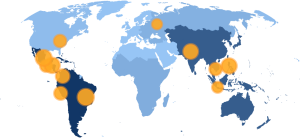

The International Finance Corporation (IFC), the private lending arm of the World Bank Group, is indirectly backing dozens of new coal projects throughout Asia, according to a new report, Blowing Smoke: How Coal Finance is Flowing through the IFC’s Paris Alignment Loopholes. The report, based on research conducted by Inclusive Development International, Recourse and Trend Asia, was published today, in advance of the World Bank Annual Meetings taking place in Marrakech next week.

“We found that the IFC is still backing new coal capacity through its investments in banks and other financial institutions despite its commitments to align those investments with the Paris Agreement,” said David Pred, executive director of Inclusive Development International. “This is the opposite of the sustainable development that IFC purports to promote, and it is having a devastating impact on coal-affected communities throughout Asia and the entire planet in this time of climate peril.”

A planned 700-megawatt coal-fired power plant called Jambi 2, to be located in Indonesia’s Jambi province, is among the new coal projects the IFC is indirectly supporting. The new report focuses on Jambi 2 as a case study for how the IFC’s lending ends up supporting new coal development and the impact that has on local communities. According to local advocates and community members interviewed by Inclusive Development International, Jambi 2 is a project the province doesn’t want and doesn’t need—one that will exacerbate the already devastating impacts of coal development in the area, including air and water pollution and related health issues. Yet Postal Savings Bank of China—an IFC intermediary and a major coal financier in the region—has provided a credit line to Jambi 2’s developer, China Huadian.

“Ongoing coal development in Indonesia, including the Jambi 2 plant, will accelerate climate change and its catastrophic consequences,” said Novita Indri, energy campaigner at Trend Asia. “It’s a slap in the face to Indonesia, an island nation that is uniquely vulnerable to rising sea levels and already suffering from extreme weather events.”

Postal Savings Bank of China is by far the largest financier of coal developers in the IFC’s portfolio. According to data compiled by Inclusive Development International and published alongside the new report, the IFC purchased a $300 million equity stake in Postal Savings Bank in 2015 and the bank has gone on to provide 418 billion RMB ($57.3 billion) in no-strings-attached credit lines and project loans to companies developing dozens of coal-fired power plants in the region. The bank has provided these loans at a time when much of the financial industry is shifting away from coal, implicating the IFC and the World Bank Group in the last vestiges of coal finance and the devastating impacts it has for coal-affected communities and the climate. The authors of the report are calling on the IFC to leverage its influence as a major shareholder to stop Postal Savings Bank from continuing to finance coal development.

“It’s hypocritical for the IFC to allow its banking clients to finance projects like Jambi 2 and other coal development in Asia while at the same time promising to align its lending with the Paris Agreement on Climate Change,” said Kate Geary, co-director of Recourse. “While committing to move away from coal on paper, the World Bank Group is failing to ensure that its investments aren’t supporting coal power projects that are significant contributors to climate change and that wreak devastation on affected communities.”

These latest revelations come on the heels of reports last month that communities in Indonesia’s Banten province have lodged a formal complaint against the IFC for backing two new massive units in the Suralaya mega-coal complex. Similar complaints have been lodged against the IFC in the past, including regarding its support for coal expansion in the Philippines.

“The IFC has contributed to serious harms related to coal expansion in many countries,” added Pred. “Now it has a responsibility to repair the damage it has done and prevent future harm by requiring that all of its financial intermediary clients, including Postal Savings Bank of China, stop financing coal development immediately.”

Notes for editors:

Regarding IFC’s financial intermediary lending and “no coal” commitments

Inclusive Development International previously followed the money in the IFC’s financial-sector portfolio and published our findings in our Outsourcing Development investigative series, which exposed (among other things) the coal plants and mines the IFC was indirectly backing.

Since then, the World Bank Group has made a series of commitments designed to reform its approach to investing in financial institutions, reduce its exposure to coal and align itself with the Paris Agreement. Most prominently, in 2019 the IFC launched its Green Equity Approach, which requires financial institutions in which it holds shares to halve their coal exposure by 2025 and eliminate it from their portfolios by the end of the decade. In 2023, the IFC closed a major loophole that Inclusive Development International, Recourse and Trend Asia pointed out in the approach by updating the rules to restrict equity clients from financing any new coal projects.

However, the IFC’s flagship approach aligning its indirect lending operations with the Paris Agreement contains other loopholes and gray areas: it still allows equity clients to underwrite bonds for coal developers, and it allows clients to finance industrial projects that are powered by dedicated coal plants, a concept known as captive coal. And it is unclear how and whether the “no new coal” rule is being applied to existing clients’ corporate financing of coal developers. In fact, as our new research and report show, banks in which the IFC holds equity stakes—including Postal Savings Bank of China—have continued to provide financing to the developers of new coal projects.

Regarding our methodology

For this report, Inclusive Development International traced the International Finance Corporation’s money through financial intermediaries to new coal-fired power capacity in Asia. The full results are here.

We define new coal capacity as projects that have become operational since 2019; projects that are under construction; and projects that have been announced by developers. This data does not include projects that are listed as shelved or canceled, although developers regularly reactivate shelved projects after long periods of inactivity.

For all data on coal plants, including project names, generating capacity, development timelines and project owners, we relied on the Global Energy Monitor, which tracks energy infrastructure around the world. For data on project developers, including their current coal-generating capacities, development plans, and issuances of debt securities, we relied on the Global Coal Exit List, which the IFC also uses to help its clients identify coal exposures in their portfolios.

All other data comes from research conducted by Inclusive Development International, Recourse and Trend Asia into corporate filings, the International Finance Corporation’s project disclosures, and site visits in Indonesia.

Source: inclusivedevelopment.net

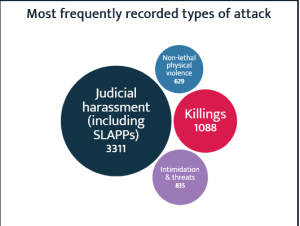

nce, community cohesion, and an inclusive and peaceful society. In addition to harming physical security, attacks can also negatively affect HRDs’ mental, emotional and economic well-being.

nce, community cohesion, and an inclusive and peaceful society. In addition to harming physical security, attacks can also negatively affect HRDs’ mental, emotional and economic well-being.