SPECIAL REPORTS AND PROJECTS

Offsets don’t stop climate change.

Published

3 years agoon

Shortly before COP26, Amazon Watch and more than 170 organisations signed on to a statement under the headline “Offsets don’t stop climate change”.

The headline is borrowed from a December 2020 letter to the Financial Times in response to an editorial about Mark Carney’s Taskforce on Scaling Voluntary Carbon Markets.

The letter, from Doreen Stabinsky (College of the Atlantic, USA), Wim Carton (Lund University, Sweden), Kate Dooley (University of Melbourne, Australia), Jens Friis Lund (University of Copenhagen, Denmark), and Kathy McAfee (San Francisco State University, USA), states that, “Offsets don’t stop climate change because they don’t stop emissions.”

They write that,

In an ideal world, some types of offsets might theoretically balance out emissions with removals. But the whole point of an offset is that one entity gets to keep emitting.

And they explain that the problem is that with continued emissions, CO2 continues “to accumulate in the atmosphere where it resides for hundreds to thousands of years, and the temperature of the planet continues to increase”.

They point out that the oil industry is a primary beneficiary of offsetting and Carney’s taskforce was stacked with respresentatives of Big Polluters:

All the major oil companies are planning to continue with exploration and new extraction projects. None of them have plans for a managed decline of production that is anywhere near in line with the Paris goal aiming to limit warming to 1.5C. Indeed some fossil fuel majors have even stated their intent to increase exploration and production for at least the next five years. These are hardly decarbonisation goals. All of them intend to rely heavily on carbon offsetting to keep drilling and emitting-as-usual.

They conclude that if Carney were serious about addressing the climate crisis, he would “convene a taskforce on the managed decline of fossil fuels and bring the fossil fuel industry to the table”.

It’s not controversial to point out that offsetting does not reduce emissions (and therefore does not help address the climate crisis). Even proponents of offsetting will, if pushed, admit this fact:

In a press release about the statement signed by more than 170 organisations, Jim Walsh of Food & Water Watch says,

“Offsets are nothing short of a scam that corporate interests push, allowing them to continue polluting our climate and frontline communities with impunity. The harm does not end there, as these offset schemes displace indigenous communities and prop-up corporate agriculture and factory farming. Addressing the climate crisis means keeping fossil fuels in the ground, rather than pursuing these scams that harm our communities and climate for nothing other than corporate profits.”

Here is the statement, “Offsets don’t stop climate climate change”. The list of signatories is available here:

Offsets don’t stop climate changeClimate-driven wildfires, flooding, droughts and other extreme weather events daily impact every corner of the globe.Yet the fossil fuel industry, big utilities, big agriculture, big finance — and their political allies — are pushing carbon offset schemes to allow them to continue releasing the greenhouse gases driving the climate crisis, harming Indigenous, Black, and other already-marginalized communities, and undermining sustainable farming and forestry practices.The science is clear: we need to rapidly phase out fossil fuels and emissions-intensive agricultural practices like factory farming, while protecting forests, wetlands, and other natural carbon sinks. Every delay means greater impacts on our climate and more pollution in historically overburdened communities.[1]We call on leaders around the world to join us in rejecting offset schemes because these pay-to-pollute practices are nothing more than false and harmful solutions to the climate crisis.

- Nature-based offsets cannot “offset” fossil fuel combustion. While fossil fuel companies and other polluters would like fossil carbon and biological carbon to be fully interchangeable, this has no scientific basis.[2] Fossil carbon emissions are effectively permanent, coming from reservoirs deep in the earth where they have been stored for millions of years. When burned, the carbon pollution remains in the atmosphere for hundreds to thousands of years. In contrast, crops, soils, oceans, and forests are “fast-exchange” carbon reservoirs that have limited carbon storage capacity and can re-release carbon back into the atmosphere over the course of a few decades, or sometimes even over a few days.[3] Offsets confuse this basic science by wrongly treating the Earth’s biosphere as an endless source of potential storage for fossil carbon emissions.

