rent payments).

However, even as the land tenure system evolved by law to include leasehold, controversy persisted, especially regarding government land. This ongoing tension highlights the need to address historical challenges while adapting to modern realities.

This is partly because there is no comprehensive, up-to-date inventory of government land, and the Uganda Land Commission’s limited district presence. Thus, significant tests in managing and protecting government land, making it vulnerable to mismanagement and encroachment.

Recognizing these challenges, the Government of Uganda is now taking decisive steps to modernize land management systems and restore confidence in public land administration. The government is launching a digital land inventory through the Uganda Land Commission, aiming to secure, monitor, and ensure transparent management of all state-owned land.

The Uganda Land Commission (ULC), established under Article 238 of the Constitution, is tasked with holding and managing all land in Uganda vested in or acquired by the state, ensuring it is protected, put to proper use, and fully accounted for.

According to Tom John Fisher Kasenge, a commissioner at Uganda Land Commission, much of the government land has been encroached upon. Government land includes all property managed or held by ministries, departments and agencies (MDAs), government schools, health centres, hospitals, police stations, prisons, offices, farms, and army barracks. It also covers land under the National Forestry Authority. ULC is the custodian of this land and holds the titles on behalf of all MDAs.

“This inventory will also go a long way in helping to solve land disputes, wrangles and conflicts that are over land management and ownership in the country,” Kasenge remarked.

“There is a big problem now, as we talk, in distinguishing between land owned by the government and managed by the Commission; land under the Buganda Land Board; and land under the authorities, like the local governments and the cities,” Kasenge added.

“Because of that lack of accuracy in the boundaries and extent of the land and the jurisdiction of each of these bodies.”

The Land Commission’s priority is to create a digitized, accurate inventory of all government land to close information gaps. By bridging the current information divide, this initiative seeks to support proper planning, protect against encroachment, and encourage investment in projects, recognizing land as a vital national resource.

“So, planning for this land becomes very crucial at the moment that the NRM government has attracted a lot of investors, and every now and then, these investors would like to put their projects in various places around the country,” Kasenge observed. This further emphasizes the importance of reliable land records for national development.

With updated digital land records, the Commission expects to resolve disputes, reduce misallocation, and ensure efficient use of public land. These improvements are expected to build greater transparency and accountability in land administration.

Revenue Collection

Many occupants of government land are not paying ground rent largely due to limited awareness and the absence of formalized tenure, a situation that continues to affect national revenue, Kasenge revealed.

He explained that to address this gap, the Uganda Land Commission (ULC) is rolling out a new system that will regularly remind lessees of their ground rent obligations and notify them ahead of lease expiry dates, a move aimed at improving compliance.

Kasenge further noted that correcting erroneous freehold titles will allow affected lessees to regularize their tenure. This will also enable the government to collect due ground rent. He emphasizes that stronger land administration and improved revenue collection are critical to better service delivery and to ensuring government land benefits both the state and citizens.

Currently, ULC has a Financial Year revenue target of UGX 7 billion from ground rent and leases on government land. After the digitized, GIS-enabled (Geographic Information System) inventory is fully rolled out, the Commission expects collections to rise to about Shs12 billion in the first three years. Revenues are projected to gradually increase to as much as Shs40 billion in the long term.

Local governments and technical officers are playing a key role in supporting the nationwide exercise through boundary verification, data sharing and identification of government land. Their contributions include providing physical planning and land-use guidance, protecting environmentally sensitive areas, and engaging communities to raise awareness and build cooperation.

The Land Commission assures the public and current lessees that the inventory exercise is not intended to trigger evictions but is focused on documentation, compliance and improved land governance. Addressing public concerns remains central to the Commission’s approach, with an emphasis on fairness and openness throughout the process.

Uganda Land Commission has formally written to all ministries, departments and agencies (MDAs), requesting details of land under their custody and the nomination of focal persons to work with the Commission in developing a comprehensive inventory, a request that has received positive responses.

