NGO WORK

A new wave of land grabs strikes Tanzania

Published

2 years agoon

Tanzania was one of the most heavily targeted countries of a huge scramble for farmland around the world that followed the food and financial crises of 2008 and that was supposed to help solve global food insecurity. The large farm projects, which became a strategy of choice for donors, multinational corporations and some governments, ultimately caused more harm than good by exacerbating land conflicts and destroying people’s livelihoods. In Tanzania, most of these projects soon collapsed and caused miseries for small farmers. But, despite this tragic record, Tanzania’s government is pursuing another round of foreign agribusiness investment by turning hundreds of thousands of hectares of lands into block farms where corporations will produce export crops, not local foods for the people. With China looking to Tanzania as a new supply source for soybeans, the stage could be set for another wave of land grabs, with dire consequences for Tanzania’s small farmers.

It should have been the death knell for large-scale agribusiness in Tanzania. In early 2019, Kilombero Plantation Limited (KPL), the much-hyped, showcase model of the Southern Agricultural Growth Corridor for Tanzania (SAGCOT), went bankrupt.[1] Despite receiving tens of millions of dollars from foreign development banks and investors, the owner of this large-scale rice farm, a UK-based private equity fund, was unable to pay off its debts and the farm was seized by its creditors. Tanzania’s NMB Bank spent the next two years trying to find a buyer, before the government stepped in to acquire it, and then handed it over to the Army to manage.[2]

The 5,818-hectare rice farm was once highlighted by the G7 and the World Economic Forum as proof that large-scale agribusiness could drive Africa’s agricultural growth. But, with the firm in financial ruin, Kilombero Plantations Limited became instead a stark example of Tanzania’s misguided and failed decade-long drive to increase foreign investment in agriculture.

The collapse of Kilombero Plantations was the latest in a long list of failed agribusiness projects in Tanzania, ushered in by a series of donor-funded programmes under the Presidency of Jakaya Kikwete (2005-2015).[3] These programmes– beginning with Kilimo Kwanza in 2006, then SAGCOT in 2010, and finally Big Results Now in 2013– aimed to make large areas of land available to companies, on the assumption that these would make Tanzania an export powerhouse, ensure food security, and most importantly, bring employment, technology, services (training, inputs, machinery, etc) and new markets for the small farmers living near to the farms. SAGCOT alone claimed it would bring in USD 2.1 billion in private sector investment.[4] But after 10 years, very little of this promised investment had materialised, and, of the few projects that got off the ground, most had failed, leaving a legacy of problems for the affected communities to deal with.[5]

By the time of the Kilombero Plantations bankruptcy, Tanzania’s then President, Dr John Pombe Magufuli, had grown frustrated with the approach of his predecessor, and had begun charting a new course. He scrapped the Big Results Now programme and began winding down SAGCOT. His government cancelled funding to a SAGCOT “catalytic fund” that had been created through a World Bank Loan– a clear sign of the changed approach.[6] And he also launched a process to revoke dozens of land titles from companies that had failed to bring lands under production.[7]

But in 2021, Magufuli died, and his successor, his Vice-President, Samia Suluhu Hassan, quickly reversed direction. Under the leadership of her Minister of Agriculture, Hussein Bashe, large-scale agribusiness once again became the government’s priority and the doors were swung wide open for domestic or foreign companies wanting large areas of farmland. SAGCOT resumed its central role, with an expanded mandate to establish corridors across the whole country.[8] Hundreds of millions of dollars of public funds have been budgeted for large-scale irrigation and, through a programme that claims to support the involvement of youth in agriculture, hundreds of thousands of hectares of lands across the country are being cleared and consolidated into “block farms” and offered to companies for the production of specified export crops.[9]

Betting on tomorrow

The centrepiece of President Samia’s renewed effort to allocate lands to agribusiness companies is a programme called Building a Better Tomorrow (BBT).[10] Under this programme, the government designates and clears large areas of land for conversion to large-scale, irrigated agriculture, called “block farms”, in which a selection of youth and women, mainly from urban cities and graduates from universities, are allocated small plots of between 1 – 10 acres (0.4-4 ha), while local communities are sidelined. In July 2023, President Samia announced that all 52,000 youth who had applied to join the army that year would be drafted into the BBT programme.[11]

Each BBT block farm is to produce a specific crop for a company that co-invests in the operation. In the model, the company will supply the inputs and machinery and purchase all of the production. It can also get a 99-year lease on a portion of the block farm area to farm the lands itself. The BBT farmers meanwhile get 33 to 66 year titles, and, while they can transfer the titles to someone else, they cannot change the conditions of their contract. They will thus be at the mercy of the company controlling the farm from whom they must buy all of their inputs and to whom they must sell all of their harvests.[12]

President Samia has stated that 690,000 hectares around the country have already been identified for block farms, but there is no publicly available information about the exact locations. In January 2023, the government published a first call for investment proposals for various BBT block farms on 65,000 hectares in the regions of Dodoma, Mbeya, Kagera and Kigoma. Interested companies could apply for lands of between 400 to 8,000 hectares on each block farm.