- Offsets of any kind perpetuate environmental injustice. Greenhouse gas emitting industries are disproportionately sited in poor communities and communities of color, causing them to bear the brunt of pollution. Offset schemes increase pollution in these communities, worsening environmental injustice.[4] Furthermore, by allowing pollution to continue in exchange for land grabs elsewhere, offsets often shift the burden of reducing emissions from the Global North to the Global South.[5]

- The use of offsets is likely to increase greenhouse gas emissions. Polluters frequently purchase offsets for emissions-reducing practices by one entity, so that their own emissions can continue. In this case, emissions are still added to the atmosphere, so global warming continues. Polluters also purchase offsets for practices that could pull carbon out of the atmosphere, such as by planting forests or protecting existing forests. However, carbon storage in natural ecosystems is inherently temporary and highly reversible, as has been seen so clearly in the tragic forest fires in the U.S. west in the past few years.[6] All that carbon can be released very quickly back into the atmosphere, again increasing emissions.

- Offsets can result in violations of the rights of Indigenous and tribal peoples. Satisfying market demands for offsets will require access to huge expanses of land and forest, lands already occupied by Indigenous Peoples, peasants, and local communities. As such, Indigenous lands are increasingly targeted by forest offset project developers, creating pressure and division in Indigenous communities.[7]

- Offsets undermine sustainable farming and increase consolidation in agriculture. Carbon offset programs give additional leverage to already powerful corporations, including agribusinesses and factory farms, that have long squeezed farm income and drained rural economies, while increasing environmental pollution.[8] Corporations and large landowners are best-positioned to develop offset projects, which further entrenches the factory farm and corn/soybean monocultural model at the expense of small farmers, including Black and Indigenous farmers and Tribal Nations. Instead of allowing the industrial, extractive model of agriculture to further prosper by selling offsets to industrial polluters, policy makers should support traditional and ecologically regenerative agricultural practices.

- Offsets markets create more conditions for fraud and gambling than for climate action. Existing offset schemes have already proven to be easily open to fraud.[9] Yet the speculative trading of offsets derivatives and other financial products has already begun, prioritizing profit-seeking traders and speculators over economic and climate justice.[10]

We call on global policy makers to reject offset schemes and embrace real climate solutions that will keep fossil fuels in the ground, support sustainable food systems, and end deforestation, while eliminating pollution in frontline communities.

[1] IPCC, Global Warming of 1.5°C. International Energy Agency, Net Zero by 2050. IPCC, AR6 Climate Change 2021.

[2] Carton et al. “Undoing Equivalence: Rethinking Carbon Accounting for Just Carbon Removal,” Frontiers in Climate, 16 April 2021.

[3] Anderegg, W. et al., Climate-driven risks to the climate mitigation potential of forests, Science 368 (6947) 2020. Mackey, B. et al. 2013., “Untangling the confusion around land carbon science and climate change mitigation policy,” Nature Climate Change, 3(6),pp.552-557, 2013.

[4] Food & Water Watch, “Cap and trade: More pollution for the poor and people of color,” November 2019 at 1 to 2.

[5] Gilbertson, Tamara, Carbon Pricing: A Critical Perspective for Community Resistance, Indigenous Environment Network and Climate Justice Alliance, 2017.[6] Anderegg, W., “Gambling with the climate: how risky of a bet are natural climate solutions?,” AGU Advances, 2021. Coffield, S.R. et al., “Climate-driven limits to future carbon storage in California’s wildland ecosystems,” AGU Advances, 2021.

[7] Ahmend, N., “World Bank and UN carbon offset scheme ‘complicit in genocidal land grabs – NGOs,” The Guardian, 3 July 2014. Forest Peoples Programme, The Reality of REDD in Peru: Between Theory and Practice, November 2011.

[8] Institute for Agriculture and Trade Policy, “Why carbon markets won’t work for agriculture,” January 2020 at 2.

[9] Elgin, B., “A Top U.S. Seller of Carbon Offsets Starts Investigating Its Own Projects,” Bloomberg. 5 April 2021.

[10] Hache, F., Shades of Green: The Rise of Natural Capital Markets and Sustainable Finance, Green Finance Observatory, March 2019.