In addition, the Commission has engaged 16 town clerks from cities and municipalities. It has reviewed its own records and those of the National Land Information System (NLIS), a centralized digital platform for managing national land records, to verify government land details. The Commission has also partnered with the Ministry of Lands, Housing and Urban Development (MLHUD) to support the exercise through surveying, valuation, and titling. These collaborative efforts highlight the collective responsibility needed to address longstanding land challenges and a need to strengthen accountability, improve compliance, and enhance management of government land across the country.

As the digital registry project continues, ongoing collaboration among government agencies, local authorities, and the public will be crucial to its success. Sustained commitment and transparent communication will ensure that the benefits of improved land management are realized for all Ugandans.

Source: independent.co.ug

Related posts:

Uganda’s president stops plans seeking to review and amend the Land Act CAP 227 that sought to curb widespread illegal land evictions.

Uganda’s president stops plans seeking to review and amend the Land Act CAP 227 that sought to curb widespread illegal land evictions.

Govt launches Central Account for Busuulu to protect tenants from evictions

Govt launches Central Account for Busuulu to protect tenants from evictions

Govt resurrects emotive Land Acquisition Bill.

Govt resurrects emotive Land Acquisition Bill.

New digital tool to empower farmers to access extension services

New digital tool to empower farmers to access extension services

MEDIA FOR CHANGE NETWORK

Witness Radio and Seed Savers Network are partnering to produce radio content to save indigenous seeds in Africa.

Published

4 days agoon

January 28, 2026

By Witness Radio team.

Across Africa, indigenous seeds are vital, climate-resilient, and culturally significant resources that smallholder farmers deeply value for biodiversity and food sovereignty.

Today, however, these traditional seed systems face threats from commercial seed interests, restrictive laws, and policies that may impact farmers’ rights. Addressing these concerns directly can help farmers understand how the program supports their legal and cultural rights.

In response to this growing challenge, Witness Radio Uganda, in partnership with the Seed Savers Network (SSN) in Kenya, is launching a radio broadcast titled “The Struggle to Save Cultural Seeds in Africa.”

Witness Radio and Seed Savers in Africa aim to use the radio as a tool to organize, mobilize, and empower smallholder farmers across Africa and beyond.

Food production and consumption patterns in Africa have changed significantly since the pre-colonial era. The gradual introduction of exotic crops, the establishment of settler farms on land seized from local communities, and the shift from agroecological practices to agrochemical-dependent and mechanized agriculture have disrupted indigenous food systems.

While agribusinesses continue to generate profits, research by civil society organizations shows that these models have contributed to soil degradation, biodiversity loss, widening inequalities through land grabbing, and increased vulnerability among smallholder farmers. These historical disruptions have laid the groundwork for modern policies that further marginalize farmer-managed seed systems.

The struggle to save indigenous seeds affirms farmers’ rights to control their seeds and farming knowledge, empowering smallholder farmers to protect their food security and cultural heritage.

In 2025, the East African Community (EAC) Seed and Plant Varieties Draft Bill threatened farmers’ rights by criminalizing traditional seed practices and favoring multinational companies. This situation should motivate policymakers and community leaders to stand for farmers’ rights and food sovereignty.

In response to this emergency, it is critical to close this gap by placing smallholder farmers, Africa’s largest food producers, at the center of seed and food systems. This radio program draws inspiration from the 2025 Seed Savers Boot Camp organized by the Seed Savers Network Kenya. Held in Gilgil, Nakuru County, from the last week of October to the first week of November last year, the boot camp brought together farmers and civil society leaders from across Africa for hands-on training and learning exchanges.

Participants explored seed conservation methods and shared knowledge, fostering a movement that builds community resilience and revives traditional farming systems.

Witness Radio participated in this gathering alongside farmers, reinforcing a shared commitment to strengthening community resilience and farmer-led food systems across Africa.

This broadcast launches a new series from Witness Radio and the Seed Savers Network to raise awareness of seed saving and food sovereignty, offering practical tips and resources for farmers to actively participate in safeguarding farmer-managed seeds.