In March 2023, the first BBT farm was officially opened in the Chamwino district of Dodoma Region. The Minister of Agriculture, Hussein Bashe, explained that an initial 162 hectares were allocated for training 812 youth selected to participate in the project.[13] Despite access to land being an issue for the local communities, most of the youth selected for the project are not local and have little of any agricultural experience. The farm in Dodoma is supposed to eventually extend to 11,453 hectares and will produce grapes for a wine processing plant. But there has been no public mention of any private investor as of yet.

Promotional photoshoot of youth farmers at the BBT block farm in Dodoma, Tanzania, 25 March 2023. Source Twitter (X)

Promotional photoshoot of youth farmers at the BBT block farm in Dodoma, Tanzania, 25 March 2023. Source Twitter (X) Prudence Lugengo, a policy specialist with SAGCOT, says lands for another BBT farm have also been allocated in the regions of Katavi and Tabora. In this case, the BBT farm is said to be a massive, 120,000-hectare block farm that will produce wheat for the Tanzanian agribusiness company MeTL, owned by the Tanzanian billionaire and former politician Mohammed Dewji. According to Lugengo, MeTL will acquire 50,000 hectares for itself and the remaining 70,000 hectares will be allocated under the BBT programme for youth. MeTL did not respond to our requests for confirmation of the deal, and it is not clear how Dewji will be financing this project.[14] It should be noted that just a few years ago, Magufuli’s government revoked several titles for large areas of farmland belonging to Dewji because of his failure to bring them into production.[15]

Together with the aforementioned issues, the odds and prospects of the glorified BBT programme are questionable in its very early days, with allegations surfacing within the corridors of social media, accounting on the government’s failure to live and fulfil its promises. As of late January 2024, a letter alleged to have originated from one BBT youth participant was widely circulated on social media, asserting that the government had failed to allocate to them the promised 5 hectares of land, individually, (let alone the 10 hectares originally promised) and so has the government failed to establish irrigation facilities. Instead, 260 of the youth who had passed through the training programme were sent to a 600 acres farm area in Chinangali, where they are farming without irrigation or decent housing, and are producing sunflower under an off-take arrangement with a company, without any guarantee of a land allocation for themselves.[16]

Zambia has pursued a programme since 2006 to establish block farms of 100,000 hectares in each of its 10 provinces. Although the government failed to attract any “credible investors”, in 2023 it hoped to revive the programme through a USD 300 million loan from the World Bank for the construction of infrastructure at the farm sites.[17] The Government of Malawi also launched a block farm programme in 2020, consisting of a number of what it calls “mega farms” of around 5,000 hectares each. It too has struggled to attract significant private sector investment.[18]

A new soybean frontier for China?

Despite the pomp surrounding the roll-out of the BBT programme, there is little evidence of much interest from the private sector. The only significant funds that have so far been committed are from the government, which has pledged USD 1.4 billion over the next 10 years, and from a similar batch of donors to those who supported the SAGCOT era investment drive. These include the World Bank (USD 300 million), the African Development Bank (USD 100 million), AGRA (USD 40 million), the International Fund for Agricultural Development (USD 60 million) and USAID (USD 100 million).[19]

Soybeans could be an exception, and in particular, soybeans destined for China. Due to the growing tensions with the US and the war in the Ukraine, China is increasingly concerned about its dependence on these two countries for soybeans (as well as maize), and it is now looking to Africa as an alternative source of supply. Tanzania is one of three African countries that China has identified for the development of soybean exports. In 2020, it passed a phytosanitary measure to allow the import of soybeans from Tanzania and the first shipment was made the following year by China’s largest grain trader, COFCO.[20] In November 2022, President Samia signed a Comprehensive Strategic Cooperative Partnership with China during her visit to Beijing in which soybean exports were specified as an initial priority and a task force was created for implementation.