Original Source: Redd-monitor.

Related posts:

Climate change will see East Africa get wetter say scientists

Climate change will see East Africa get wetter say scientists

Finnish carbon offsetting firm Compensate finds 91% of carbon offset projects fail its evaluation process. Of course the remaining 9% will also not help address the climate crisis

Finnish carbon offsetting firm Compensate finds 91% of carbon offset projects fail its evaluation process. Of course the remaining 9% will also not help address the climate crisis

Farmers in Eastern Uganda receive small grants to tackle climate change

Farmers in Eastern Uganda receive small grants to tackle climate change

Africa must unlock the power of its women to save climate change

Africa must unlock the power of its women to save climate change

You may like

SPECIAL REPORTS AND PROJECTS

Seizing the Jubilee moment: Cancel the debt to unlock Africa’s clean energy future

Published

34 mins agoon

July 12, 2025

Africa has the resources and the vision for a just energy transition, but it is trapped in a financial system structured to take more than it gives. In this blog, we outline how debt burdens and climate impacts are holding the continent back, and looks at the role of institutions that shape the global financial order, like the World Bank, African Development Bank and IMF. As these institutions and governments meet in Seville for FfD4, we urge them to heed people’s calls for reform: cancel the debt, redistribute the wealth, and fund the just transition. — By Rajneesh Bhuee and Lola Allen

With 60% of the world’s best solar energy resources and 70% of the cobalt essential for electric vehicle batteries, the African continent has everything it needs to power its development and become a global reference point for sustainable energy production. That potential, however, remains largely untapped; Africa receives just 2% of global renewable energy investment. As the UNCTAD Secretary-General Rebeca Grynspan warns, too many countries are forced to “default on their development to avoid defaulting on their debt.”

The cost of servicing unsustainable debts, layered with new loan-based climate and development finance, leaves governments with little fiscal space to invest in clean energy, health or education. In 2022 alone, African countries spent more than $100 billion on debt servicing, over twice what they spent on health or education. Add to this the $90 billion lost annually to illicit financial flows, and the reality is stark: more money leaves the continent through financial leakages (also including unfair trade and extractive investment) than comes in through productive, equitable and development-oriented finance.

These are not isolated problems. They reflect a financial system that has been built to serve global markets rather than people. Between 2020 and 2025, four African countries defaulted on their external debts, that is, they failed to make scheduled repayments to creditors like the International Monetary Fund or bondholders, triggering fiscal crises and, in several cases, IMF interventions tied to austerity measures. Pope Francis’ Jubilee Report (2025) and hundreds of civil society groups argue that these defaults reflect the deeper crisis of unsustainable debt. Meanwhile, 24 more African countries are now in or near debt distress. None have successfully restructured their debts under the G20 Common Framework, a mechanism launched in 2020 to facilitate debt relief among public and private creditors. The Framework has been widely criticised for being slow, opaque and ineffective. According to Eurodad, without urgent systemic reforms, up to 47 Global South countries, home to over 1.1 billion people, face insolvency risks within five years if they attempt to meet climate and development goals.

How debt undermines the just energy transition

Debt has become both a driver and a symptom of climate injustice. Countries that did the least to cause the climate crisis now pay the highest price, twice over. First, they suffer the impacts. Second, they must borrow to rebuild.

This is happening just as concessional finance disappears. The US has withdrawn from the African Development Fund’s concessional window (worth $550m), yet maintains influence over private-sector lending. It has also opted out of the UN Financing for Development Conference (FfD4), a historic opportunity to confront the injustice of our financial system. Meanwhile, European governments, though now celebrating themselves as defenders of multilateralism, played a key role in weakening the outcome of FfD4, slashing aid budgets, redirecting funds toward militarisation, and systematically blocking proposals for a UN-led sovereign debt workout mechanism. With rising insecurity and geopolitical tensions, these actions send a troubling signal: at a moment when global cooperation is urgently needed, many Global North countries are stepping back from efforts to fix the very system that is preventing climate justice and clean energy for much of the Global South.