The live program will feature voices from across the continent, including Atim Robert Anaab from Trax Ghana and The Beela Project, who works to strengthen indigenous seed systems in Ghana’s Upper East and North East Regions. Other guests include June Bartuin, Executive Director of Indigenous Peoples for Peace and Climate Justice in Kenya, and Priscilla Nakato, Chairperson of the Informal Alliance for Communities Affected by Irresponsible Land-Based Investments in Uganda.

Together, the speakers will reflect on what motivated them to join the Seed Savers Boot Camp, what they learned, the current state of seed sovereignty in their countries, and how they are applying this knowledge within their communities.

The goal is to show how insights from the Seed Savers Boot Camp translate into tangible actions, inspiring farmers and policymakers to protect indigenous seeds for food sovereignty and climate resilience.

The program will air live on Witness Radio tomorrow, Thursday at 3:00 pm EAT, accessible via the Witness Radio App or online via www.witnessradio.org or https://radio.witnessradio.org/. to maximize reach and participation.

Related posts:

Seed Sovereignty: Most existing and emerging laws and policies on seeds are endangering seed saving and conservation on the African continent.

Seed Sovereignty: Most existing and emerging laws and policies on seeds are endangering seed saving and conservation on the African continent.

The EAC Seed and Plant Varieties Bill 2025 targets organic seeds, aiming to replace them with modified seeds, say smallholder farmers.

The EAC Seed and Plant Varieties Bill 2025 targets organic seeds, aiming to replace them with modified seeds, say smallholder farmers.

Happening shortly! Kenya’s upcoming court ruling on the Seed Law could have a significant impact on farmers’ rights, food sovereignty, and the country’s food system.

Happening shortly! Kenya’s upcoming court ruling on the Seed Law could have a significant impact on farmers’ rights, food sovereignty, and the country’s food system.

Know Your Land rights and environmental protection laws: a case of a refreshed radio program transferring legal knowledge to local and indigenous communities to protect their land and the environment at Witness Radio.

Know Your Land rights and environmental protection laws: a case of a refreshed radio program transferring legal knowledge to local and indigenous communities to protect their land and the environment at Witness Radio.

MEDIA FOR CHANGE NETWORK

Evicted from their land to host Refugees: A case of Uganda’s Kyangwali refugee settlement expansion, which left host communities landless.

Published

4 days agoon

January 28, 2026

By Witness Radio team.

As Uganda continues to host more refugees than almost any other country in Africa, displaced residents in Kikuube are still waiting for accountability, restitution, and the chance to live with dignity once again. This ongoing struggle should stir feelings of compassion and urgency in the audience.

More than 60,000 people occupying 9323.96 hectares (36 square miles) were displaced from villages, including Bukinda A and B, Bukinda II, Kavule, Bwizibwera A and B, Kyeya A and B, Nyaruhanga, Kabirizi, Nyamigisa A and B, Katoma, and others in Kasonga parish, Kyangwali sub-county.

The violent forced land evictions in Kyangwali date back more than a decade. Beginning in September 2013, masterminded by officials from the Office of the Prime Minister (OPM), led by the Principal Resettlement Officer Charles Bafaki, backed by the Uganda Police Force and the Uganda People’s Defence Forces (UPDF). The OPM office claimed that the contested land had been gazetted for refugee settlement, a claim former refugee host communities refute, saying they are bona fide landowners.

According to evidence seen by the Witness Radio team, most of the evictees were born on the land from the 1950s to the date they were illegally evicted.

According to Uganda’s Land Act, a bona fide occupant is a person who, before the 1995 Constitution, had occupied land unchallenged for 12 years or more, or was settled by the government. Clarifying these legal standards can help the public and policymakers understand the legal basis of land claims and potential violations.

According to the UN Refugee Agency, by the end of 2024, Uganda was hosting approximately 1.8 million refugees and asylum-seekers – the largest refugee population in Africa – reflecting a 10% increase from the previous year. The majority were from South Sudan (57%) and DRC (31%), with smaller populations from Somalia, Burundi, Eritrea, Rwanda, Sudan, and Ethiopia. Women and children made up 80% of the refugee population.