At the moment, Tanzania only produces 200,000 tonnes of soybeans per year– a mere drop in the bucket compared to China’s annual import of 100 million tonnes, most of which goes to produce animal feed and vegetable oil. Production would have to increase dramatically for Tanzania to become a significant supplier.

China’s largest seed company, Yuan Longping High-tech Agriculture, has been tasked with pursuing this potential. The company is part of the CITIC Group, China’s largest state-owned conglomerate, and it is already playing a key role in advancing China’s control over soybean and maize production in Brazil, China’s most important supplier. After entering Brazil in 2017, Longping quickly became one of the top seed companies in the country. Now Longping is looking to do the same in Tanzania, as China seeks to export the Brazilian model to Africa.

“We want to take Longping’s expertise in maize and soybean seeds to [Tanzania and Ghana]. There, the climate conditions, temperature and altitude are similar to those in Brazil and very favourable for the development of agriculture. We want to be facilitators of this process, teach them how to plant and produce grains so that in the future they will also be suppliers to China”, says Aldenir Sgarbossa, President of Longping’s Brazilian operations.[21]

In 2022 and early 2023, Longping sent delegations to Tanzania to secure political support and to identify areas for soybean production. Tests of its soybean varieties from Brazil are now underway, as well as for its hybrid maize and sorghum seeds, which will be grown in rotation with the soybeans, as is done in Brazil. While these initial varieties are not GMOs, Longping has several GMO varieties under testing and awaiting approval for commercial sale in China, and it has already had some of its GMO maize varieties approved for human consumption.

Longping says it will invest over USD 213 million (500 billion shillings) in a first phase for developing soybean production in the south of Tanzania and will also invest in the improvement of grain exporting facilities at the port of Dar es Salaam.

The company’s operations in Tanzania are being run through a joint venture with a Tanzanian businessman, the media mogul Joseph Kusaga, owner of Clouds Entertainment Group, along with his wife, Juhayna Kusaga. Longping also has high level support from within the Ministry of Agriculture, from SAGCOT and even from former President Kikwete, who has been using his position as a director of AGRA to encourage Tanzanian farmers to plant soybeans for export to China.[22] As evidence of Longping’s political connections, the government gave it special clearance to reduce the required time for testing of its seeds from five years to five seasons, making it possible for Longping to start large-scale production in 2024.[23]

The Tanzanian government is also making lands available for the company. An initial area of 53,000 ha is said to have been allocated as a BBT farm in the Chunya District of Mbeya Region. Longping Tanzania says it has “acquired” 10,000 ha of these lands for its own farm and claims to have already started farming, while the remaining 43,000 ha will be allocated to participating farmers who the company will supply with seeds, fertilisers, and machinery.[24] The farmers must sell their harvests exclusively to Longping Tanzania, which will then export to China, where the Chinese government has offered a guarantee to purchase all of the soybeans that are produced.[25]

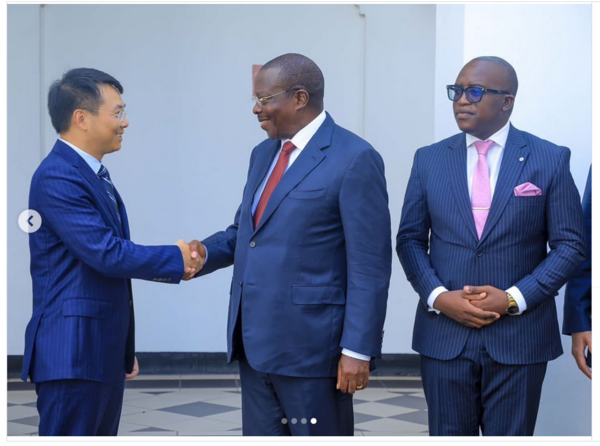

Vice-President of Tanzania Dr. Philip Mpango shakes hands with the CEO of Yuan Longping High-tech Agriculture, Liang Shi, outside the national State House. To the right is Deputy Minister of Agriculture, Anthony Mavunde. February 17, 2023 . Source : Twitter (X)

Vice-President of Tanzania Dr. Philip Mpango shakes hands with the CEO of Yuan Longping High-tech Agriculture, Liang Shi, outside the national State House. To the right is Deputy Minister of Agriculture, Anthony Mavunde. February 17, 2023 . Source : Twitter (X) Longping’s ambitions extend beyond this BBT farm. The company is also setting up block farms with the recently established Soybean Association of Tanzania.[26] According to the association’s chairman, Marcus Albany, these block farms will bring together a group of farmers, with each farmer contributing an area of land (minimum is 2 hectares and maximum is 10% of the entire block farm) to establish one large farm that will be managed as a group. The farm will operate under a contract with Longping, which stipulates the amount the farmers must pay Longping for the supply of inputs and machinery and the price they receive for the sale of their harvests, with the amounts renegotiated each season. As with the BBT farms, a farmer can transfer their share of the lands to another farmer, but that farmer must then take on the same conditions agreed to with Longping.