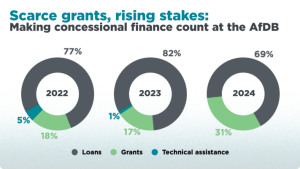

A role for the AfDB?

The African Development Bank (AfDB), under incoming president Sidi Ould Tah , has made progressive commitments of $10 billion to climate-resilient infrastructure and $4 billion to clean cooking. Between 2022 and 2024, one in five (20%) of its energy dollars were grants, far exceeding The World Bank ‘s 10% and the Asian Development Bank (ADB) ‘s 3.8%. The AfDB has also backed systemic reform: for example, calling for Special Drawing Rights (SDR) redistribution, launching an African Financial Stability Mechanism that could save up to $20 billion in debt servicing, and consistently advocating for fairer lending terms.

Yet, even progressive leadership struggles within a broken system. Recourse’s recent research shows that AfDB energy finance dropped 67% in 2024, from $992.7 million to just $329.6 million. Of this, a staggering 73% went to large-scale infrastructure like mega hydro dams and export-focused transmission lines, ‘false solutions’ that bypass the energy-poor and displace communities. Meanwhile, support for locally-appropriate, decentralised renewable energy systems such as mini-grids, solar appliances, and clean cookstoves plummeted by over 90%, from $694.5 million to just $61 million, with only five of 13 projects directly addressing energy access in 2024.

Africa received just 2.8% of global climate finance in 2021–22, and what is labelled as “climate finance” is often little more than a Trojan horse: resource-backed loans, debt-for-nature swaps, and blended finance instruments that shift risk to the public while offering little real benefit to local communities. These mechanisms, promoted as “innovative” or “green”, often entrench financial dependency and fail to deliver meaningful change for energy-poor or climate-vulnerable groups.

Meanwhile, initiatives that could build green industry and renewable capacity across Africa are falling short in both scale and speed. Flagship projects, such as the EU’s Global Gateway, have failed to drive green industrialisation in Africa, and carbon markets continue to delay real emissions reductions, subsidise fossil fuel interests, and entrench elite control over land and resources.

Mission 300: Ambition or another missed opportunity?

In this constrained context, the AfDB and World Bank launched Mission 300, an ambitious plan to connect 300 million Africans to electricity by 2030. Pragmatic goals like electrification are crucial, but the story beneath the surface of Mission 300 raises concern. Far from serving households, many projects under the initiative appear more aligned with export markets and large-scale energy users, echoing decades of infrastructure that bypasses those most in need.

Mission 300 can still be transformative, but only if it centres people, not profits. Energy access must begin with those who need it most: women and youth, especially in rural communities. Across Africa, many women cook over open fires, walk hours to gather fuel, and care for families in homes without light or clean air. This is not just an inconvenience, it is structural violence and policy failure.

Yet most energy finance still flows to centralised grids, mega-projects, and sometimes fossil gas (misleadingly called a “transition fuel”). These do little to address energy poverty. Locally appropriate decentralised renewable energy solutions, solar-powered appliances, clean cookstoves, and mini-grids can deliver faster, cheaper, and more equitable impact. Mission 300 must invest in such solutions, without adding to existing debt problems. It should support national policy design, for example, by ensuring that energy policy is responsive to women’s needs, making use of gender-disaggregated data and community consultation.

The Jubilee: A year for action

In a year already marked as a Jubilee moment, African leaders have demanded reform: including a sovereign debt workout mechanism and a UN Tax Convention to end illicit financial flows. Yet as AFRODAD has documented, these demands were blocked at the FfD4 negotiations by wealthy nations—notably the EU and UK—even as climate impacts grow and fiscal space shrinks.

This is not just about finance. It is about reclaiming sovereignty. The incoming AfDB president and all the multilateral development banks face a choice: continue financing extractive, large-scale projects that serve foreign interests, or invest in decentralised, gender-responsive, pro-people solutions that shift power and ownership.

Africa has the resources. What it needs is fiscal space, public-led finance, and global rules that prioritise people and planet over profit. The Jubilee call is clear: cancel the debt, redistribute the wealth, and fund the just transition.

Source: Recourse through LinkedIn Account Recourse.