In Butyamba village, along the Hoima-Kagadi Road in Kikuube District in Western Uganda, is an informal settlement of fragile, makeshift houses that stretches across a single acre of land. It hosts over 500 people, including evictees. It’s packed tightly together, their shelters built from tarpaulins, scrap wood, and other grass thatched.

The residents, who have camped in the area since 2023, were once landowners in Bukinda and Katikala. Now, they are landless and struggling after an illegal land eviction for the expansion of the Kyangwali refugee settlement, one of Uganda’s largest refugee-hosting areas.

For many here, life changed abruptly in 2013, followed by another series of forced land evictions in 2020, at the height of the COVID-19 pandemic.

“I became a refugee in my own country,” an elderly Kabulala Oliver struggles to hold back tears as she recalls the forced land eviction that shattered her life and the lives of other members of her family.

Kabulala is among the over 60,000 people evicted from 30 villages in Bukinda, Kyangwali Sub-county. We found her together with others at the informal camp.

“When we were evicted from our land, we camped at the Kikuube Resident District Commissioner (RDC)’s premises, but this was short-lived, and we were chased away. Later, we were given this small piece of land by an area member of parliament, Hon. Natumanya,” she says.

What pains her most, she says, is that she was displaced to make room for refugees, only to become displaced herself.

“I am a Munyoro. I had lived on my land for decades. “Why should I be evicted because the government wants land for refugees? This is total impunity where the poor are not counted as humans.” Kabulala asks?

She now lives in a small makeshift shelter with a family of 13. With no land to cultivate, survival has become a daily struggle.

“My land was taken. We have nowhere to farm. We are starving every day. Children ask for food, and I don’t know where to get it. We drink dirty water,” she says.

Kabulala belongs to the Bunyoro tribe, which is constitutionally recognised as one of Uganda’s 56 indigenous communities.

The affected communities say they were never notified about the eviction or given meaningful consultation. According to Ahumuza and other witnesses, armed security personnel arrived in trucks, firing bullets, beating residents, and demolishing homes.

“In August 2013, OPM officials came and told us we had three hours to leave the land, which people had lived on for decades. They treated us like rebels. They beat people and destroyed all properties worth billions of Shillings, which forced people to scatter in all directions. After three days, refugees were ferried in and settled in our gardens where food was still growing.”

Ahumuza Businge, chairperson of the Internally Displaced Youth in Bukinda and Katikala. recalls

After the eviction, many families fled to Kyangwali sub-county headquarters, seeking refuge. Others later settled in an Internally Displaced Persons (IDP) camp in Butyamba, near Kiziranfumbi town, an area with no permanent services, such as water, toilets, and other essentials.

“You can also see how people are suffering. When our loved ones die, we have nowhere to bury them. Children don’t go to school. People die every day because there is no food, there is no water, and our temporary toilets are almost full,” Mbambali Fred, a former resident of Bukinda, whose land was also taken despite having a lease title, told Witness Radio.

Mbambali says his land was grabbed at gunpoint and misused. “I had a land title, but my land was forcefully taken and used to settle people who are not even refugees. Part of it is hired out for maize farming while I, the land owner, suffer.” He added.

In 2020, during the COVID-19 lockdown, the same government security forces forcefully evicted another group of more than 20,000 people from 1812.99 hectares (7 square miles) of land. Victims revealed that security forces sealed off their area under the pretext of a disease outbreak. Journalists and political leaders were barred, and evictions resumed quietly.

According to the ministry responsible for lands, housing, and urban development’s then guidelines, during COVID-19, no land evictions were to take place. On April 16th, 2020, the government of Uganda, through the Ministry of Lands, ordered a halt to all land evictions during the ongoing COVID-19 pandemic. The same ministry directed all local governments and security agencies to enforce the order, but the OPM disregarded it.

Today, many of the evictees live in IDPs who are framed as encroachers on their land, landless, impoverished, and dependent on casual labor. Unable to farm, families struggle to feed themselves, educate their children, or rebuild their lives.