The Soybean Association of Tanzania and Longping have already formed one block farm in Morogoro Region that is presently at 5,700 hectares and they expect it to eventually reach 10,500 hectares. They are in the process of setting up another one in Lindi Region on 10,500 hectares, one in Katavi starting at 202 hectares and one in Sumbawanga that is still in the process of negotiation with a private landowner. Albany says that, although his association is not made up of youth, the government is also trying to get them to be part of the BBT farm in Mbeya.

Other Tanzanian businessmen are also moving quickly to acquire lands for soybean production. The newly established company Jadeja Farming is developing a 2,800-hectare soybean farm on contested lands at Sumbawanga district in Rukwa Region.[27] The company has ties to Jatu PLC, a company listed on the national stock exchange that claimed to be pursuing block farms but that ended up defrauding its shareholders of over USD 2 million.[28] In the northern region of Kagera, a Tanzanian company called Global Agency is building a massive 21,000 ha maize and soybean farm. Despite its past legal and financial troubles, Global Agency has received substantial funding from the Tanzania Agricultural Development Bank (via a loan from the African Development Bank), as well as political support from high level members of President Samia’s party.[29]

Moreover, Longping is not the only Chinese company investing in soybean production in Tanzania. In the coastal region of Kilwa, a company called Pan Tanzania Agriculture Developments is pursuing a 25,000 ha large-scale cassava and soybean farming project, on lands that were previously part of a much contested biofuels project that went bust. Pan Tanzania Agriculture Developments is connected to the Chinese company, Beijing Chaoliang (translated as “Best Agro” or “Super Grain”), as well as Hunan Construction Engineering Group and the Djibouti Silk Road International Bank.[30] In July 2022, nearly 25,000 ha were converted from village lands to “Export Processing Zone” lands, opening the possibility for Pan Tanzania Agriculture Developments to acquire them on a long-term lease.[31]

Land conflicts will get much worse

The combination of China’s new interest in soybean exports from Tanzania and the Tanzanian government’s revitalised interest in foreign agribusiness investment is creating the conditions for a surge in land grabbing. Land conflicts are already present across the country, not only because of agribusiness projects but also because of deals for mining, wildlife and forest reserves, parks and carbon credit projects that the government is also pursuing. One of these, a “sustainable forestry” project with a company owned by a member of the Dubai Royal Family, involves setting aside eight million hectares of lands for the generation of carbon credits.[32]

The new push for block farms and soybean production adds fuel to a fire that is already running hot. For example, in the Kilosa District of Morogoro Region, tensions over land have simmered for decades between villagers who want to maintain access to lands for food production and businessmen who either use the lands for sisal plantations, rent them out for cash or hoard them and render them unproductive. The villagers finally succeeded in getting the government to intervene during the presidency of Magufuli and many land titles held by these businessmen were revoked. But the lands were not redistributed to the villagers. Instead, they were turned over to the District Councils, which are now consolidating the lands and leasing them out as block farms to so-called “farmer groups” to produce cash crops like sisal on the instructions of the state or are handing them over to businessmen and public agencies, such as Tanzania’s Agricultural Seed Agency.

Abdul Tumbo is a farmer from Mvumi village in Kilosa District. He has been repeatedly arrested and imprisoned for farming on lands that his grandparents farmed but that are also claimed by a powerful businessman. The Magufuli government revoked the businessman’s land titles a few years back but the District Council is now trying to organise these lands into a block farm instead of letting Tumbo and the other villagers continue with their farming. The villagers want nothing to do with the block farm. They say the land is theirs and there is no reason why they should pay rent for it. Moreover, they want to produce food for their families and communities, not commodities for companies.[33]

Tumbo points to one neighbouring community where the District Council has pushed ahead with a 325-hectare block farm on lands the local villagers have been farming since 1984 when a sisal estate was shuttered. In December 2022 the villagers planted local maize for food, and shortly after, on the very same lands, the “farmer group” planted sunflowers. Now the District Council has seized the maize harvest and tensions are boiling over.