Related posts:

Statement: The Energy Sector Strategy 2024–2028 Must Mark the End of the EBRD’s Support to Fossil Fuels

Statement: The Energy Sector Strategy 2024–2028 Must Mark the End of the EBRD’s Support to Fossil Fuels

African Development Bank decides not to fund Kenya coal project

African Development Bank decides not to fund Kenya coal project

Africa must unlock the power of its women to save climate change

Africa must unlock the power of its women to save climate change

PFZW scraps funding from Total and others for failure to transition into a cleaner energy mix.

PFZW scraps funding from Total and others for failure to transition into a cleaner energy mix.

SPECIAL REPORTS AND PROJECTS

Activism on Trial: Despite the increasing repressive measures, Uganda’s EACOP protesters are achieving unexpected victories in the country’s justice systems.

Published

4 days agoon

July 8, 2025

Special report by the dedicated and thorough Witness Radio team, offering a comprehensive and in-depth overview of the situation.

As Uganda moves forward with the controversial East African Crude Oil Pipeline (EACOP), a wave of arrests, intimidation, and court cases has targeted youth and environmental activists opposing the project. However, there is a noticeable and encouraging shift within Uganda’s justice systems, with a growing support for the protesters, potentially signaling a change in the legal landscape.

The EACOP project, stretching 1,443 kilometers from Uganda to Tanzania, has been hailed by the government as a development milestone. However, human rights groups and environmental watchdogs have consistently warned that the project poses serious risks to communities, biodiversity, and the climate. Concerns over land grabbing, inadequate compensation, and ecological degradation have mobilized a new generation of Ugandan activists.

Since 2022, as opposition to EACOP grew louder, Ugandan authorities have intensified a campaign of arrests and legal harassment. Police, military, and currently the Special Forces Command, a security unit tasked with protecting Uganda’s president, have been involved in brutal crackdowns on these activists.

Yuda Kaye, the mobilizer for students against EACOP, believes the criminalization is an attempt by the government to weaken their cause and silence them from speaking out about the project’s negative impacts.

“We are arrested just for raising the project concerns, which affect our future, the local communities, and the environment at large. Oftentimes, we are arrested without reason. They just round us up at once and brutally arrest us, Mr. Kaye reveals, in an interview with Witness Radio’s research team.

Activists have faced a litany of charges, including unlawful assembly, incitement to violence, public nuisance, and criminal trespass. Many of these charges have lacked substantive evidence and have been dismissed by the courts or had their files closed by the police after prolonged delays.

A case review conducted by Witness Radio Uganda reveals that Uganda’s justice system is being used to suppress the activities of youth activists opposing the project, rather than convicting them. However, despite the system being used to silence them, it has often found no merit in these cases.

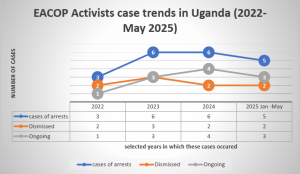

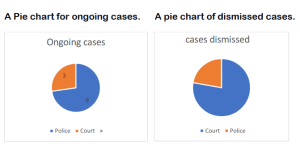

Of a sample of 20 documented cases since 2022 involving the arrest of over 180 activists, 9 case files against the activists have either been dismissed by courts or closed by the police due to a lack of prosecution, another signal indicating the relevance of their work, while 11 cases remain ongoing.

The chart below shows trends in arrests, dismissed cases, and ongoing cases involving EACOP activists in Uganda from 2022 to May 2025.

The review was conducted with support from the activists themselves and their lawyers. It involved a desk review and analysis of Witness Radio articles concerning the arrests of defenders and activists opposing the EACOP project.

Witness Radio’s analysis reveals a concerning trend as the majority of cases involving these activists are stalling at the police level rather than progressing to the courts of law. This suggests that the police have not only criminalized activism but are also playing a syndicate role in deliberately prolonging these cases under the excuse of ongoing investigations.

“While both the police and judiciary are being used to suppress dissent, the courts have at least demonstrated a degree of fairness, having dismissed at least 78% of cases that fall within their jurisdiction. In contrast, the police continue to hold 73% of activist cases in limbo, citing investigations as justification for indefinite delays.” The research team discovered.