Thirteen years after the first eviction, the affected communities say they have reached out to all concerned offices, including the president’s office, for justice, but in vain.

“The land was our life. Without it, we are nothing.” Mbambali reacts

Related posts:

MPs investigating possession of Kyangwali refugee land titles by individuals

MPs investigating possession of Kyangwali refugee land titles by individuals

Museveni grants avocado growing investor 5 square miles of refugee camp land

Museveni grants avocado growing investor 5 square miles of refugee camp land

Indigenous communities lost over 9 square miles; coerced to accommodate refugees

Indigenous communities lost over 9 square miles; coerced to accommodate refugees

Adjumani officials worry as refugees strip the land bare

Adjumani officials worry as refugees strip the land bare

Why govt is launching a comprehensive digital land registry

Witness Radio and Seed Savers Network are partnering to produce radio content to save indigenous seeds in Africa.

Evicted from their land to host Refugees: A case of Uganda’s Kyangwali refugee settlement expansion, which left host communities landless.

Women environmental rights defenders in Africa are at the most significant risk of threats and attacks – ALLIED New report

Will Uganda’s next government break the land-grabbing cycle?

Swedish pension fund drops TotalEnergies amid rising EACOP risks

Women environmental rights defenders in Africa are at the most significant risk of threats and attacks – ALLIED New report

Land tenure security as an electoral issue: Museveni warns Kayunga land grabbers, reaffirms protection of sitting tenants.

Innovative Finance from Canada projects positive impact on local communities.

Over 5000 Indigenous Communities evicted in Kiryandongo District

Petition To Land Inquiry Commission Over Human Rights In Kiryandongo District

Invisible victims of Uganda Land Grabs

Resource Center

- Land And Environment Rights In Uganda Experiences From Karamoja And Mid Western Sub Regions

- REPARATORY AND CLIMATE JUSTICE MUST BE AT THE CORE OF COP30, SAY GLOBAL LEADERS AND MOVEMENTS

- LAND GRABS AT GUNPOINT REPORT IN KIRYANDONGO DISTRICT

- THOSE OIL LIARS! THEY DESTROYED MY BUSINESS!

- RESEARCH BRIEF -TOURISM POTENTIAL OF GREATER MASAKA -MARCH 2025

- The Mouila Declaration of the Informal Alliance against the Expansion of Industrial Monocultures

- FORCED LAND EVICTIONS IN UGANDA TRENDS RIGHTS OF DEFENDERS IMPACT AND CALL FOR ACTION

- 12 KEY DEMANDS FROM CSOS TO WORLD LEADERS AT THE OPENING OF COP16 IN SAUDI ARABIA

Legal Framework

READ BY CATEGORY

Newsletter

Trending

-

MEDIA FOR CHANGE NETWORK1 week ago

MEDIA FOR CHANGE NETWORK1 week agoWomen environmental rights defenders in Africa are at the most significant risk of threats and attacks – ALLIED New report

-

MEDIA FOR CHANGE NETWORK2 weeks ago

MEDIA FOR CHANGE NETWORK2 weeks agoUganda moves toward a Bamboo Policy to boost environmental conservation and green growth.

-

FARM NEWS1 week ago

FARM NEWS1 week ago200 farmers demonstrate at parliament, worried about new seed monopoly

-

MEDIA FOR CHANGE NETWORK4 days ago

MEDIA FOR CHANGE NETWORK4 days agoEvicted from their land to host Refugees: A case of Uganda’s Kyangwali refugee settlement expansion, which left host communities landless.

-

MEDIA FOR CHANGE NETWORK4 days ago

MEDIA FOR CHANGE NETWORK4 days agoWitness Radio and Seed Savers Network are partnering to produce radio content to save indigenous seeds in Africa.

-

MEDIA FOR CHANGE NETWORK2 days ago

MEDIA FOR CHANGE NETWORK2 days agoWhy govt is launching a comprehensive digital land registry