Across Tanzania, similar conflicts are erupting as the government and businessmen illegally use backdoor channels to transfer large areas of village lands into block farms to produce soybeans and other crops for export. Thousands of small farmers and pastoralists could be displaced from their lands in the process, and many more could lose access to water, as these projects tend to involve the use of large amounts of water for irrigation. The impacts will be felt not only in rural areas, but also in urban centres, as the lands that small farmers now use to produce food for the country will be converted into large-scale farms to produce agricultural commodities for export.

In another example, in 2023, the government, controversially, gave an eviction order to villagers of at least 23 villages in Mbarali District through a government notice (no. 28 of 2008), whose implementation was delayed because of the controversy and uncertainty on the legality and morality of the notice itself. This eviction order affects one of the most productive districts and national food baskets for rice and will affect over 25,000 smallholder farmers in the area. The order is to expand the Ruaha National Park in a World Bank funded project.[34] At present, 852 villagers have taken the matter to the High Court of Tanzania to challenge the eviction order.[35]

The current situation in Tanzania is reminiscent of the ProSavana project that Japan sought to finance in Northern Mozambique a decade ago. That project involved the take-over of 14 million hectares of land in one of the most fertile and densely populated areas of the country to set up large farms and enlist farmers into contract farming schemes to produce soybeans and other cash crops for export to Japan. ProSavana was developed between the Japanese, Brazilian and Mozambican governments behind closed doors, without the knowledge of the affected communities. When these communities became aware of what was going on, they immediately began to organise resistance, with the support of civil society organisations in Mozambique, Brazil and Japan. Despite the powerful forces aligned against them, Mozambican farmers and their allies managed to stop the project, and it was officially terminated in 2020.[36]

This is a critical moment for Tanzania’s small farmers and pastoralists to defend their lands. These food producers are already struggling with a lack of access to sufficient land and water, exacerbated by the climate crisis and the country’s rapidly growing population. They can produce an abundance of nutritious, chemical-free foods to feed the country, and even produce a surplus for export, if the right policies are in place to support their seed systems, provide protection for their lands and water and ensure they have adequate access to markets. Scarce public resources should not be wasted on a failed model of corporate agriculture.

Banner photo: Tanzania’s Minister of Agriculture, Hussein Bashe, visiting a block farm project in Chinangali area, Chamwino, Dodoma District. Source : Twitter (X)

__________________________________

[36] For more information on ProSavana, see: https://www.farmlandgrab.org/cat/show/827

Original Source: Grain

Related posts:

Worldwide Condemnation Over Violence against the Maasai by Tanzania Security Forces

Worldwide Condemnation Over Violence against the Maasai by Tanzania Security Forces

African bishops demand end to ‘land grabs’ by private companies

African bishops demand end to ‘land grabs’ by private companies

DR Congo oil palm company bankrolled by development banks unleashes wave of violence against villagers after peaceful protests

DR Congo oil palm company bankrolled by development banks unleashes wave of violence against villagers after peaceful protests

Repression for land and profits

Repression for land and profits

You may like

NGO WORK

Violations against Kenya’s indigenous Ogiek condemned yet again by African Court

Published

3 weeks agoon

January 13, 2026

Minority Rights Group welcomes today’s decision by the African Court on Human and Peoples’ Rights in the case of Ogiek people v. Government of Kenya. The decision reiterates previous findings of more than a decade of unremedied violations against the indigenous Ogiek people, centred on forced evictions from their ancestral lands in the Mau forest.

The Court showed clear impatience concerning Kenya’s failure to implement two landmark rulings in favour of the indigenous Ogiek people: in a 2017 judgment, that their human rights had been violated by Kenya’s denial of access to their land, and in a 2022 judgment, which ordered Kenya to pay nearly 160 million Kenyan shillings (about 1.3 million USD) in compensation and to restitute their ancestral lands, enabling them to enjoy the human rights that have been denied them.

Despite tireless activism from the community and the historic nature of both judgments, Kenya has not implemented any part of either decision. The community remains socioeconomically marginalized as a result of their eviction and dispossession. Evictions have continued, notably in 2023 with 700 community members made homeless and their property destroyed, and in 2020 evicting about 600, destroying their homes in the midst of the Covid-19 pandemic.

Daniel Kobei, Executive Director of the Ogiek Peoples’ Development Program stated, ‘We have been at the African Court six times to fight for our rights to live on our lands as an indigenous people – rights which our government has denied us and continues to violate, compounding our plights and marginalization, despite clear orders from the African Court for our government to remedy the violations. This is the seventh time, and we were hopeful that the Court would be more strict to the government of Kenya in ensuring that a workable roadmap be followed in implementation of the two judgments.’