Witness Radio’s analysis further shows that in most of these cases, the state has failed to produce witnesses or evidence to convict the activists, adding that the charges are often just tools of intimidation. Additionally, this is accompanied by more extended periods during which decisions are being made.

Despite the intense crackdown, it is evident that these activists are winning, as no proven record of sentencing has been observed. Instead, these cases are often marred by delays in court or at the police, and in the end, some have been dismissed. This implies that protest marches and petition deliveries serve a purpose; the state just needs to listen to their concerns and formulate possible solutions to address them,” said Tonny Katende, Witness Radio Uganda’s Research, Media and Documentation Officer.

According to Article 29(1)(d) of the Constitution of Uganda, every individual has the right to “assemble and demonstrate together with others peacefully and unarmed and to petition.” Additionally, Article 20 emphasizes that fundamental rights and freedoms “are inherent and not granted by the State.” Yet activists report that police regularly deny them the right to exercise their rights as guaranteed.

At a February 2025 press conference, EACOP activists strongly condemned the police’s continued unlawful arrests of demonstrators exercising their constitutional rights and case delays. This followed escalating crackdowns that added to the tally of over 100 activists arrested in 2024 alone.

“We strongly condemn these arrests. Detaining demonstrators does not address the concerns affecting grassroots communities impacted by oil and gas projects,” declared the group, led by Bob Barigye, who remains in prison on another charge still linked to his opposition to EACOP.

An interview with Mr. Yuda Kaye, a mobilizer from the Students Against EACOP Movement, confirmed that the ongoing dismissals only reaffirm the legitimacy of their resistance.

“These cases are dismissed because the government and its justice systems don’t have any grounds to convict us. This justifies the fact that the issues we’re discussing are real. We only seek accountability, but since the government has power, they criminalize us and silence us,” Mr. Kaye added.

According to Kaye, the intimidation is real, but so is their commitment. “We are called enemies of progress, but we’re only protecting our future and that of our country. We’ve often proposed alternatives, but the government doesn’t want them.” He re-echoes.

Despite this, activists say their rights are routinely violated. Witness Radio Uganda attempted to contact the police spokesperson, Mr. Kituuma Rusooke, but known numbers were unreachable, and messages sent to him went unanswered.

In a separate interview with Mr. James Eremye Mawanda, the Judiciary Spokesperson, he acknowledged the pattern of dismissals and delays.

“As the Judiciary, we listen to cases, and where there is no evidence to support the case, a decision is made. When a crime is allegedly committed and an individual is brought before the court, the courts upholding the rule of law shall administer justice,” he said.

According to Witness Radio’s analysis, 2025 has seen the most dismissals so far, with six cases concluding, reinforcing the view that criminalization is used more for intimidation than as a means of legal redress. “Whereas the arrests took place in separate years, most of the dismissals have happened in 2025,” the research team further highlighted.

Mr. Brighton Aryampa, the team lead of Youth for Green Communities, one of the organizations that provide legal representation for Stop-EACOP activists, highlighted that the criminalization of Ugandan activists undermines Uganda’s democratic principles of free expression and open discourse.

“The government, in bed with oil corporations Total Energies and CNOOC, is deliberating using legal action against Stop EACOP activists to suppress dissent, free speech, right to peaceful protest, and against public participation. This is tainting Uganda as a country that undermines the democratic principles of free expression and open discourse, as hundreds of Stop EACOP activists have been arrested, charged, and some tried by a competent court. However, no one has been found guilty of the fabricated offense usually slapped on them.” He said in an interview with Witness Radio.

Counsel Aryampa further advised that the practice of powerful companies and businesses blackmailing and corrupting the Ugandan government to develop harmful projects while ignoring all social warnings and human rights abuses must be stopped.

The pressure exerted by these activists, both locally and internationally, has slowed the EACOP project. It has also led to bankers and insurers withdrawing from financing or insuring the project. According to Stop EACOP campaigners, more than 40 international banks and 30 global insurance firms, including Chubb, have distanced themselves from the controversial pipeline project, citing human rights and climate concerns raised by these activists.