Kenya has repeatedly justified the eviction of Ogiek as necessary for conservation, although the forest has seen significant harm since evictions began. Many in the community see a connection between their eviction and Kenya’s participation in lucrative carbon credit schemes.

‘The Court’s decision underscores the importance of timely and full implementation of measures imposed on a state which has been found to be in breach of their internationally agreed obligations. Kenya must now repay its debt to the indigenous Ogiek by restituting their land and making reparations, among other remedies ordered by the Court’, said Samuel Ade Ndasi, African Union Advocacy and Litigation Officer at Minority Rights Group.

The decision states, ‘the court orders the respondent state to immediately take all necessary steps, be they legislative or administrative or otherwise, to remedy all the violations established in the judgment on merits.’ The court also reaffirmed that no state can invoke domestic laws to justifiy a breach of international obligations.

Both of the original judgments were historic precedents, breaking new ground on the issue of restitution and compensation for collective violations experienced by indigenous peoples and confirming the vital role of indigenous peoples in safeguarding ecosystems, that states must respect and protect their land rights, that lands appropriated from them in the name of conservation without free, prior and informed consent must be returned, and their right to be the ultimate decision makers about what happens on their lands. Today’s decision adds to this tally of precedents as it is the first decision of the African Court on Human and Peoples’ Rights concerning the record of a state in implementing a binding decision.

The case

In October 2009, the Kenyan government, through the Kenya Forestry Service, issued a 30-day eviction notice to the Ogiek and other settlers of the Mau Forest, demanding that they leave the forest. Concerned that this was a perpetuation of the historical land injustices already suffered, and having failed to resolve these injustices through repeated national litigation and advocacy efforts, the Ogiek decided to lodge a case against their government before the African Commission on Human and Peoples’ Rights with the assistance of Minority Rights Group, the Ogiek Peoples’ Development Program and the Centre for Minority Rights Development. The African Commission issued interim measures, which were flouted by the Government of Kenya and thereafter referred the case to the African Court based on the complementarity relationship between the African Commission and the African Court on Human and Peoples’ Rights and on the grounds that there was evidence of serious or massive human rights violations.

On 26 May 2017, after years of litigation, a failed attempt at amicable settlement and an oral hearing on the merits, the African Court on Human and Peoples’ Rights rendered a merits judgment in favour of the Ogiek people. It held that the government had violated the Ogiek’s rights to communal ownership of their ancestral lands, to culture, development and use of natural resources, as well as to be free from discrimination and practise their religion or belief. On 23 June 2022, the Court rejected Kenya’s objections and set out the reparations owed for the violations established in the 2017 judgment.

Source: minorityrights.org

Related posts:

Trauma and Land Loss: New Study Focuses on Mental Health of Evicted Indigenous People

Trauma and Land Loss: New Study Focuses on Mental Health of Evicted Indigenous People

Justice Denied: East African Court of Justice Grants Tanzanian Government Impunity to Trample Human Rights of the Maasai

Justice Denied: East African Court of Justice Grants Tanzanian Government Impunity to Trample Human Rights of the Maasai

EACOP: East African Court of Justice will hear arguments on court’s jurisdiction

EACOP: East African Court of Justice will hear arguments on court’s jurisdiction

Tanzanian High Court Tramples Rights of Indigenous Maasai Pastoralists to Boost Tourism Revenues

Tanzanian High Court Tramples Rights of Indigenous Maasai Pastoralists to Boost Tourism Revenues

NGO WORK

Climate wash: The World Bank’s Fresh Offensive on Land Rights

Published

3 months agoon

November 13, 2025

Climate wash: The World Bank’s Fresh Offensive on Land Rights reveals how the Bank is appropriating climate commitments made at the Conference of the Parties (COP) to justify its multibillion-dollar initiative to “formalize” land tenure across the Global South. While the Bank claims that it is necessary “to access land for climate action,” Climatewash uncovers that its true aim is to open lands to agribusiness, mining of “transition minerals,” and false solutions like carbon credits – fueling dispossession and environmental destruction. Alongside plans to spend US$10 billion on land programs, the World Bank has also pledged to double its agribusiness investments to US$9 billion annually by 2030.

This report details how the Bank’s land programs and policy prescriptions to governments dismantle collective land tenure systems and promote individual titling and land markets as the norm, paving the way for private investment and corporate takeover. These reforms, often financed through loans taken by governments, force countries into debt while pushing a “structural transformation” that displaces smallholder farmers, undermines food sovereignty, and prioritizes industrial agriculture and extractive industries.

Drawing on a thorough analysis of World Bank programs from around the world, including case studies from Indonesia, Malawi, Madagascar, the Philippines, and Argentina, Climatewash documents how the Bank’s interventions are already displacing communities and entrenching land inequality. The report debunks the Bank’s climate action rhetoric. It details how the Bank’s efforts to consolidate land for industrial agriculture, mining, and carbon offsetting directly contradict the recommendations of the IPCC, which emphasizes the protection of lands from conversion and overexploitation and promotes practices such as agroecology as crucial climate solutions.

Read full report: Climatewash: The World Bank’s Fresh Offensive on Land Rights

Source: The Oakland Institute

Related posts:

30 civil society organizations have written to the World Bank Group demanding to publicly disclose the Africa Energy Approach paper.

30 civil society organizations have written to the World Bank Group demanding to publicly disclose the Africa Energy Approach paper.

World Bank’s new scheme to privatize land in the developing world exposed

World Bank’s new scheme to privatize land in the developing world exposed

World Bank is backing dozens of new coal projects, despite climate pledges

World Bank is backing dozens of new coal projects, despite climate pledges

Communities Under Siege: New Report Reveals World Bank Failures in Safeguard Compliance and Human Rights Oversight in Tanzania

Communities Under Siege: New Report Reveals World Bank Failures in Safeguard Compliance and Human Rights Oversight in Tanzania

NGO WORK

Africa’s Land Is Not Empty: New Report Debunks the Myth of “Unused Land” and Calls for a Just Future for the Continent’s Farmland

Published

3 months agoon

November 13, 2025

A new report challenges one of the most persistent and harmful myths shaping Africa’s development agenda — the idea that the continent holds vast expanses of “unused” or “underutilised” land waiting to be transformed into industrial farms or carbon markets.

Titled Land Availability and Land-Use Changes in Africa (2025), the study exposes how this colonial-era narrative continues to justify large-scale land acquisitions, displacements, and ecological destruction in the name of progress.

Drawing on extensive literature reviews, satellite data, and interviews with farmers in Zambia, Mozambique, South Africa, and Zimbabwe, the report systematically dismantles five false assumptions that underpin the “land abundance” narrative:

-

That Africa has vast quantities of unused arable land available for cultivation

-

That modern technology can solve Africa’s food crisis

-

That smallholder farmers are unproductive and incapable of feeding the continent

-

That markets and higher yields automatically improve food access and nutrition

-

That industrial agriculture will generate millions of decent jobs

Each of these claims, the report finds, is deeply flawed. Much of the land labelled as “vacant” is, in reality, used for grazing, shifting cultivation, foraging, or sacred and ecological purposes. These multifunctional landscapes sustain millions of people and are far from empty.

The study also shows that Africa’s food systems are already dominated by small-scale farmers, who produce up to 80% of the continent’s food on 80% of its farmland. Rather than being inefficient, their agroecological practices are more resilient, locally adapted, and socially rooted than the industrial models promoted by external donors and corporations.

Meanwhile, the promise that industrial agriculture will lift millions out of poverty has not materialised. Mechanisation and land consolidation have displaced labour, while dependency on imported seeds and fertilisers has trapped farmers in cycles of debt and dependency.

A Continent Under Pressure

Beyond these myths, the report reveals a growing land squeeze as multiple global agendas compete for Africa’s territory: the expansion of mining for critical minerals, large-scale carbon-offset schemes, deforestation for timber and commodities, rapid urbanisation, and population growth.

Between 2010 and 2020, Africa lost more than 3.9 million hectares of forest annually — the highest deforestation rate in the world. Grasslands, vital carbon sinks and grazing ecosystems, are disappearing at similar speed.

Powerful actors — from African governments and Gulf states to Chinese investors, multinational agribusinesses, and climate-finance institutions — are driving this race for land through opaque deals that sideline local communities and ignore customary tenure rights.

A Call for a New Vision

The report calls for a radical shift away from high-tech, market-driven, land-intensive models toward people-centred, ecologically grounded alternatives. Its key policy recommendations include:

-

Promoting agroecology as a pathway for food sovereignty, ecological regeneration, and rural livelihoods.

-

Reducing pressure on land by improving agroecological productivity, cutting food waste, and prioritising equitable distribution.

-

Rejecting carbon market schemes that commodify land and displace communities.