Meanwhile, as the activism grows, the number of arrests is rising. Within just the first six months of 2025, over 40 activists have been criminalized for their activism. Among them is KCB 11, a group of eleven activists that was arrested at the KCB offices in April 2025. The group has spent over two months on remand, despite their lawyers’ pleas for bail to be granted.

Related posts:

EACOP activism under Siege: Activists are reportedly criminalized for opposing oil pipeline project in Uganda.

EACOP activism under Siege: Activists are reportedly criminalized for opposing oil pipeline project in Uganda.

EACOP: The trial of 20 environmental activists failed to take off, and now they want the case dismissed for lack of prosecution.

EACOP: The trial of 20 environmental activists failed to take off, and now they want the case dismissed for lack of prosecution.

Milestone: Another case against the EACOP activists is dismissed due to the want of prosecution.

Milestone: Another case against the EACOP activists is dismissed due to the want of prosecution.

The latest: Another group of anti-EACOP activists has been arrested for protesting Stanbic Bank’s financing of the EACOP Project.

The latest: Another group of anti-EACOP activists has been arrested for protesting Stanbic Bank’s financing of the EACOP Project.

SPECIAL REPORTS AND PROJECTS

‘Left to suffer’: Kenyan villagers take on Bamburi Cement over assaults, dog attacks

Published

4 months agoon

March 22, 2025

- The victims are aged between 24 and 60, and one of them has since passed on.

- Many were severely injured and hospitalized following brutal attacks, unlawful detention, and physical assault by Bamburi’s security personnel.

Editor’s note: Read the petition here.

Their hopes for justice seemed to be slipping away after initially taking on a multinational corporation and failing to hold it accountable for the brutal injuries they suffered.

The death of one of their own cast a shadow of despair, making it seem unlikely that they would ever bring the corporation to justice for the crimes they alleged.

However, 11 victims of dog attacks, assaults, and other severe human rights violations are now challenging Bamburi Cement PLC’s role in these abuses in court.

They are represented by the Kenya Human Rights Commission (KHRC), which on January 29, 2025, filed a legal claim before a constitutional court in Kenya, seeking to hold the multinational accountable for the harm suffered by the victims—residents of land parcels in Kwale that Bamburi claims ownership of. KHRC worked with the Kwale Mining Alliance (KMA) to bring this case.

The victims, aged between 24 and 60, include Mohamed Salim Mwakongoa, Ali Said, Abdalla Suleiman, Hamadi Jumadari, Abdalla Mohammed, and Omari Mbwana Bahakanda. Others are Shee Said Mbimbi, Omar Mohamed, Omar Ali Kalendi (deceased), Abdalla Jumadari, and Bakari Nuri Kassim.

Bamburi had hired a private security firm and deployed General Service Unit (GSU) officers to guard three adjoining land parcels, covering approximately 1,400 acres in Denyenye, Kwale. The GSU established a camp on the land, which has historically been accessed by residents who have long used established routes to reach the forest and the Indian Ocean.

For decades, these routes provided them with access to resources such as firewood, crops, and fish, which they relied on for their livelihoods. However, five years ago, when they attempted to collect firewood, harvest crops, and access the ocean through the land, Bamburi accused them of trespassing. The company’s private guards and GSU officers responded with force, setting dogs on them and assaulting them.

Many were severely injured and hospitalized following brutal attacks, unlawful detention, and physical assault by Bamburi’s security personnel. These incidents occurred despite the lack of clearly defined boundaries and the fact that the traditional access routes had never been contested.

According to the petition, GSU officers and private guards inflicted serious injuries by kicking, punching, and beating the victims with batons. Those who were arrested were neither taken to a police station nor charged with any offense. Despite their injuries, they were denied emergency medical care.

These actions were intended to intimidate residents, prevent them from accessing the beach, and suppress any historical claims to the land, the victims tell the court. Local police in Kwale failed to investigate the abuses, visit the crime scenes, or arrest any of the perpetrators, they add.