-

Legally recognising customary land rights, particularly for women and Indigenous peoples.

-

Upholding the principle of Free, Prior, and Informed Consent (FPIC) for all land-based investments.

This report makes it clear: Africa’s land is not “empty” — it is lived on, worked on, and cared for. The future of African land must not be dictated by global capital or outdated development theories, but shaped by the people who depend on it.

Download the Report

Read the full report Land Availability and Land-Use Changes in Africa (2025) to explore the evidence and policy recommendations in detail.

Related posts:

Financial Institutions from Africa have made a monumental commitment of $100 billion to Africa’s green industrialization, a decision of immense significance that has the potential to shape Africa’s future.

Financial Institutions from Africa have made a monumental commitment of $100 billion to Africa’s green industrialization, a decision of immense significance that has the potential to shape Africa’s future.

Africa adopts the Africa Climate Innovation Compact (ACIC) Declaration to drive the continent towards innovative climate solutions.

Africa adopts the Africa Climate Innovation Compact (ACIC) Declaration to drive the continent towards innovative climate solutions.

One in three people sleeps on an empty stomach – World Bank Report.

One in three people sleeps on an empty stomach – World Bank Report.

Transforming Africa’s livestock sector is key to food security-Report

Transforming Africa’s livestock sector is key to food security-Report

Why govt is launching a comprehensive digital land registry

Witness Radio and Seed Savers Network are partnering to produce radio content to save indigenous seeds in Africa.

Evicted from their land to host Refugees: A case of Uganda’s Kyangwali refugee settlement expansion, which left host communities landless.

Women environmental rights defenders in Africa are at the most significant risk of threats and attacks – ALLIED New report

Will Uganda’s next government break the land-grabbing cycle?

Swedish pension fund drops TotalEnergies amid rising EACOP risks

Women environmental rights defenders in Africa are at the most significant risk of threats and attacks – ALLIED New report

Land tenure security as an electoral issue: Museveni warns Kayunga land grabbers, reaffirms protection of sitting tenants.

Innovative Finance from Canada projects positive impact on local communities.

Over 5000 Indigenous Communities evicted in Kiryandongo District

Petition To Land Inquiry Commission Over Human Rights In Kiryandongo District

Invisible victims of Uganda Land Grabs

Resource Center

- Land And Environment Rights In Uganda Experiences From Karamoja And Mid Western Sub Regions

- REPARATORY AND CLIMATE JUSTICE MUST BE AT THE CORE OF COP30, SAY GLOBAL LEADERS AND MOVEMENTS

- LAND GRABS AT GUNPOINT REPORT IN KIRYANDONGO DISTRICT

- THOSE OIL LIARS! THEY DESTROYED MY BUSINESS!

- RESEARCH BRIEF -TOURISM POTENTIAL OF GREATER MASAKA -MARCH 2025

- The Mouila Declaration of the Informal Alliance against the Expansion of Industrial Monocultures

- FORCED LAND EVICTIONS IN UGANDA TRENDS RIGHTS OF DEFENDERS IMPACT AND CALL FOR ACTION

- 12 KEY DEMANDS FROM CSOS TO WORLD LEADERS AT THE OPENING OF COP16 IN SAUDI ARABIA

Legal Framework

READ BY CATEGORY

Newsletter

Trending

-

MEDIA FOR CHANGE NETWORK1 week ago

MEDIA FOR CHANGE NETWORK1 week agoWomen environmental rights defenders in Africa are at the most significant risk of threats and attacks – ALLIED New report

-

MEDIA FOR CHANGE NETWORK2 weeks ago

MEDIA FOR CHANGE NETWORK2 weeks agoUganda moves toward a Bamboo Policy to boost environmental conservation and green growth.

-

FARM NEWS1 week ago

FARM NEWS1 week ago200 farmers demonstrate at parliament, worried about new seed monopoly

-

MEDIA FOR CHANGE NETWORK4 days ago

MEDIA FOR CHANGE NETWORK4 days agoEvicted from their land to host Refugees: A case of Uganda’s Kyangwali refugee settlement expansion, which left host communities landless.

-

MEDIA FOR CHANGE NETWORK4 days ago

MEDIA FOR CHANGE NETWORK4 days agoWitness Radio and Seed Savers Network are partnering to produce radio content to save indigenous seeds in Africa.

-

MEDIA FOR CHANGE NETWORK2 days ago

MEDIA FOR CHANGE NETWORK2 days agoWhy govt is launching a comprehensive digital land registry