Now, the victims are seeking compensation for these violations. They have also asked the court to declare that their rights were violated through torture inflicted by Bamburi’s guards and GSU officers. Additionally, they want the court to rule that releasing guard dogs to attack them during arrests constituted an extreme and unlawful use of force.

Source: khrc.or.ke

Related posts:

Breaking: Over 600 attacks against defenders have been recorded in the year 2023 globally- BHRRC report.

Breaking: Over 600 attacks against defenders have been recorded in the year 2023 globally- BHRRC report.

Kaweeri Coffee land grabbing case re-trial resumes as evictees continue to suffer gross human rights violations.

Kaweeri Coffee land grabbing case re-trial resumes as evictees continue to suffer gross human rights violations.

Criminalization of planet, land, and environmental defenders in Uganda is on the increase as 2023 recorded the soaring number of attacks.

Criminalization of planet, land, and environmental defenders in Uganda is on the increase as 2023 recorded the soaring number of attacks.

Local land grabbers evict villagers at night; foreign investors cultivate the same lands the next day

Local land grabbers evict villagers at night; foreign investors cultivate the same lands the next day

Land Grabbing Crisis Escalates in Uganda: Mayiga Urges Citizens to Secure Land Documents

Seizing the Jubilee moment: Cancel the debt to unlock Africa’s clean energy future

Activism on Trial: Despite the increasing repressive measures, Uganda’s EACOP protesters are achieving unexpected victories in the country’s justice systems.

Communities Under Siege: New Report Reveals World Bank Failures in Safeguard Compliance and Human Rights Oversight in Tanzania

A decade of displacement: How Uganda’s Oil refinery victims are dying before realizing justice as EACOP secures financial backing to further significant environmental harm.

Govt launches Central Account for Busuulu to protect tenants from evictions

Activism on Trial: Despite the increasing repressive measures, Uganda’s EACOP protesters are achieving unexpected victories in the country’s justice systems.

Top 10 agribusiness giants: corporate concentration in food & farming in 2025

Innovative Finance from Canada projects positive impact on local communities.

Over 5000 Indigenous Communities evicted in Kiryandongo District

Petition To Land Inquiry Commission Over Human Rights In Kiryandongo District

Invisible victims of Uganda Land Grabs

Resource Center

- LAND GRABS AT GUNPOINT REPORT IN KIRYANDONGO DISTRICT

- RESEARCH BRIEF -TOURISM POTENTIAL OF GREATER MASAKA -MARCH 2025

- The Mouila Declaration of the Informal Alliance against the Expansion of Industrial Monocultures

- FORCED LAND EVICTIONS IN UGANDA TRENDS RIGHTS OF DEFENDERS IMPACT AND CALL FOR ACTION

- 12 KEY DEMANDS FROM CSOS TO WORLD LEADERS AT THE OPENING OF COP16 IN SAUDI ARABIA

- PRESENDIANTIAL DIRECTIVE BANNING ALL LAND EVICTIONS IN UGANDA

- FROM LAND GRABBERS TO CARBON COWBOYS A NEW SCRAMBLE FOR COMMUNITY LANDS TAKES OFF

- African Faith Leaders Demand Reparations From The Gates Foundation.

Legal Framework

READ BY CATEGORY

Newsletter

Trending

-

SPECIAL REPORTS AND PROJECTS4 days ago

SPECIAL REPORTS AND PROJECTS4 days agoActivism on Trial: Despite the increasing repressive measures, Uganda’s EACOP protesters are achieving unexpected victories in the country’s justice systems.

-

NGO WORK1 week ago

NGO WORK1 week agoCommunities Under Siege: New Report Reveals World Bank Failures in Safeguard Compliance and Human Rights Oversight in Tanzania

-

SPECIAL REPORTS AND PROJECTS34 mins ago

SPECIAL REPORTS AND PROJECTS34 mins agoSeizing the Jubilee moment: Cancel the debt to unlock Africa’s clean energy future

-

MEDIA FOR CHANGE NETWORK21 mins ago

MEDIA FOR CHANGE NETWORK21 mins agoLand Grabbing Crisis Escalates in Uganda: Mayiga Urges Citizens to Secure Land Documents